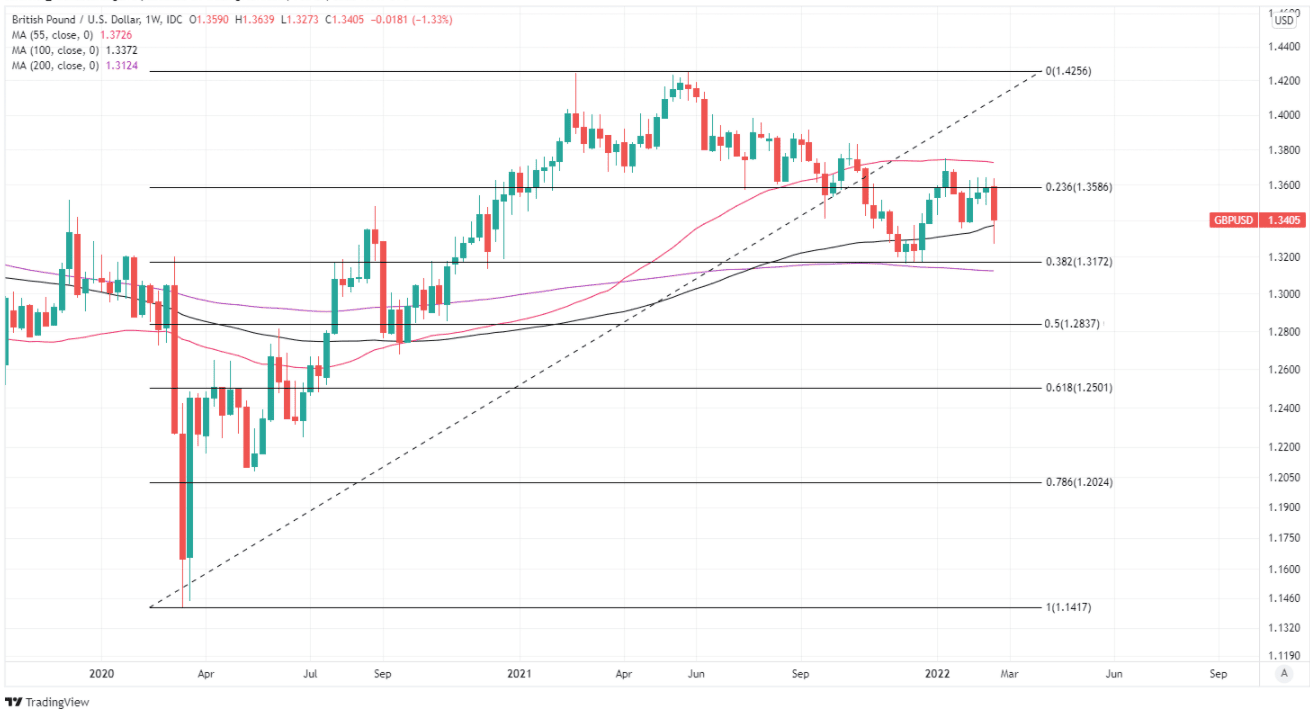

Pound / Dollar Week Ahead Forecast: Looking to Hold 1.3370 but Risking Slide to 1.3172

- Written by: James Skinner

- GBP/USD supported by 100-wk average at 1.3370

- But risks sliding back to major support near 1.3172

- Sanctions implementation gap poses downside risk

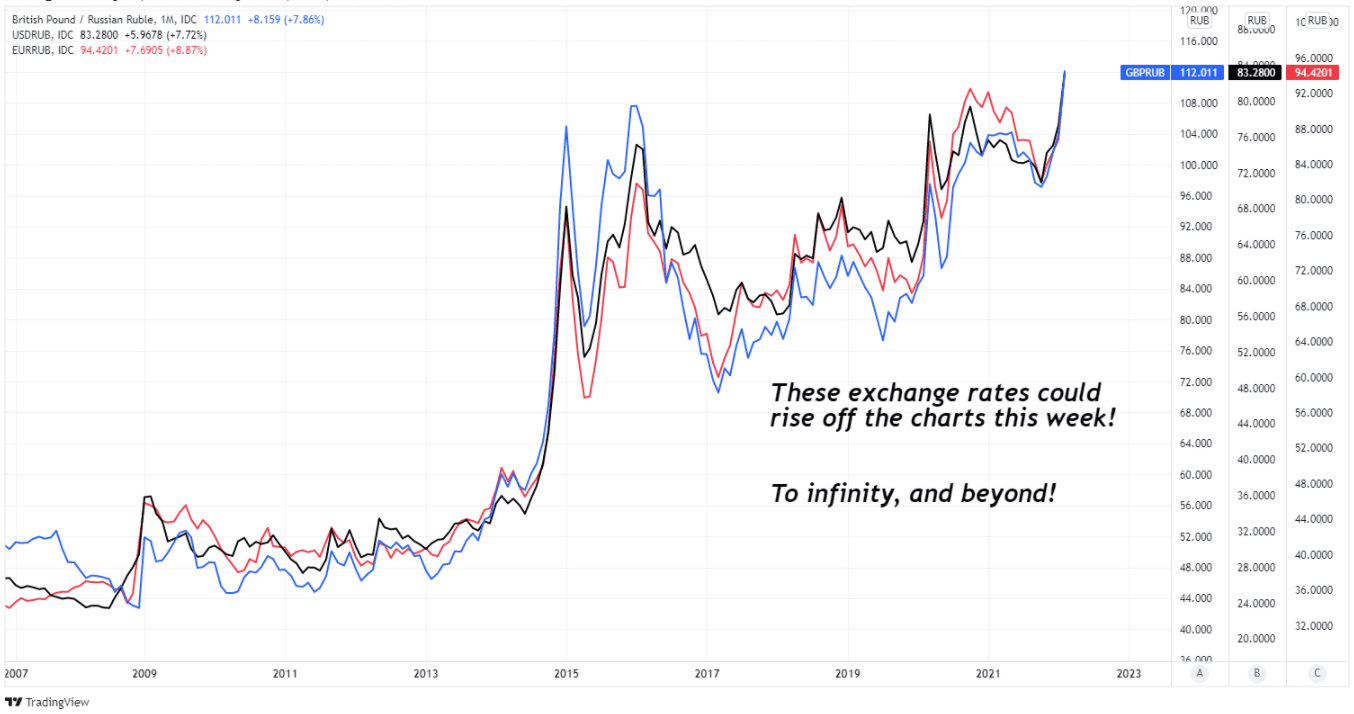

- As CBR asset freeze leaves RUB staring into abyss

- But Ukrainian strength, resilience poses upside risk

Image © Adobe Images

The Pound to Dollar rate entered the new week with support from its 100-week average intact around 1.3370 but faces downside risks from the ongoing Russian assault on Ukraine, although these risks could be quickly neutralised if the invading force flounders further in its attack.

Pound Sterling rebounded only tepidly against the Dollar last Friday as global markets rallied following what was then a mild international sanctions response to Russia’s attempted conquest of Ukraine, although it could easily come under pressure again early in the new week.

GBP/USD could be vulnerable alongside some other exchange rates after leaders of G7 countries announced what is quite possibly ‘the mother of all sanctions packages’ on Saturday just past, which includes a decision to freeze the official reserve assets of the Central Bank of Russia (CBR).

“We are collectively planning to impose measures to ensure Russia cannot use its Central Bank reserves to support its currency and thereby undermine the impact of our sanctions. This will show that Russia’s supposed sanctions-proofing of its economy is a myth,” the White House said at the weekend.

Source: Central Bank of Russia.

- GBP/USD reference rates at publication:

Spot: 1.3378 - High street bank rates (indicative band): 1.3010-1.3103

- Payment specialist rates (indicative band): 1.3258-1.3311

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

While the eviction of numerous Russian banks from The Society for Worldwide Interbank Financial Telecommunication (SWIFT) amounts to a heavy right hand blow landed directly on the body of the Russian economy, the CBR asset freeze is by far the more significant in its potential implications.

“Putin’s Central Bank will lose the ability to offset the impact of our sanctions. The Ruble will fall even further, inflation will spike, and the Central Bank will be left defenseless,” the White House also said.

Not without good reason, sanctions such as the proposed asset freeze are almost certain to require primary legislation in at least some jurisdictions and this could lead to a delay in their implementation as well as create scope for some potentially wild price action parts of the market during the interim.

“The share of CBR official reserves which remain liquid and available, plus hard currency in the National Wealth Fund, plus energy and other commodity receipts seem enough to forestall an immediate funding crisis within Russian banks and NFCs. Restrictions on FX transactions, however, may make reserves less usable when it comes to intervening to prop up the ruble,” says Richard Kelly, head of global strategy at TD Securities.

Above: GBP/RUB shown at monthly intervals alongside USD/RUB and EUR/RUB.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Almost two thirds of Russia’s official reserves were reported to be held in G7 currencies and denominated assets at the last disclosure, and any possible attempt to sell them before sanctions are implemented is one potential source of downside risk for GBP/USD this week.

There are also further risks associated with the threat of a protracted conflict in Ukraine, although these are a long way from being a done deal after fierce resistance from Ukraine’s military and civilian population appeared to have left Russia’s invading force floundering at the weekend.

“The ferocity of Ukrainian resistance is the polar opposite of the collapse of the Afghan government, which exited in jets filled with US cash,” says Michael Every, a global macro strategist at Rabobank.

“Any dreams Putin had of imposing a puppet regime, or of carving up and holding Ukraine, have been shattered by cries of “Slava Ukraini! (Glory to Ukraine!). Overall, the Russian military is performing extremely poorly,” Every also said on Monday.

Above: Pound to Dollar rate shown at weekly intervals with 100-week moving-average in black and Fibonacci retracements of 2020 recovery indicating likely areas of technical support for Sterling.

Ukraine’s national news agency Ukrinform reported on Monday that the invading force had failed in its fourth overnight attempt to capture the capital city at the opening of the new week, which follows a series of reported losses from the weekend including the destruction of a large Chechen military formation at the site of an important airfield near Hostomel in Kyiv region.

The latest loss in Hostomel is at least the third instance since Thursday in which the invading force has captured and then failed to hold onto that particular location, and it further bolsters the appearance of an invading army that is failing to secure its strategic objectives and which is at risk of leaving Moscow with a complete and unabridged calamity on its hands.

To the extent that this remains the case it could eventually become a source of support for the Pound by negating the risk of a protracted conflict that would otherwise darken European economic outlook for as long as it goes on.

Developments in and of relevance to Ukraine are likely to be the dominant considerations for financial markets in the week ahead, although there’s a number of the Bank of England (BoE) Monetary Policy Committee who’re scheduled to speak publicly over coming days and will likely be listened to closely by Sterling, while Friday’s non-farm payrolls report could also come in for close scrutiny.