USD Rebound to be Temporary Says Swedbank

- Written by: Gary Howes

Image © Adobe Images

A growing debate in FX at present is whether the Dollar's May rebound is temporary, or whether it can last for a number of months.

We report that analysts at investment bank Jefferies look for the dollar to rally into year-end, but peers at Swedbank say they believe, for now at least, that the Dollar's rebound is to be a short-term phenomenon.

"We believe this is a temporary comeback, but uncertainty is high and conviction low," says Anders Eklof, Chief FX Strategist at Swedbank.

Swedbank is a 200-year-old Swedish lender with a $18.23BN market capitalisation.

"Our view of some further dollar weakness ahead and gradually improving risk sentiment in H2 is still valid," says Anders Eklof, Chief FX Strategist at Swedbank.

The Dollar has been amongst the weaker global currencies in 2023 but May has seen something of a revival.

Catalysts include rising bets that the Federal Reserve can hike interest rates once more owing to resilient U.S. economic data, slowing Chinese economic growth and uncertainty as to the resolution of the U.S. debt ceiling.

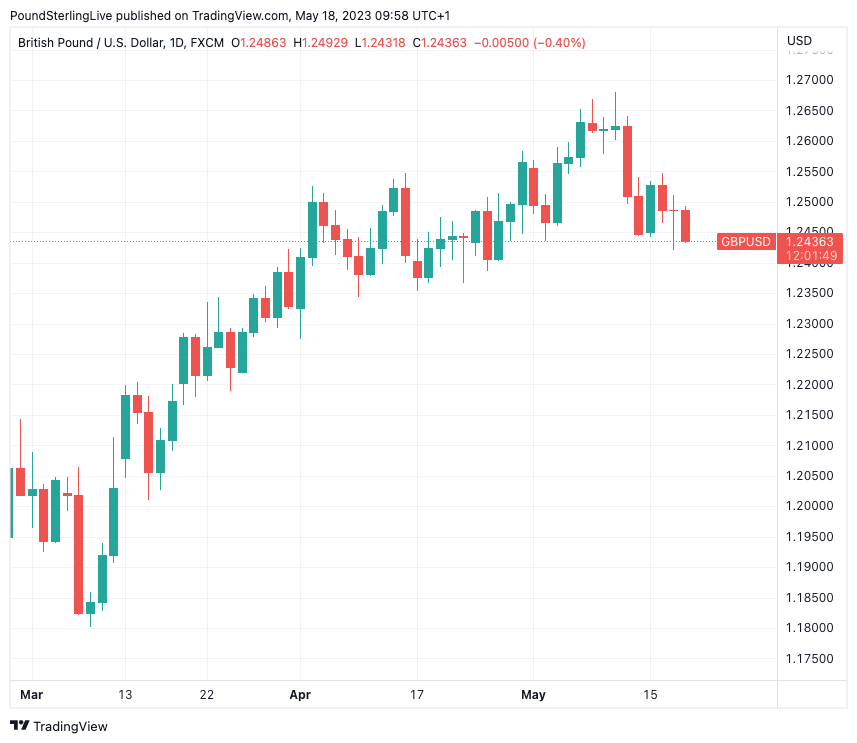

Owing to the USD reboot, the Pound to Dollar exchange rate (GBPUSD) has fallen from a multi-month high at 1.2679 on May 10 to 1.2439 at the time of writing, trimming 2023's advance to 3.0%.

Above: GBP/USD at daily intervals. is the rally on hold, or has it completed?

The Dollar's rebound has naturally prompted analysts to question whether the trend of weakness has come to an end, or whether this is just a retracement, a natural phenomenon in financial market behaviour.

Swedbank says an unknown "is whether tightening so far is enough to take inflation on the rapid path back to target. If not, policy rates may need to stay higher for longer on both sides of the Atlantic, weighing on risk."

Higher for longer U.S. interest rates would be supportive of the Dollar, while deteriorating risk sentiment would also boost the Dollar owing to its safe haven credentials.

"An important watershed ahead is the FOMC June 14 where we believe they will pause hikes. Fed will receive one more NFP and CPI ahead of that and will closely follow how credit conditions evolve," says Eklof. "It is an open question is if Fed dare to call a firmer end to hikes."

"I lean toward that will be the case, which should be a signal to expect further dollar weakness, even if Fed is not underwriting rate cuts toward the end of the year," he adds.

If this were to the case the Dollar's rebound could find itself running low on fuel.

"We believe this is a temporary comeback," says Eklof.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

But analyst W. Brad Bechtel, Global Head of FX at Jefferies LLC, is of the latter school of thought and is pencilling in a stronger Dollar into year-end as a global slowdown and as U.S. funding issues drive demand for the U.S. unit.

"I continue to think that we are in the earlier stages of what will be a prolonged USD rally straight into year-end 2023," says Bechtel in a recent currency briefing.

He says the Dollar will receive a tailwind from the angst around the debt ceiling which "is only just starting to heat up" and the Swiss Franc will likely be the only outperformer against the USD in that phase.

The call would therefore underline a view that the Pound to Dollar exchange rate (GBPUSD) has reached a peak for 2023, as have the likes of EURUSD and AUDUSD.

"As we move through the debt ceiling and the US Treasury begins issuing an enormous amount of U.S. Treasuries the USD liquidity will drain from the system and this will spark the next leg up in the USD," says Bechtel.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks