Wounded Dollar Bites Back, Prodded by a Bumper Payroll Report

- Written by: Gary Howes

The Dollar jumped following the release of new data that showed the U.S. economy continues to add jobs and churn out inflation-generating wage increases, defying expectations for a slowdown.

The market was expecting a non-farm payroll reading of 180K for April but instead got a 253K print, this represents an acceleration on March's 165K reading.

The Dollar has been steadily sold over the recent weeks as investors grow wary of the U.S. falling into recession in the second half of the year as higher interest rates at the Federal Reserve and reduced lending amidst banking stresses begin to bite.

But this bias is severely tested by the observation Non-Farm Payrolls have now exceeded expectations for a record 13 straight months.

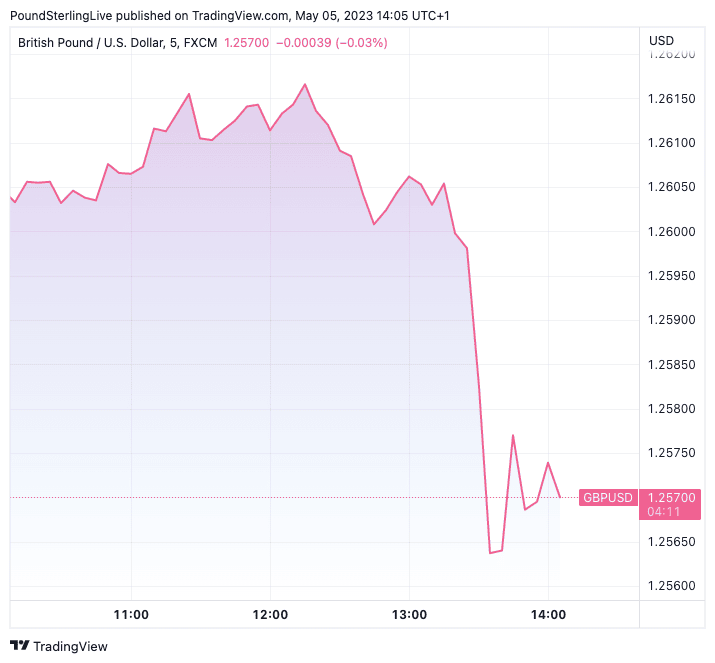

Above: GBP/USD at 5-minute intervals showing the USD comeback following the jobs report.

"The U.S. dollar strengthened after strong hiring and low unemployment allayed both recession concerns and prospects for interest rate cuts later this year," says Joe Manimbo, Senior FX Analyst at Convera.

The unemployment rate also wrong-footed Dollar bears by unexpectedly falling to 3.4% from 3.5%, whereas the expectation was for an increase in unemployment to 3.6%.

Rising unemployment would have signalled to the Fed that its job was done given wages would be expected to retreat and contribute to lower inflation rates.

Further signs of resilience were observed in the wage numbers where average hourly earnings accelerated to 0.5% in April from 0.3% previously.

The Federal Reserve hinted on Wednesday it might pause its interest rate hiking following another 25 basis point hike. But Fed Chair Jerome Powell kept the door ajar to a further rate hike in June.

Much could change over the coming weeks, but based on the labour market the Fed might feel compelled to hike again.

The Dollar would rise if the market prices for a further hike while lowering expectations for H2 rate cuts.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

GBPUSD had risen to a new one-year high at 1.2615 earlier in the day but has since retraced to 1.2574.

EURUSD has meanwhile seen its post-ECB losses stretch below 1.10 to 1.0983.

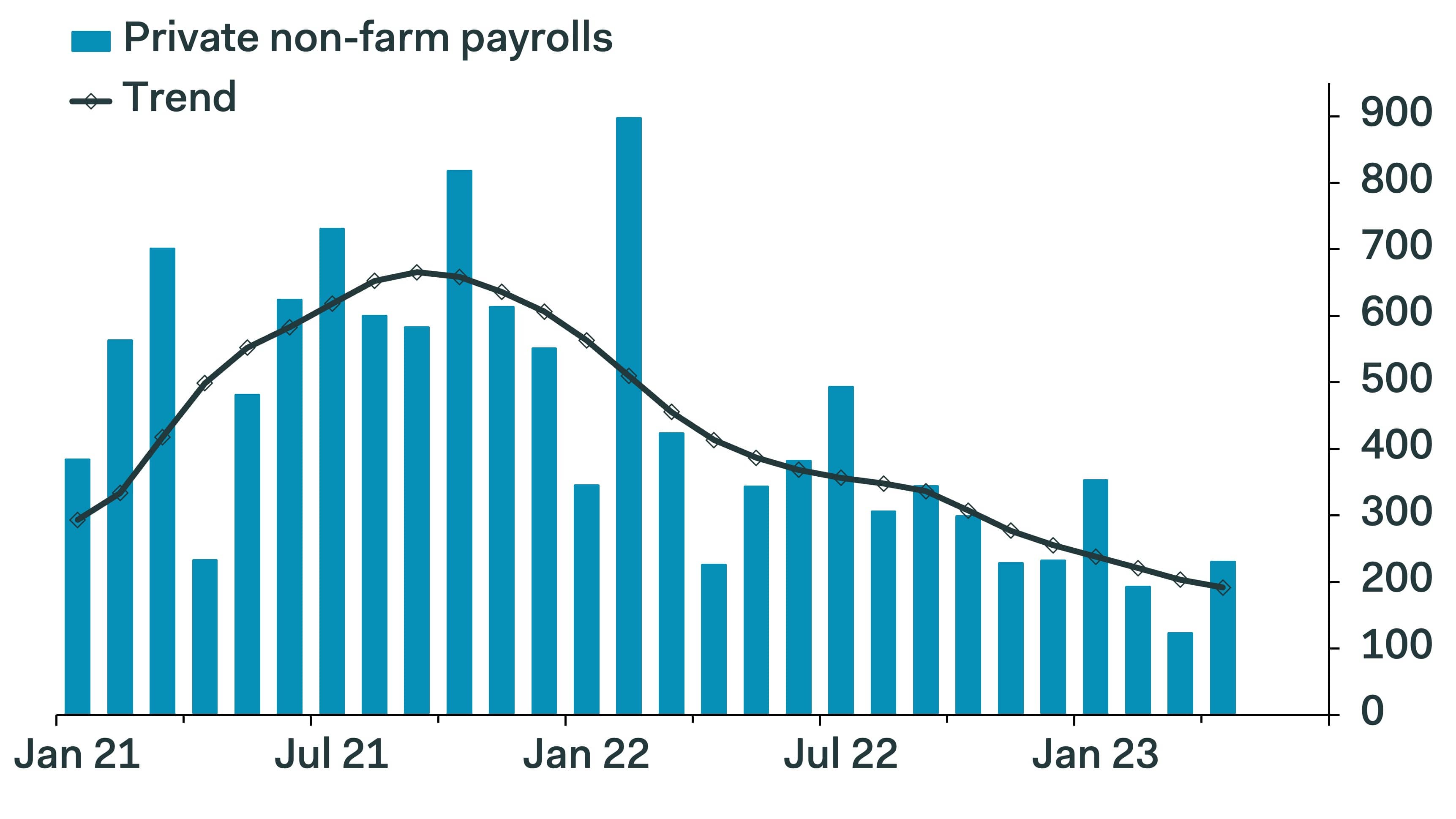

Dollar bears will nevertheless point to the steady trend of decline in the jobs data, arguing that data never moves in a smooth straight line. Furthermore, May will see credit conditions tighten once more as U.S. regional bank stresses emerge, prompting lenders to tighten credit conditions.

In fact, Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, says "the trend is slowing quite relentlessly."

Above: U.S. non-farm payroll prints, courtesy of Pantheon Macroeconomics.

The Fed's most recent hike, combined with tighter credit conditions, will surely be felt by businesses and households over the coming months.

"The Fed will want to see to what extent a tightening of credit conditions slows down the economy and is therefore unlikely to raise key rates further," says Christoph Balz, Senior Economist at Commerzbank.

The Dollar's trend remains one of depreciation and snapbacks can be expected. For the trend to truly change markets would need to see a series of labour market reports to suggest the economy is starting to accelerate.

This remains unlikely given the combination of higher rates and banking stresses meaning investors will likely buy into GBPUSD dips.

"For now, positive momentum favours sterling and GBP/USD could look to target its 100-week moving average at $1.2725 in the short term," says analyst George Vessey at Convera.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |