Pound Could be at $1.27 Before Summer Forecasts Jefferies

- Written by: Gary Howes

Image © Adobe Images

The Pound and Euro could reach fresh multi-month highs against the U.S. Dollar this spring, although a lull in price action over the northern hemisphere's summer months would then be expected.

This is according to the analysis of W. Brad Bechtel, Global Head of FX at Jefferies LLC, which also warns of the potential for a more notable turn lower in the Dollar by year-end.

Bechtel has been watching the Dollar index - a measure of overall USD performance against a basket of major currencies - and finds the rise witnessed over recent days can continue, even if it is somewhat unconvincing.

"I am still of the view that we are likely to see some weakness in the USD in the medium term, but in the very short term DXY might get pulled just a bit higher first," says W. Brad Bechtel, Global Head of FX at Jefferies LLC.

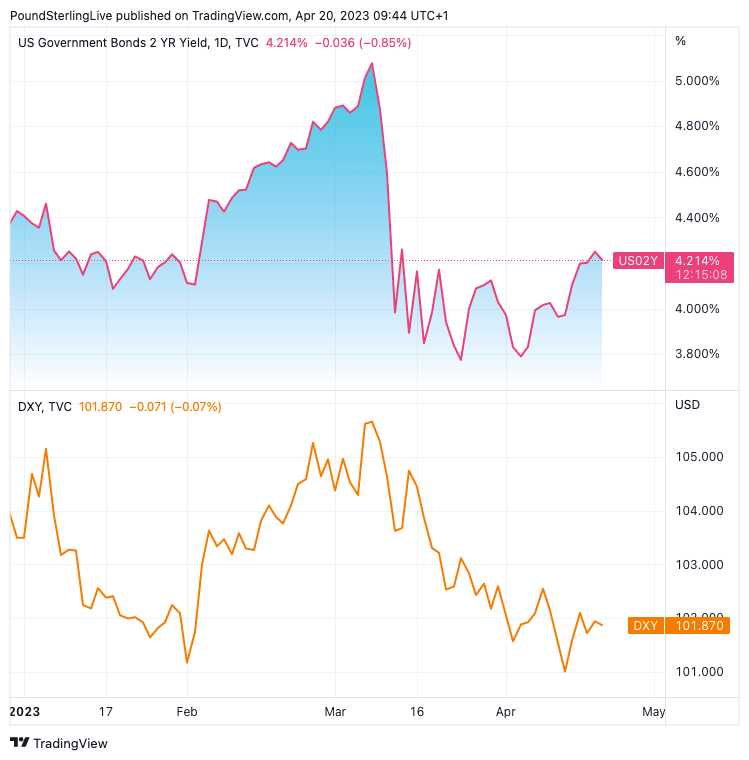

Bechtel is watching U.S. interest rate markets as an explainer of the Dollar's performance as inflation narratives become "a thing again".

"DXY made a double bottom around 100.80 for now but has not really participated in the rally as U.S. rates grind higher," says Bechtel.

U.S. two-year bond yields have been rising since the week of March 20, a development that would typically be expected to offer the U.S. Dollar support.

But, "in percentage retracement terms the USD is nowhere close to the 50% seen in the 2yr which tells me that there is some structural weakness in the USD out there still.

Above: U.S. two-year bond yields (top) and the Dollar index.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"If this move in U.S. yields fizzles and starts to reverse lower again, then the USD will take out 100.80 pretty quick and EUR/USD will rise through 1.1100," predicts Bechtel.

The Dollar is expected to be the prime driver of where the Pound to Dollar exchange rate and other pairs trade over the coming weeks.

"In the end, EUR/USD will trade to 1.1250, GBP/USD 1.2700, AUD/USD through 0.7000, maybe up to 0.7200 eventually," says the Jefferies analyst.

The Dollar index is meanwhile expected to trade through 100.00 floor, but Jefferies' FX strategy team is not looking for "a huge break lower".

"A move through 100.00 and then some range-bound activity as we push through the Summer," says Bechtel.

This suggests another leg higher in GBP/USD, EUR/USD, AUD/USD et al. is possible during spring, ahead of rangebound trade during the summer months (through to end-August).

"By end of Summer, we'll have a better view on where things stand with the US economy. Will the US economy roll over hard or will the Fed pull the rabbit out of its hat and have a soft landing," says Bechtel.

If the Dollar slides sharply into year-end and into next year "then we could enter a bigger down cycle in the USD, but I am reticent to make that call just yet," says Bechtel.

The Jefferies strategist says his favourite currencies at the moment in order are the EUR, AUD, GBP, CAD with JPY as a preferred short.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |