Dollar to Stay Supported against Pound and Euro Forecasts BofA

- Written by: Gary Howes

Image © Adobe Images

U.S. Dollar tailwinds are expected "to strengthen once again" by a leading U.S.-based investment bank, a view which if correct poses headwinds to the Euro and Pound.

Bank of America Merrill Lynch says the market has lost sight of what matters for the Dollar: that the Federal Reserve will win the "race to the top" in terms of interest rate hikes.

"USD is no longer broadly perceived as having a strong monetary policy tailwind behind it. We disagree, less with the impulse to re-price global central banks (CBs) higher, and more with the failure of markets to preserve the Fed's lead," says Ben Randol, G10 FX & Rates Strategist at Bank of America.

The findings come amidst a mixed start to 2022 for the Dollar that has seen it fall a third of a percent against the Euro and 0.12% against the Pound.

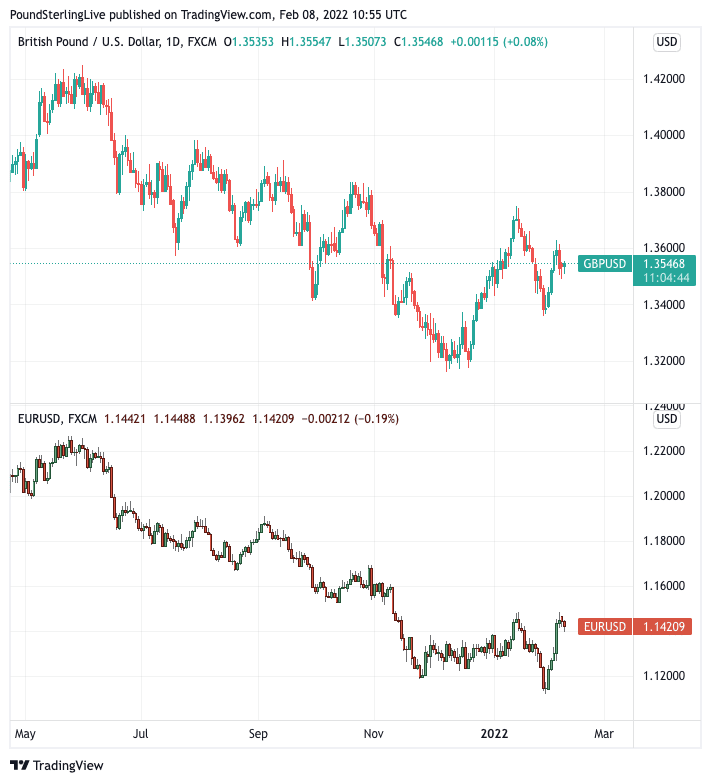

Above: GBP/USD (top) and EUR/USD (bottom) at daily intervals.

Dollars were bought after the Federal Reserve on January 26 provided an advanced warning that U.S. interest rates could rise in March while also suggesting that further increases could be announced and at a quicker pace than was seen during the last monetary tightening cycle.

In detailing why the Fed would move fast on interest rates Fed Chair Jerome Powell said the economy is in a very different place than it was when we began raising rates in 2015.

Specifically, the economy is now much stronger, the labour market now is far stronger and inflation is running well above the two percent target.

But the Dollar's upside impetus did fade somewhat as it became clear the Fed was not the only central bank set to tighten policy, with both the European Central Bank and Bank of England in February detailing a need to tighten monetary policy in light of rising inflation.

Nevertheless Randol says it is U.S. inflation that shows signs of being persistent enough to warrant a higher 'terminal' interest rate, i.e. the rate at which the cycle ends, then elsewhere.

"Other CBs, in particular the ECB and the BoE, look aggressively priced, if not outright overpriced, relative to BofA calls," he says.

And for the Dollar this suggests further upside against the Euro and Pound.

"For now at least, the US appears exceptional in terms of having the greatest capacity-related price pressures in G10," says Randol. "As long as the Fed's response to genuine upside inflation risks in the US remains under-appreciated, we are buyers of USD on dips."

Bank of America holds a EUR/USD forecasts for 1.10 in 2022, 1.15 next year and 1.20 (lower end of long-term equilibrium range) in 2024.

GBP/USD is forecast at 1.24 in 2022 and 1.31 in 2023.

At the time of writing the Pound to Dollar exchange rate is quoted at 1.3544 and the Euro to Dollar exchange rate is quoted at 1.1412.