Nomura Will Keep Selling Pounds and Euros against the Dollar

- Written by: Gary Howes

- Truss no game-changer for GBP says Nomura

- GBP/USD decline can extend

- EUR/USD also going materially lower

- As energy crisis remains the only game in town

Image © Adobe Images

The British Pound's relentless selloff is by no means over according to a major investment bank, despite hopes that the new government of Prime Minister Liz Truss can alter the outlook for the UK economy for the better.

Truss is likely to announce a significant support package for UK households and business before the week is over, with talk of a cap on energy bills at, or near, current levels being likely.

This would effectively mean the peak in inflation is very near, or has even passed, thereby improving the prospects for the economy.

"A new Prime Minister and Chancellor could bring a new lease of life to GBP. A change of leadership is usually GBP positive, especially when up to £130bn of fresh deficit spending may be on the agenda," says Jordan Rochester, a foreign exchange strategist at Nomura.

But for Rochester these developments are no game changer and he continues to be an advocate for selling the Pound to Dollar exchange rate (GBP/USD).

Rochester is particularly concerned that the issuing of significantly more debt could be problematic for the government.

"The current crisis is unlike any we’ve seen in the recent past, especially with a lack of fresh QE to soak up this fresh issuance," says Rochester.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

During the Covid crisis the government was able to guarantee jobs and businesses with generous handouts, financed by the issuing of more debt.

At the this time the debt was bought by the Bank of England which was engaged in quantitative easing, a process whereby it created money to buy the government's bond issuance, thereby ensuring the yield paid by the government was maintained at low and affordable levels.

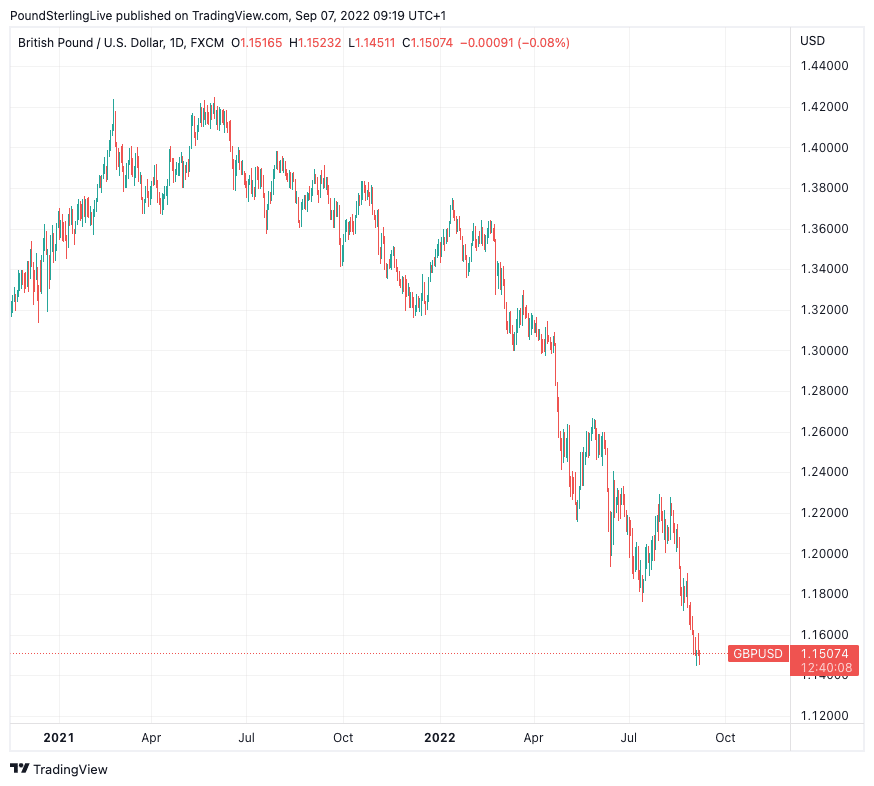

GBP/USD fell to a two-year low at 1.1442 on Monday before recovering back to 1.1515 midweek, taking the quoted exchange rates for dollar payments at high-street banks to the region of 1.1285 and those quoted at payment specialists to 1.1480.

Rochester also reckons that any peak in near-term inflation could prompt the Bank of England to step back from raising interest rates.

"Artificially lower energy prices for consumers will remove pressure on the BoE to be as hawkish in the near term. UK consumers will pay less, but the government will pay a lot more and the UK’s trade deficit will widen further – a completely different story to the COVID-19 spending outcome when the trade balance improved," says Rochester.

"It’s a recipe for the balance of payments to continue to deteriorate, the UK’s terms of trade to worsen and with it GBP’s value to fall," he adds.

Nomura retains a sell on GBP/USD, looking for 1.10 by end-October and 1.06 by year-end. Those looking to protect their dollar payments should consider locking in current exchange rate levels for future payments, find out more here.

Above: GBP/USD at daily intervals. Set your FX rate alert here to keep on top of the market.

But Rochester is also chasing a lower Euro.

"As Nord Stream 1 has entered another leg of unplanned maintenance this will probably raise gas prices and lead to further industrial demand destruction," he says.

The call comes as the Dollar index, as measured by Bloomberg, tests all-time highs and confirms the Greenback's uptrend remains the single most decisive factor in today's currency markets.

Nomura does not see recent political efforts to shore up support for Eurozone industries as being particularly useful for the Euro.

These include a substantive energy support package announced by Germany and efforts by the EU to cap gas prices at a conference due Friday.

The ECB is meanwhile expected to hike interest rates on Thursday, and like the Bank of England, is no longer available to hoover up Eurozone sovereign debt to keep funding costs down.

"Deficit spending without sizeable ECB QE is a very different matter for FX to consider. This is why the continued terms-of-trade shock, many rate hikes already priced for the ECB and global growth expectations in decline are likely to weigh on EUR/USD towards our target of 0.975 by end-September and 0.95 in October, with 0.90 by end-December," says Rochester.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes