Pound / Dollar Week Ahead Forecast: Thicket of Resistances Obstructs Near 1.37

- Written by: James Skinner

- GBP/USD supported at 1.35 with upside bias intact

- But thicket of resistance near 1.37 may limit upside

- Ukraine poses lingering downside risk for GBP/USD

- GBP eyeing BoE testimony, PCE data looms for USD

Image © Adobe Images

The Pound to Dollar exchange rate furthered its recovery from late January’s lows last week but a thicket of overhead resistances near the 1.37 handle could limit the upside for Sterling over the coming days while the situation along the Russia-Ukraine border remains a lingering downside risk.

Sterling entered the new week trading a touch shy of the 1.36 handle against the Dollar after ceasefire violations and related events in Eastern Ukraine stoked concern in the market about the risk of conflict in Europe and dealt a setback to riskier currencies on Friday.

The evacuation of inhabitants from the breakaway provinces in Eastern Ukraine, to Russia, was a clear indication of the escalating conflict risk that will likely remain top of mind for at least some market participants over the coming days, although for Sterling the recent string of upside surprises in UK economic data has been a dominant influence while its possible implications for Bank of England (BoE) policy will be in focus again this week.

“We await speeches and appearances in Parliament next week from BoE Gov Bailey and DG Broadbent to inform odds for the March meeting— where we still think it’s unlikely that the bank hikes by 50bps,” says Juan Manuel Herrera, a strategist at Scotiabank.

“Cable climbed to an eight-day high this morning before some selling pressure emerged around the mid-figure zone but technical trends over the past four days suggest further gains ahead to a test of 1.37 once it firmly breaks past the mid-1.36s,” Herrera and colleagues said on Friday.

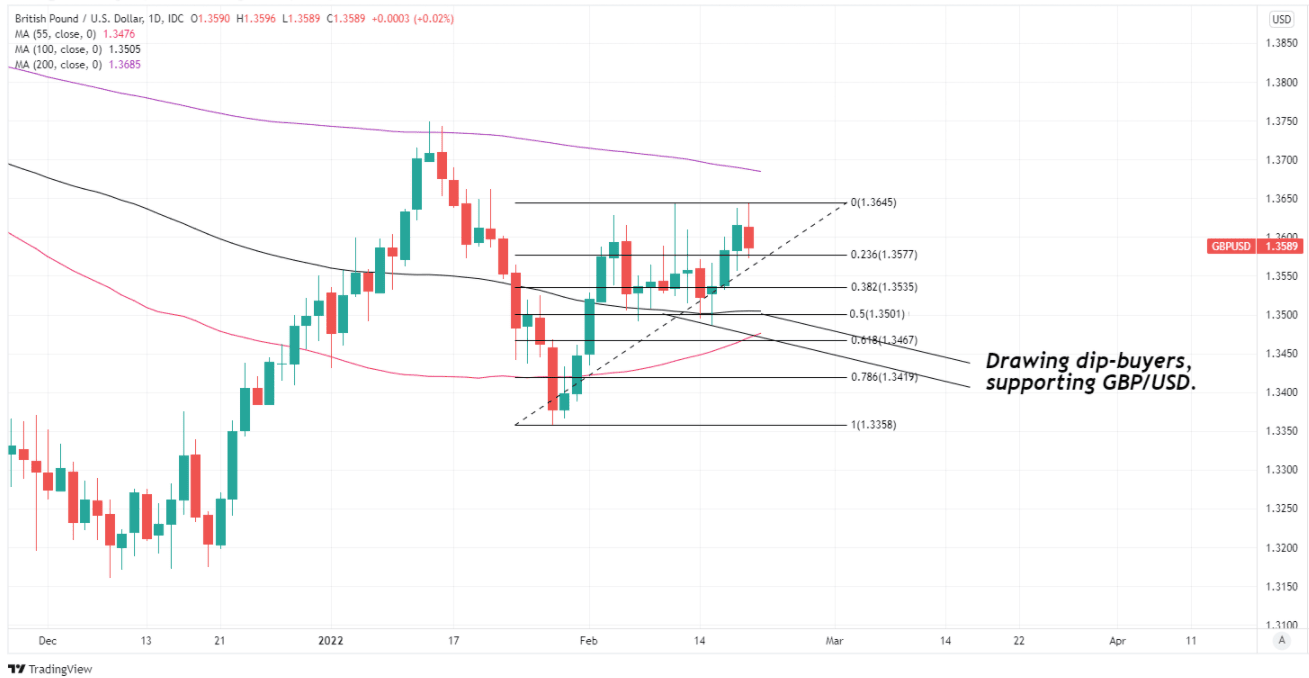

Above: GBP/USD shown at daily intervals with Fibonacci retracements of late January rebound indicating possible areas of short-term technical support while selected moving-averages denote prospective support and resistance levels.

- GBP/USD reference rates at publication:

Spot: 1.3628 - High street bank rates (indicative band): 1.3250-1.33346

- Payment specialist rates (indicative band): 1.3505-1.3560

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The first appointment in the UK calendar this week is the release of IHS Markit surveys of key economic sectors on Monday at 09:30, which could offer a further indication that the economy weathered the Omicron variant of the coronavirus in a resilient fashion, although the highlight of the week ahead is Wednesday afternoon’s parliamentary appearances by Bank of England (BoE) Governor Andrew Bailey and colleagues.

Wednesday’s testimonies to the House of Commons’ Treasury Select Committee will see the attending BoE policymakers answering questions about the February Monetary Policy Report, recent inflation developments and the outlook for interest rates, which will be of high interest to Sterling after the Monetary Policy Committee came close to lifting Bank Rate by 0.50% to 0.75% this month before settling for a smaller increase to 0.50%.

“We continue to think that the near-term strength of CPI inflation will persuade the MPC to hike Bank Rate to 0.75% in March and then to 1.00% in May. One or two members might vote to hike rates by 50bp in March, but we think most will agree with Chief Economist Huw Pill, who made the case in a speech last week for gradualism,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Financial markets have come to anticipate an aggressive series of interest rate rises this year and next in a turn of events that has been supportive of Sterling in recent months, although the Pound to Dollar exchange rate would likely be vulnerable to a setback in the event of any further suggestions from the BoE that the actual pace and scale of any additional increases could turn out to be more moderate than is envisaged by the market.

“The US PCE deflator report for January is expected to provide further evidence that underlying inflation pressures continue to build,” Halpenny also said when writing in a Friday briefing,” says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

Across the Atlantic Friday’s release of the PCE price index for January is a wild card risk for the Pound to Dollar rate given that it’s seen by the Federal Reserve (Fed) as a better measure of U.S. and so will likely impact market perceptions of the pace at which the bank could be likely to begin lifting its interest rate in March, perceptions which have recently begun to entertain the prospect of a large 0.50% initial increase in the Federal Funds rate.

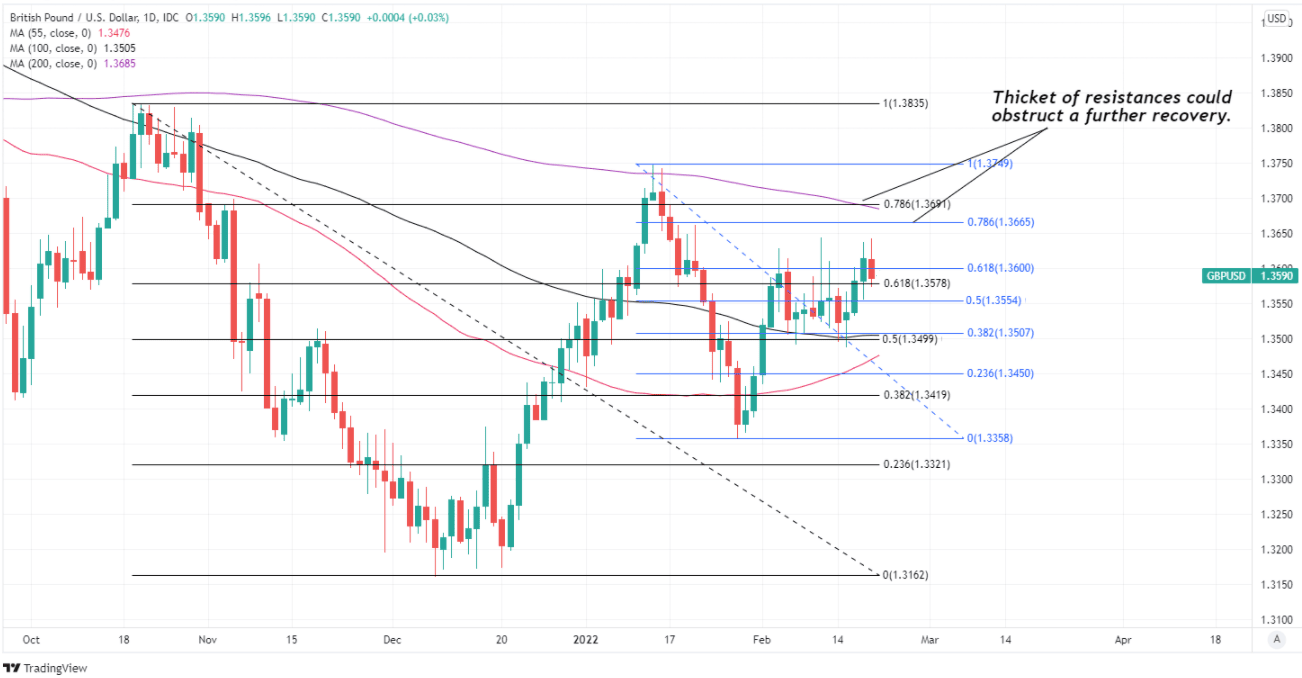

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of January 2022 and late October 2021 downtrends indicating possible areas of short-term technical resistance to any further recovery, while selected moving-averages denote prospective support and resistance levels.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“A realization of our forecasts would pull up the core PCE deflator—the Fed’s preferred inflation gauge—to 5.1% year/year in January (from 4.9% year/year in December) while the headline PCE would rise from 5.8% year/year to 6.1% year/year in January. Both measures are expected to rise to their highest levels since early 1983,” says Kevin Cummins, chief U.S. economist at Natwest Markets.

The Pound-Dollar rate could come under pressure if Friday's data leads the market to anticipate a higher probability of the Fed moving in larger-than-usual increments as it eventually begins to lift interest rates, or if this notion is encouraged on Thursday when Federal Reserve Bank of Cleveland President Loretta Mester speaks at an online event hosted by the University of Delaware.

However, and before then the market’s focus across the Atlantic will likely be on Wednesday’s release of fourth-quarter GDP data and possibly also any diplomatic developments relating to Ukraine.

“The Blinken-Lavrov meeting is seen as the next pivotal event, but an extension of the diplomatic stalemate could make markets somewhat less sensitive to Ukraine-related headlines, and likely more comfortable with continuing to factor in some (moderate) degree of geopolitical risk into asset classes. We think this means that the downside should remain quite limited for the dollar and the other safe-havens,” says Francesco Pesole, a strategist at ING.