GBP/USD Rate September Forecast: Vulnerable to Decline Says Convera

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling appears vulnerable to losses against the Dollar over the coming weeks of September according to a new analysis released at the start of the new month.

"Potential overpricing makes the pound vulnerable," says George Vessey, FX and Macro Strategist at Convera, the international payments firm, formerly known as Western Union Business Solutions.

The call comes after the Pound to Dollar exchange rate (GBPUSD) posted a 1.25% loss for August, an outcome that is not entirely unexpected given the strong seasonal tendency for the pair to decline in August.

"Seasonality trends held up for the pound during August as it depreciated against the US dollar. GBP/USD fell over 1% to log only its third monthly decline so far this year," notes Vessey.

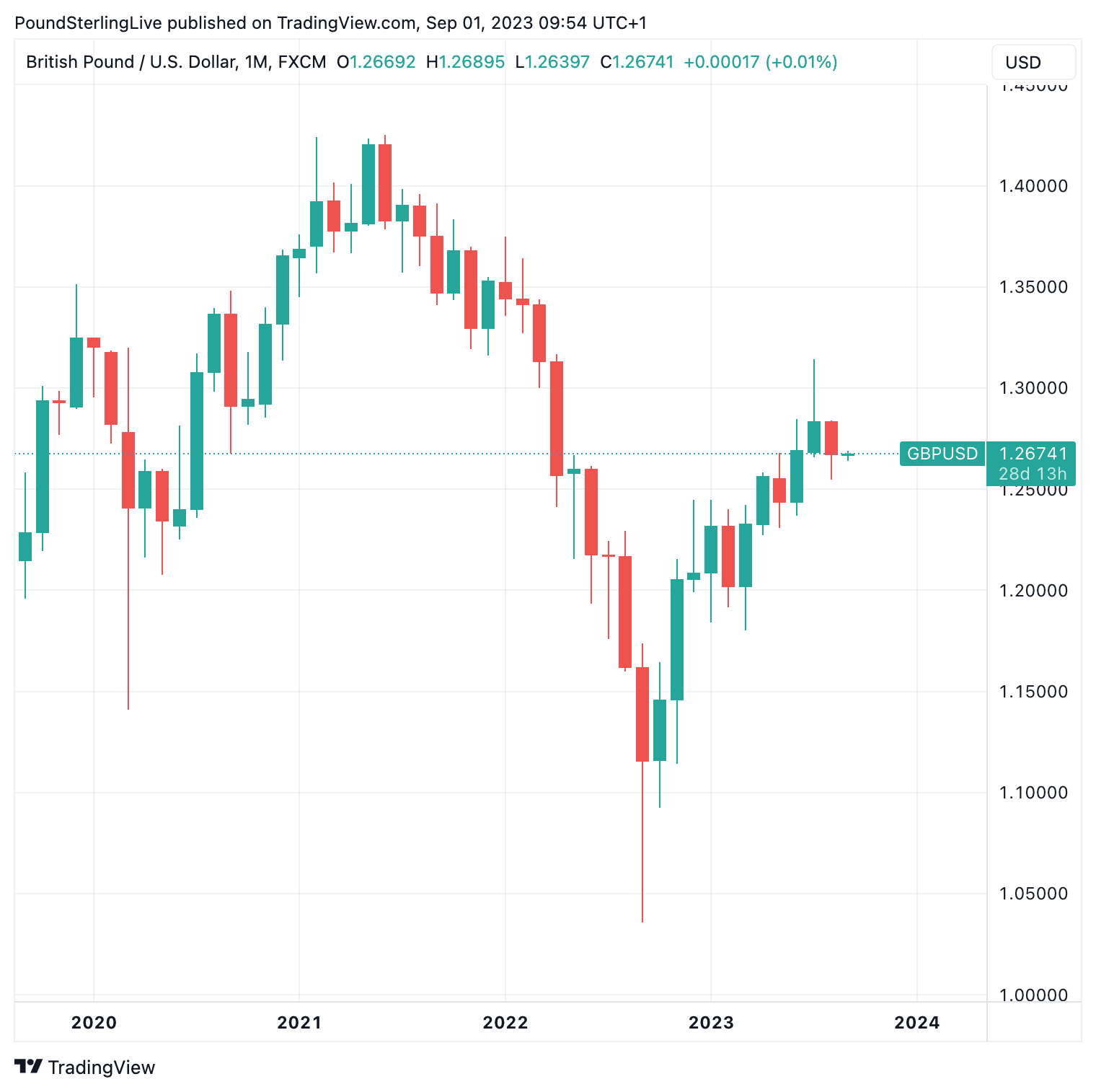

Above: GBPUSD at monthly intervals.

Turning to the outlook, analysts at Reuters point out that September tends to be another month that favours the Dollar from a seasonal perspective.

"The USD index's performance for each September since 2000 shows it has risen in 14 of the last 23 years, including in each of the last six, highlighting a possible in-built structural upside bias. While seasonality should not be considered in isolation, it can be useful when combined with other factors," says Martin Miller, a Reuters market analyst.

Vessey notes the monthly chart set-up also looks bearish, "implying a softer start to September may unfold."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Vessey interprets recent comments from Bank of England Chief Economist Huw Pill, made in Cape Town, as "not-so-hawkish", hinting that there might be some disappointment in store for the Pound in terms of Bank of England interest rate policy.

"A keynote speech from the Chief Economist suggested he favours keeping the BoE’s Bank Rate at its current 5.25% or that only one more hike is necessary compared to current market pricing of at least two more hikes. But in a further rebuff to market thinking, he also underlined keeping rates at current levels for some time to ensure inflation does move back to target," says Vessey.

"At present, the emphasis is still on ensuring that we are - in the words of the MPC's last statement - sufficiently restrictive for sufficiently long to ensure that we have that lasting return to target," Pill told the South African Reserve Bank's Biennial Conference in Cape Town.

Vessey cautions, however, that some leading UK economic indicators, as well as base effects, point to lower inflation in the short term.

"Couple this with further UK economic weakness suggests market pricing of BoE rate expectations is still too aggressive, which makes the pound vulnerable," says Vessey.

"While current yield spreads still suggest upside scope for sterling, this change of heart by Mr Pill, who has been on the hawkish side up till now, may limit the pound’s upside potential from here," he adds.

Studies of the daily charts by Convera meanwhile suggesets daily momentum readings have flipped to negative, and the relative strength index has turned lower.

"A break of the 100-day moving average support could open the door to test $1.25 this month. Meanwhile, after Eurozone inflation data, GBP/EUR has looked poised to test €1.17 again after its biggest two-day rally in over two weeks, yet the currency pair has started today on the softer side," says Vessey.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks