GBP/USD Outlook: "Nothing Gets Worse Forever" says Morgan Stanley

- Written by: Gary Howes

Image © Adobe Images

The Dollar should make a decisive turn lower by Autumn says Morgan Stanley, which would allow Pound Sterling and other major currencies to recover.

In a mid-year strategy update Morgan Stanley analysts expect further strength into the northern hemisphere summer, although this strength is anticipated to be modest and would ask questions of the more bearish forecasts in the analyst community for levels sub-1.20.

The Morgan Stanley research comes as the Pound to Dollar exchange rate (GBP/USD) remains caught in a long running downtrend largely driven by the seemingly irresistible appreciation of the Dollar since May 2021.

Last week saw the Dollar index - a measure of broad USD performance - reach its highest level in 20 years at 105.00, with corresponding multi-year lows of 1.0348 in EUR/USD and 1.2155 in GBP/USD being printed.

The declines had lead some analysts to warn GBP/USD is prone to test the psychological level of 1.20 in the near future.

"We had expected USD to continue strengthening into 1H22 as rising US real yields and Fed hawkishness would propel a ‘policy divergence’ narrative. Market expectations for the Fed certainly have moved in this direction, but an unexpectedly weak global growth outlook and geopolitical uncertainties bolstered USD by more than expected," says Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

A number of headwinds to the global economy have emerged this year, these include Russia's invasion of Ukraine, surging inflation, central bank interest rate hikes and Chinese Covid lockdowns.

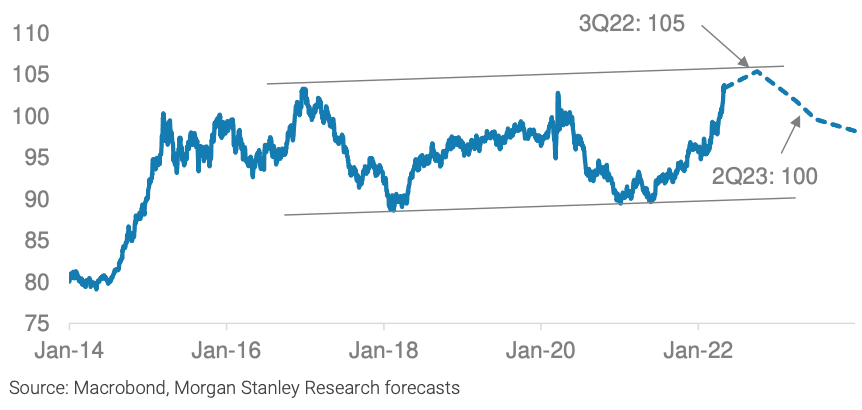

"We expect these trends to continue into the summer with modest but broad-based USD strength into 3Q22 propelling the DXY to 105," says Hornbach.

At the time of writing the Dollar index (DXY) is at 104.53, GBP/USD is at 1.2345 and EUR/USD is at 1.0442; therefore a retest of the 2021 highs could mean a test of last week's lows for these two pairs once more before the year is out. (Set your FX rate alert here).

"The combination of continued geopolitical uncertainties in Europe and Covid lockdowns in Asia should continue to fuel the ‘growth divergence’ narrative while North America, with continued policy normalization from the Fed and BoC, economic insularity, clean local balance sheets, and elevated savings, may be more immune to the perceived global slowdown," says Hornbach.

But, "nothing gets worse forever," he adds.

Morgan Stanley's analysts expect the U.S. Dollar to peak by early autumn, leading the DXY to reach the top, but fail to break out, of its long-term range.

Above: "We expect the DXY to peak at 105 in 3Q22, the top of its long-run range" - Morgan Stanley.

This should be reflected in a number of major key exchange rates such as GBP/USD and EUR/USD holding supports.

Morgan Stanley argues central banks cannot continue hiking aggressively into restrictive territory and global economic data will fail to worsen further from relatively pessimistic expectations.

Furthermore the probabilities of a global recession will unlikely rise further and commodity prices and inflation will prove unable to accelerate at their recent pace.

"A reduced probability of Covid lockdowns in Asia and unexpected resilience of European data in response to the commodity price shock would also support USD peaking," says Hornbach.

Morgan Stanley forecasts the Euro-Dollar rate to continue softening in the near term, falling to 1.03 by the third quarter "and perhaps even overshooting to parity as concernsabout local geopolitics and commodities intensify meaningfully further".

However, they expect the exchange rate to begin rebounding modestly in the fourth quarter and into 2023.

The Pound-Dollar exchange rate should remain in the 1.20 range says Hornbach, falling to 1.22 by the third quarter before pushing to 1.28 by mid-2023.