GBP/USD Week Ahead Forecast: Staying Bullish

- Written by: Gary Howes

- GBPUSD setup is bullish

- Further gains possible say analysts

- But U.S. data releases could shake the tree

Image © Adobe Images

The Pound to Dollar exchange rate is tipped by analysts to extend its uptrend over the coming days, although a busy economic release calendar in the U.S. could trigger volatility.

Pound Sterling rose by 1.14% last week, helped by some better-than-expected UK economic survey data that suggested the UK economy grew again in November, while the pro-growth budget announced by Chancellor Jeremy Hunt pointed to an improved economic outlook.

From a technical perspective, the gains suggest improved momentum is building for the exchange rate.

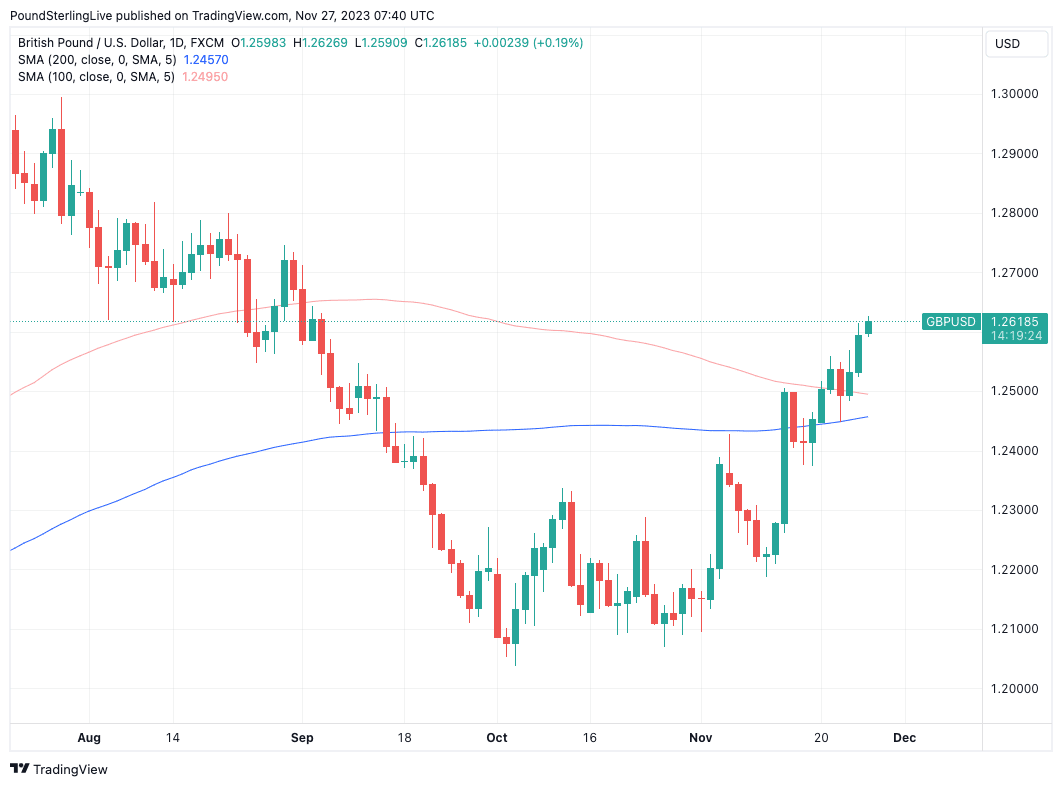

"The continued grind higher in the GBP/USD is lifting it further and further from the 100 day moving average, which opens the door to a bigger run in the pair," says W. Brad Bechtel

Global Head of FX at Jefferies.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Shaun Osborne, Chief FX Strategist at Scotiabank, says the outlook for Pound-Dollar is bullish, with the exchange rate achieving its highest weekly close since early September.

"Gains in the pound have overcome the 100– and 200-day MA over the past week or so and have the support of a bullish alignment of trend oscillators on the intraday, daily and weekly charts," says Osborne.

He expects Pound Sterling will find support on minor dips (to the 1.25 area) in the short run and looks poised to extend its rebound from a technical point of view.

Above: GBPUSD has risen above the 200-day and 100-day moving averages. Track GBPUSD with your own custom rate alerts. Set Up Here.

The fundamental outlook rests heavily with the U.S. this week, where a busy calendar should give further signs as to whether or not the economy is cooling sufficiently to meet expectations for U.S rate cuts in 2024.

Rising expectations for such cuts have recently boosted global investor sentiment, simultaneously supporting the pro-risk Pound and undermining the safe-haven Dollar.

Weekly jobless claims on Thursday bear watching as investors will question whether last week's drop was a blip, meaning another surprise undershoot could cause some nerves that support USD.

Personal spending growth is also due on Thursday and is forecast to have eased to 0.2% in October after the substantial 0.7% rise in September.

The Fed’s preferred PCE inflation data is due on Thursday and is likely to mirror the CPI release and show falls in both the headline and core measures to 3.1% and 3.5%, respectively.

Also, watch Federal Reserve speakers make their case ahead of the pre-FOMC blackout period. The highlight will, of course, be Fed Chair Jerome Powell, who speaks twice on Friday.

"While the Fed is highly unlikely to change interest rates at its last policy meeting of the year next month, markets will be listening carefully for how strongly policymakers push back against expectations for lower interest rates in 2024," says Hann-Ju Ho, Senior Economist at Lloyds Bank.

Track GBPUSD with your own custom rate alerts. Set Up Here.

There are no market-moving events in the UK calendar this week, apart from some speeches by members of the Bank of England, which leaves Pound Sterling counting on a benign global backdrop to further its gains.

Should global stock markets continue rising, the Pound can benefit against both the Euro and Dollar as it tends to be supported by positive market sentiment.

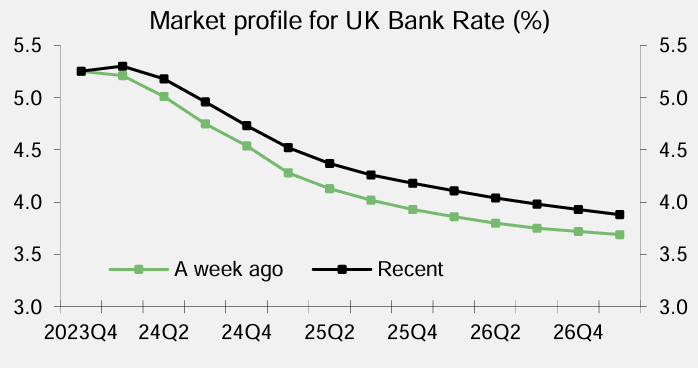

What has changed in the last week is that UK government bond yields have picked up as markets anticipate less by way of interest rate cuts at the Bank of England in 2024 than had been the case just seven days ago.

"UK government bond yields rose sharply... in contrast with more moderate changes in their US and European counterparts. Markets pushed back the expected date for a first Bank of England interest rate cut to later in 2024 in the wake of stronger-than-expected PMI business and GfK consumer survey data and the Autumn Statement," says Hann-Ju Ho.

Above: UK rate expectations have risen, aiding the Pound. Image courtesy of Lloyds Bank.

With this in mind, watch speeches by Bank of England Governor Andrew Bailey, David Ramsden, Jonathan Haskel, Andrew Hauser and Megan Greene.

"Given that the latest UK data has come in largely in line with the BoE expectations, we believe that the MPC members will continue to push back against the market rate cut expectations," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.