U.S. Dollar Tailwinds Have a Three-month Window: Standard Chartered

- Written by: Gary Howes

Image © Adobe Images

The Dollar can remain firm in the near-term but foreign exchange strategists at Standard Chartered say strength should likely be brief, allowing the likes of the Euro and Pound to resume a stalled uptrend.

But the window for gains is limited to a matter of weeks says the UK-based, Asia-focussed lender and investment bank.

In a new research note, Standard Chartered says the recent rally in the Dollar comes as investors revise higher expectations for the peak in U.S. interest rates, something that weighs on stocks, raises investor uncertainty and stimulates demand for the Dollar.

"The US Dollar appears to have caught a tailwind after a string of upside US economic data surprises. While the strong data reduces the risk of a near-term US recession, it makes it more likely that the Fed will keep raising rates for now," says Rajat Bhattacharya, Senior Investment Strategist at Standard Chartered.

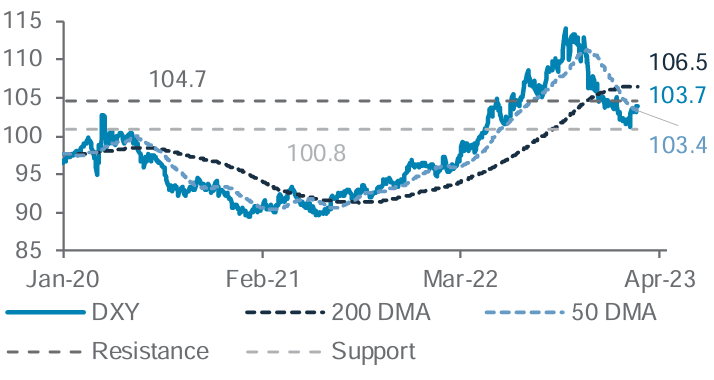

Above: USD index, with key technical levels. Source: Bloomberg, Standard Chartered.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Although the Dollar has recovered some of its recently lost value, Standard Chartered assesses that a return to the 2022 USD bullrun is unlikely.

"We also expect the rebound in the USD to fade in the next three months, along with US government bond yields, as it becomes clearer that higher policy rates would eventually cause a recession, leading to a paring back of Fed rate expectations," says Bhattacharya.

The Dollar has rallied through February on the back of a flurry of stronger-than-expected economic data points.

These include robust wages, employment gains and strong retail sales that indicate the consumer-led U.S. economy is still capable of churning out above-target inflation rates.

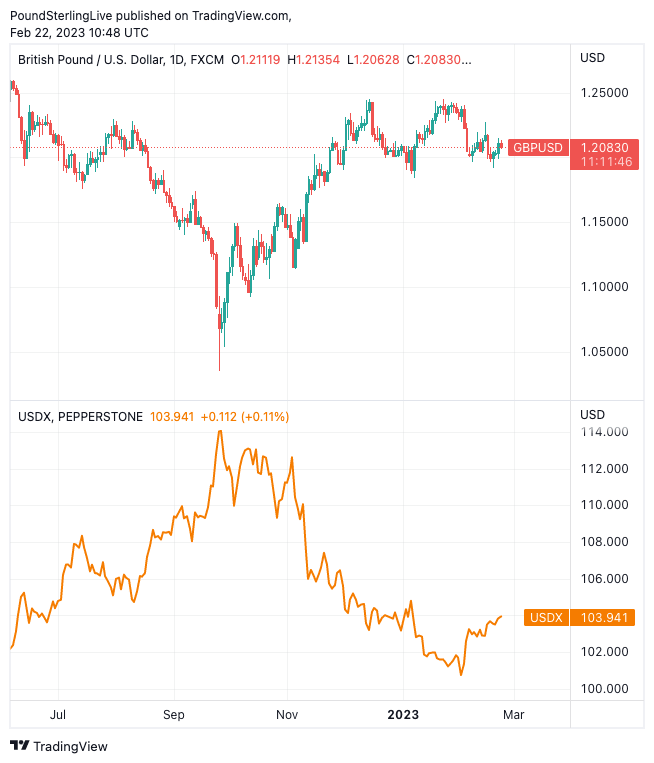

The turn higher in the U.S. Dollar meanwhile corresponds with a peak in the GBP/USD and EUR/USD exchange rates, therefore the outlook for these pairs could ultimately rely on USD developments.

Above: GBP/USD (top) and the U.S. Dollar index. Consider setting a free FX rate alert here to better time your payment requirements.

Money market pricing shows investors are now positioned for a Federal Reserve interest rate hike in both March and May, but a significant recent development is the pricing of a third additional 25bp hike in June.

The odds of a rate cut by year-end have meanwhile eased.

"Such a scenario, set against the backdrop of elevated wage pressures, would be negative for corporate margins, and by extension equities and other risk assets over the medium-term," says Bhattacharya.

But the repricing higher in interest rates is now well understood and the Fed will be unlikely to press rates materially higher than projected by current expectations.

This, therefore, limits the Dollar's upside potential.

"While the USD is getting strong support near-term from resilient US data and hawkish Fed messaging, ultimately, we believe markets will likely pare back Fed rate hike expectations as the outlook for US growth deteriorates with tighter policy. Thus, we see the USD index eventually turning lower towards 102 in the next 3 months," says Bhattacharya.

The timelines in play are important: a further three months of USD-supportive dynamics could lead to some noticeable weakness in GBP/USD and EUR/USD. (Free download: 2023 investment bank forecasts for GBP/EUR from Global Reach.)

"The strength in US data has challenged the market's weaker dollar baseline," says Audrey Ong, an analyst at Barclays Bank. "More of the same can fuel fears of overtightening and hard landing, hurt risk sentiment and lift the dollar."

Foreign exchange analysts at Bank of America also see the Dollar retaining strength over the coming weeks, but a broader downturn from mid-year is likely.

"We remain bullish on the USD for the first half of the year," says Athanasios Vamvakidis, a strategist at Bank of America. "We believe that the price action so far in February, with the USD appreciating again back to end-2022 levels, validates our views."

HSBC meanwhile says the market is currently in a USD 'chop' phase as uncertainties regarding the monetary policy outlook are confronted.

However, the bank says 2023 will still be a year of U.S. Dollar weakness.

"We still think it is likely to be late 1Q/early 2Q when the Fed and other uncertainties subside, which will open the door for the USD to renew its descent," says Dominic Bunning, a strategist at HSBC.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks