GBP/USD Week Ahead Forecast: Strong Defence

- Written by: Gary Howes

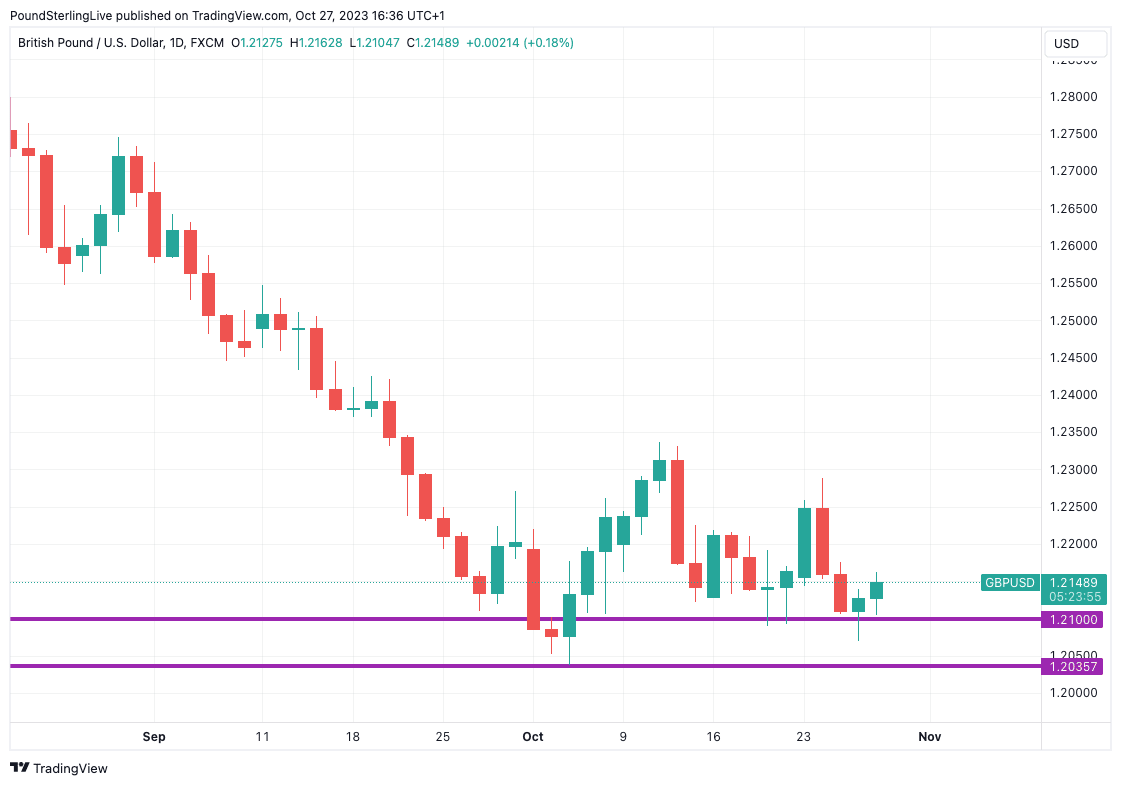

- GBPUSD well supported in the 1.20-1.21 region

- Look for any weakness to be faded

- Midweek Fed meeting is first source of event risk

- Bank of England risks striking a dovish tone for GBP

- U.S. labour market report to set the tone ahead of the weekend

Image © Adobe Images

The Pound could remain supported against the Dollar over the coming days as technical indicators suggest the selloff of recent weeks is becoming exhausted, but the Federal Reserve, Bank of England and U.S. labour market statistics form the major hurdles to any significant recovery.

The Pound to Dollar exchange rate appears to be well supported above the 1.20 level as forays below 1.21 in the past week have found buying interest, and this level can continue to act as a solid floor of support over the coming days.

"Cable’s rebound from sub-1.21 levels yesterday extends the pattern of firm support for the GBP below the figure seen through October so far," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Above: The 1.2030-1.21 area is offering some support to GBPUSD. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Osborne says the pattern of trade around the recovery from last week's lows is bullish from a technical point of view, but the lack of follow-through leaves gains stalled.

Over the coming days, foreign exchange markets will remain focussed on Middle East risks, particularly with regard to any Iranian military flex in the region.

The key conduit to financial market stress is via oil prices which tend to rise on heightened tensions.

Rising oil prices are, in turn, associated with Dollar strength.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Turning to the data and events calendar, the bar for further Dollar strength appears elevated with increasing numbers of analysts we follow saying it will take a bumper payrolls report and an unexpectedly 'hawkish' Federal Reserve to propel the currency higher.

Such a high bar should boost the Pound-Dollar rate's ability to hold the above-mentioned support levels and limit the scope of any downside.

The first major test for the Greenback comes on Wednesday with the release of the ISM manufacturing survey at 15:00 GMT, where markets are looking for further signs of U.S. economic resilience. The consensus is set for a reading of 49, although suspicions will be to the top end given the recent trend of strong data outturns.

At 19:00 GMT the Federal Reserve gives its latest interest rate decision, which is widely anticipated to be a no-change call. The market-moving element of the event will be the guidance regarding a potential December interest rate hike.

"The credibility of any 'hawkish skip' would depend on the FOMC's assessment of the evolving economic and inflation outlook as well as any indications that the recent rise of long-dated UST yields reduces the need for further monetary tightening from here," explains Crédit Agricole.

Should the market price in another rate hike, the Dollar could advance.

Key to that December decision will be Friday's labour market report, where the market is poised for a non-farm payroll reading of 172K for October and an unemployment rate of 3.88%.

Currency strategists say that the biggest Dollar reaction would likely be to the downside on any disappointment given how well subscribed the U.S. outperformance trade has now become.

"We think it would take a blockbuster print and a very strong reaction from the Fed to drive the USD higher, after the currency’s surge in recent months," says a note from the currency strategy desk at UBS.

"We think that it would take a significant positive data surprise to encourage the markets to start pricing in further tightening in a boost to the USD," says a weekly currency research note from Crédit Agricole. "Potential data disappointments could cement the market expectation that the Fed tightening cycle has peaked and encourage profit taking on stretched USD longs."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

For the Pound, "the focus will be on Thursday’s Bank of England (BoE) decision, where the soft economic backdrop suggests the bar for another hike is high. This is fully appreciated by the market and with the Fed also on hold, we expect the rangebound GBPUSD theme to hold in the coming week," says a note from the foreign exchange strategy desk at UBS.

The Bank of England forms the highlight of the coming week for the British Pound and the risks associated with the event will likely cap any strength in the currency.

Investors could opt to lower exposure to the Pound in the lead-up to Thursday's decision which is likely to see interest rates left unchanged at 5.25%.

On balance, the Bank of England's policy decisions have tended to undermine the Pound in the current hiking cycle, as policymakers have tended to err on the cautious side.

This cautious reaction function could result in the Bank inadvertently giving a green light to market participants to bring forward rate cut expectations, which can weigh on the Pound.

The Bank will be keen to stress interest rates must stay at current levels for an extended period, particularly given wage rises are elevated and could contribute to inflation remaining above target for a long period.

"With the GBP already weighed down by weak data, the currency could benefit from confirmation of the BoE's 'higher for longer' outlook," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

But the 'higher for longer' message could be undermined by how the Monetary Policy Committee (MPC) votes.

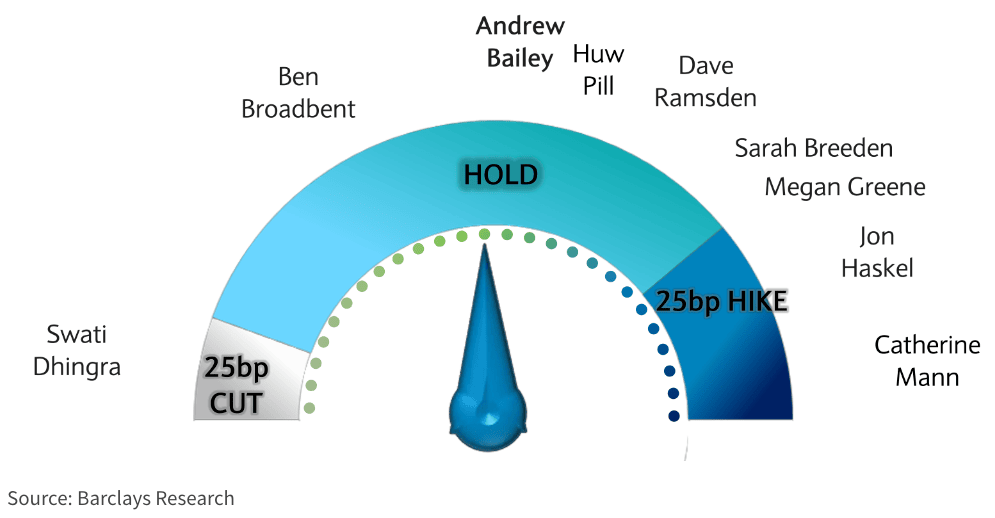

In particular, we are wary that Swati Dhingra, the most 'dovish' member of the MPC, will vote for a rate cut.

Economists at Barclays expect Dhingra to vote for a cut on Thursday, saying in a research note: "We expect the MPC to hold Bank Rate at 5.25% at the 2 November meeting, with a base case of a split vote of 1-6-2, reflecting the finely balanced nature of the decision and plausible arguments on both sides (Dhingra to vote for cut and Mann and Haskel to vote for hike)."

Should Dhingra vote for a cut, the MPC will be signalling rate cuts are actively being discussed, making the Bank of England the first to communicate that an easing of policy is now on the horizon.

Therefore, this single vote and its necessary acknowledgement in the accompanying minutes, risks undermining any unity on a 'higher for longer' message the Bank is trying to convey.

Money markets will likely bring forward expectations for rate cuts in 2024, pressuring UK bond yields relative to those of the Eurozone and U.S.

The mechanical transfer of these expectations to foreign exchange markets would imply a weaker Pound.

However, any downside risks from the vote composition could be countered by an uplift in the Bank's economic forecasts.

"Updated economic projections should provide some food for thought," says Nikesh Sawjani, Senior UK Economist at Lloyds Bank. "The BoE’s forecasts will be conditioned on a market-implied path for Bank Rate that will be around 75bp below where it was for the August."

Expectations for lower rates in the future "imply a less tight policy stance and lift the Bank of England’s projected level of GDP and CPI projections across the forecast horizon," says Sawjani.

Lifting inflation and growth projections could limit the 'dovish' tendencies of the MPC and afford the Pound some downside protection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks