Euro / Dollar Week Ahead Forecast: Struggling for Traction as 1.1356 Resistance Stymies

- Written by: James Skinner

- EUR/USD pressure eases with USD, gas prices

- Buoyant global markets also supporting uplift

- As Omicron fears ebb on hopes of mild impact

- But rebound stalled by resistance near 1.1356

- Global markets to set direction into new year

Image © European Central Bank

The Euro to Dollar exchange rate has sustained its recovery from November’s lows beneath 1.12 but has been turned away repeatedly from technical resistance at the nearby 1.1356 level, which could continue to keep the single currency under wraps as the curtain closes on 2021.

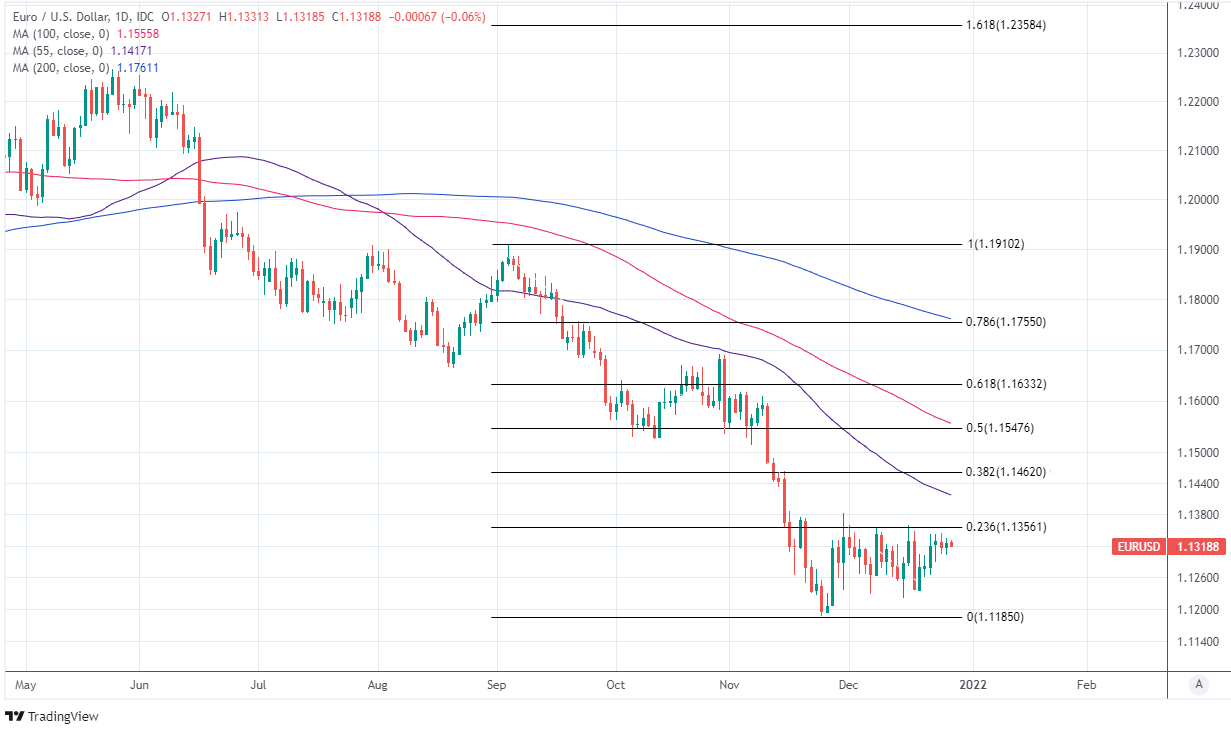

Europe’s single currency recovered back above the 1.13 handle against the Dollar ahead of the festive break before being curbed into an exceptionally narrow range when the 1.1356 level - which coincides with the 23.8% Fibonacci retracement of September’s decline - proved insurmountable.

The Euro has been lifted recently by a moderation of the inflationary surge in natural gas prices and after multiple research studies suggested the Omicron strain of coronavirus could pose a lesser threat to public health than its predecessors, potentially making it a lesser economic headwind.

“Near -term resistance stays at 1.1325/29, with 1.1356/60 ideally capping to keep the immediate risk lower. A close above 1.1387 would instead see a small base complete to clear the way for a deeper recovery to 1.1433/40 and potentially what we would expect to be much tougher resistance at 1.1457/64,” says David Sneddon, head of technical analysis strategy at Credit Suisse, in a note ahead of the festive holiday.

Euro-Dollar’s levitation above 1.13 has also been helped by an apparent stalling of the greenback’s six month rally, which has been more evident against higher yielding and typically riskier currencies like Sterling and the Australian Dollar.

Above: Euro-Dollar rate shown at daily intervals with Fibonacci retracements of September decline indicating likely areas of technical resistance.

- EUR/USD reference rates at publication:

Spot: 1.1332 - High street bank rates (indicative band): 1.0935-1.1015

- Payment specialist rates (indicative band): 1.1230-1.1275

- Find out about specialist rates, here

- Set up an exchange rate alert, here

“Price action is not showing an awful lot of directional bias in the short-run but the chart outlook is negative on the basis of the EUR’s numerous failures to advance beyond the mid/upper 1.13s over the past month. Risk/ reward alone favours shorting the EUR here for a retest of the low/mid 1.2s (at least),” says Juan Manuel Herrera, a strategist at Scotiabank, writing in a Friday research note.

There are no central bank policy events or major economic figures due in the week ahead, leaving only the typically lower trading volumes of holiday market conditions to determine if the Euro-Dollar rate remains stymied beneath 1.1356 heading into the new year.

“USD could benefit from negative Omicron news, though its positioning remains stretched and prone to further reduction into year end,” says Valery Berenshtein, an analyst at Citi FXWire, in a market commentary last week.

“Price action continues to be exacerbated by holiday liquidity conditions, and with CitiFX Flows & Positioning Report suggesting USD is the most significant long into year end. CitiFX Strategy thinks that the path of least resistance for USD is lower in the near-term,” Berenshtein also said.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

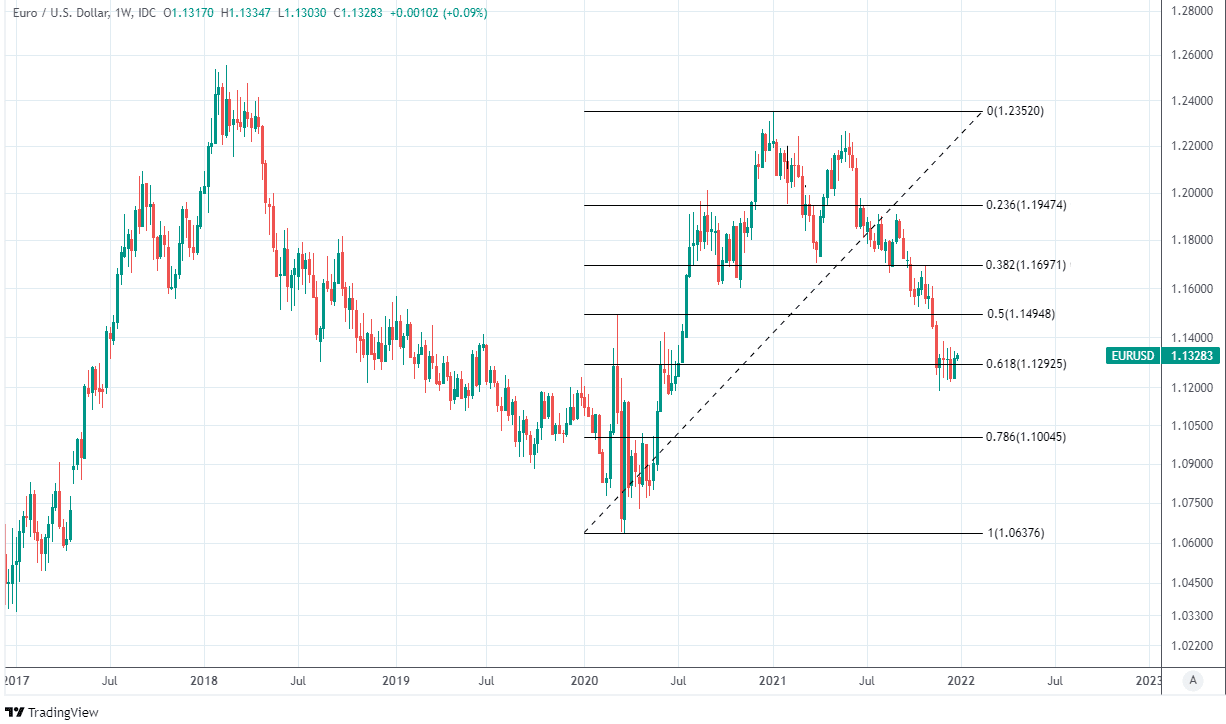

Market appetite for the greenback and changes in expectations for Federal Reserve interest rate policy will also again be important once into January as it was the divergence between the European Central Bank (ECB) and Fed that drove much of Euro-Dollar’s -7.14% 2021 decline.

The ECB set out a plan this month to end its €1.85 trillion Pandemic Emergency Purchase Programme in March and steadily return in 2022 to its pre-pandemic pace of purchases under the bank’s original Asset Purchase Programme.

This will ensure a significant downsizing of Frankfurt’s footprint in the Eurozone government bond market, although the Fed is widely expected to go further while the Euro-Dollar has lacked a directional bias since both bank’s December policy decisions were announced.

“The Fed turned more hawkish, removing its transitory assessment for inflation, speeding up its QE tapering process and front-loading rate hike expectations for the year ahead. Ultimately, the USD remains on course to end 2021 as the outperformer of the G10 FX space, even though some profit taking in the last few days of the year may still reduce its lead somewhat,” says Valentin Marinov, head of FX strategy at Credit Agricole CIB.

Above: Euro-Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating likely areas of technical support.