Dollar Pressures the Pound as U.S. Economy Churns Out Jobs

- Written by: Gary Howes

- U.S. jobs numbers smash expectations

- Wages up

- Participation rate increases

- USD rallies and can extend say analysts

Image © Adobe Images

The U.S. Dollar looks poised to extend a longer term trend of appreciation against the Pound after U.S. labour market data confirmed the economy was in rude health at the start of the year.

The Dollar jumped against the Pound and Euro after U.S. authorities reported 467K jobs were created in January, a massive beat on the lowly 150K the market was expecting.

Furthermore, December's print was revised higher to 510K.

"The US labor market roared ahead in January despite the surge in Omicron cases," says Katherine Judge, an economist with CIBC Capital Markets.

Wage growth rose to 0.7% (vs. 0.5% expected) and the unemployment rate rose to 4.0% from 3.9%. The simultaneous rise in jobs and the unemployment rate is explained by an increase in the participation rate from December's 61.9% to 62.2%.

The data suggests the U.S. jobs market has witnessed little negative impact from the Omicron wave and the figures will only embolden the Federal Reserve to proceed with an aggressive cycle of rate hikes.

This expectation for higher rates helps explain why U.S. and global markets fell in the wake of the data: the current market function is that strong economic data = higher interest rates in the future.

But higher interest rates in the future will ultimately weigh on the economic growth outlook, something equities are discounting right now.

Higher rates however offer greater returns on U.S. debt instruments which attracts international capital inflows and boosts the value of the Dollar.

The Pound to Dollar exchange rate fell two-thirds of a percent in the wake of the data release while the Euro to Dollar exchange rate is seen at 1.1446 as its post-ECB boost fades.

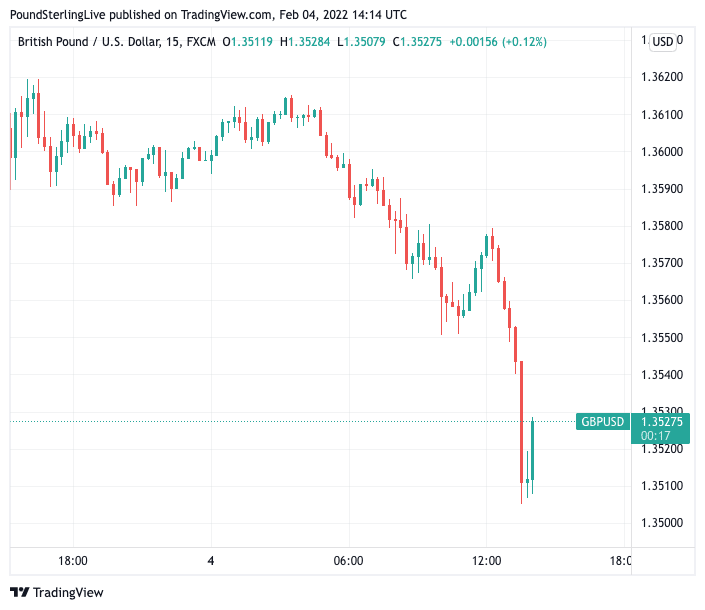

Above: Chart showing GBP/USD on Feb. 04 with post-payroll data release.

- GBP/USD reference rates at publication:

Spot: 1.3530 - High street bank rates (indicative band): 1.3156-1.3250

- Payment specialist rates (indicative band): 1.3408-1.3462

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

"The Omicron wave has depressed economic activity and this was meant to translate into weak hiring. It hasn't. 467k jobs created and massive upward revisions suggests a fundamentally very strong economy," says James Knightley, Chief International Economist at ING Bank.

Knightley says the outlook for the U.S. jobs market "remains very positive", noting that in December there were 1.7 vacancies for every unemployed person in America, an all-time high.

"This suggests the demand for workers is strong and as Covid cases and Covid caution subsides we expect employment growth to be even stronger than what we saw today," says Knightley.

ING expects upward pressure on wages to persist as companies desperate to hire pay more to attract workers, which will in turn provide "ammunition for the Fed hawks to push hard".

Economist Knut A. Magnussen at DNB Bank says the Fed will likely be even more in a hurry to tighten monetary policy after these numbers.

"In particular, the much higher than expected wage growth could likely make Fed officials considering a more aggressive tightening stance, even if higher wage growth may be partly explained by composition effects," says Magnussen.

Dr. Christoph Balz, Senior Economist at Commerzbank, says the big picture for the Fed does not change: "The labor market is tight and wage pressures remain high. Thus, the implications for monetary policy still hold: The current policy stance is far too expansionary and will soon change".

This should support the Dollar trend of appreciation that has been in place since mid-2021 extend further.

Some strategists point out that the Dollar tends to appreciate into a Fed hiking cycle, but from this point onwards performance can tend to wane.

At the very least then February could see further Pound-Dollar losses.