GBP/USD Week Ahead Forecast: Big Resistance Just Above 1.28

- Written by: Gary Howes

- GBPUSD in short-term uptrend

- But major resistance level can thwart advance

- Watch U.S. inflation Thursday

- And UK GDP Friday

Image © Adobe Images

The Pound to Dollar exchange rate is in a short-term uptrend that can extend over the coming days, provided global market sentiment remains stable, and the U.S. inflation report due Thursday proves a tame affair.

Pound-Dollar holds above 1.17 at the time of writing, following a negligible 0.06% decline in the opening week of 2024, a decent performance given the Dollar rose against all its G10 peers.

Pound Sterling vied with the U.S. dollar for the accolade of being the best-performing major currency of the first week of 2024, thanks to a reduction in market bets for the scale of Bank of England rate cuts due in the coming months.

Markets reduced Federal Reserve rate cut bets following a solid U.S. jobs report, prompting the market to bet the Bank of England would mirror the Fed. The Pound was also bolstered by last week's solid upgrade to December's PMI data that suggests the economy returned to growth territory at the turn of the year, lessening the need for immediate Bank of England rate cuts.

From a technical perspective, the Pound-Dollar exchange rate is comfortably above its 200-day moving average, which confirms it to be in a short-term uptrend that can extend over the near term, with December's highs at 1.28 being a possibility.

"GBP/USD now trades slightly above $1.27 and has been in an upward trend since November," says Boris Kovacevic, Global Macro Strategist at Convera.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"GBP/USD up move has stalled after reaching 1.2820 late last month. Signals of a large downside are not yet visible; 50-DMA near 1.2550/1.2500 should be a key support. Defence of this would mean one more up leg," says Kenneth Broux, a technical strategist at Société Générale.

The sparring for dominance between the Dollar and Pound likely limits the scope of moves to both the upside and downside, which could frustrate those looking for a stronger Sterling.

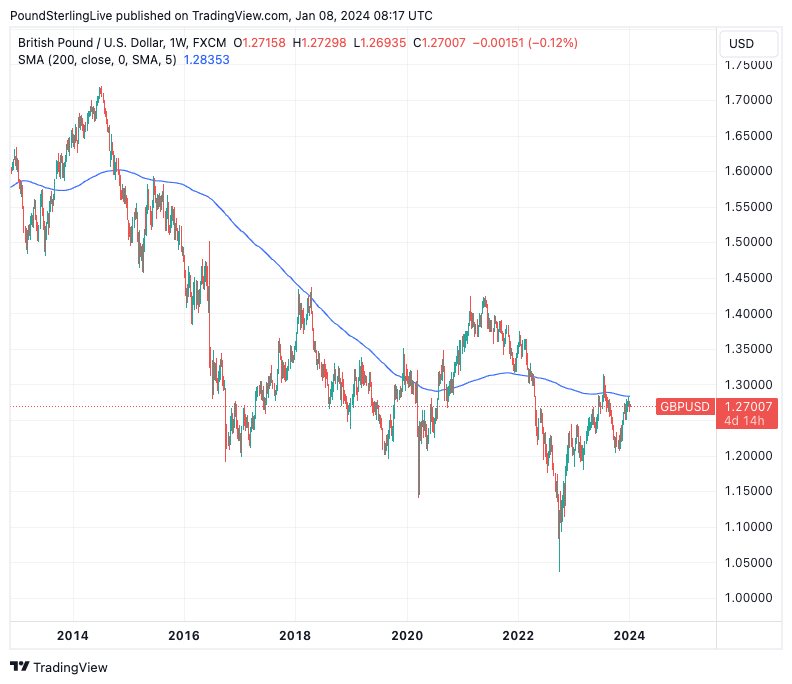

We also note the Pound-Dollar is also approaching a key area of resistance in the form of the 200-week moving average, currently at 1.2835, which can block further upside:

Above: GBPUSD at weekly intervals with the 200-week moving average annotated.

As the above shows, the pair's advance was recently scuppered at this level in late December. Furthermore, the 200-week MA helps explain the longer-term decline in Pound-Dollar, and we would expect a break higher to be hard-fought for the bulls.

This week's fundamental price action will rely on the outcome of U.S. inflation, due Thursday at 13:30 GMT.

The market looks for a print of 3.2% year-on-year in December, up from November's 3.1%, driven by a monthly increase of 0.2%.

Core inflation is expected at 3.8% y/y, down from 4.0%.

The rule of thumb says should inflation beat these expectations, the Dollar will fall, with the market reaction becoming more noticeable the greater the divergence.

Track GBP and USD with your custom rate alerts. Set Up Here.

"On balance, we don't expect that the labour market data will be the main determinant for the Federal Reserve on policy in the next several months and this week’s release of US CPI will be much more critical," says Edward Bell, an analyst at Emirates DNB.

However, the strong U.S. jobs report out last Friday serves as a reminder that the U.S. economy is still capable of delivering above-consensus readings; therefore, Dollar strength could again well be on this week's agenda.

The U.S. labour market added more jobs than expected in December, with nonfarm payrolls rising by 216k compared with market expectations for 175k.

The release of GDP numbers on Friday forms the UK data highlight, but it could well be comments from the Bank of England's Andrew Bailey on Wednesday that moves the currency market.

Governor Bailey will appear before the Treasury Select Hearing on the December Financial Stability Report at 2.15 pm GMT.

The financial stability report is not directly linked to monetary policy, but there is a chance Bailey will be asked questions regarding interest rates, which can offer some clues as to whether the Governor maintains his steadfast view that it is too soon to consider cutting interest rates.

Turning to the GDP release, the market is poised for a reading of 0.2% month-on-month in November, while the year-on-year rate is expected at 0.1%.

The rolling three-month figure is expected to read at -0.1%.

Should the data beat expectations, the Pound can move higher, but disappointments could send GBP lower across the board.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks