Pound / Dollar Week Ahead Forecast: Supported at 1.33 and Eyeing 1.35+

- Written by: James Skinner

- GBP/USD testing above 1.34 & eyeing 1.35

- After USD stalls & GBP rallies off 2021 lows

- Easing Omicron fears balm for BoE outlook

- Supported at 1.33, 1.3461 offers resistance

- Global markets in driving seat into year-end

Image © Adobe Images

The Pound to Dollar exchange rate has rallied sharply on a rising global market tide that has created scope for an attempted recapture of 1.35 over the coming days and weeks, although holiday market conditions and technical resistance could keep Sterling contained beneath 1.3461 ahead of new year.

Pound Sterling was the best performing major currency for the week to Tuesday after buoyant global markets and a favourable market reappraisal of the outlook for interest rates at the Bank of England (BoE) helped to extend December’s rebound against most counterparts.

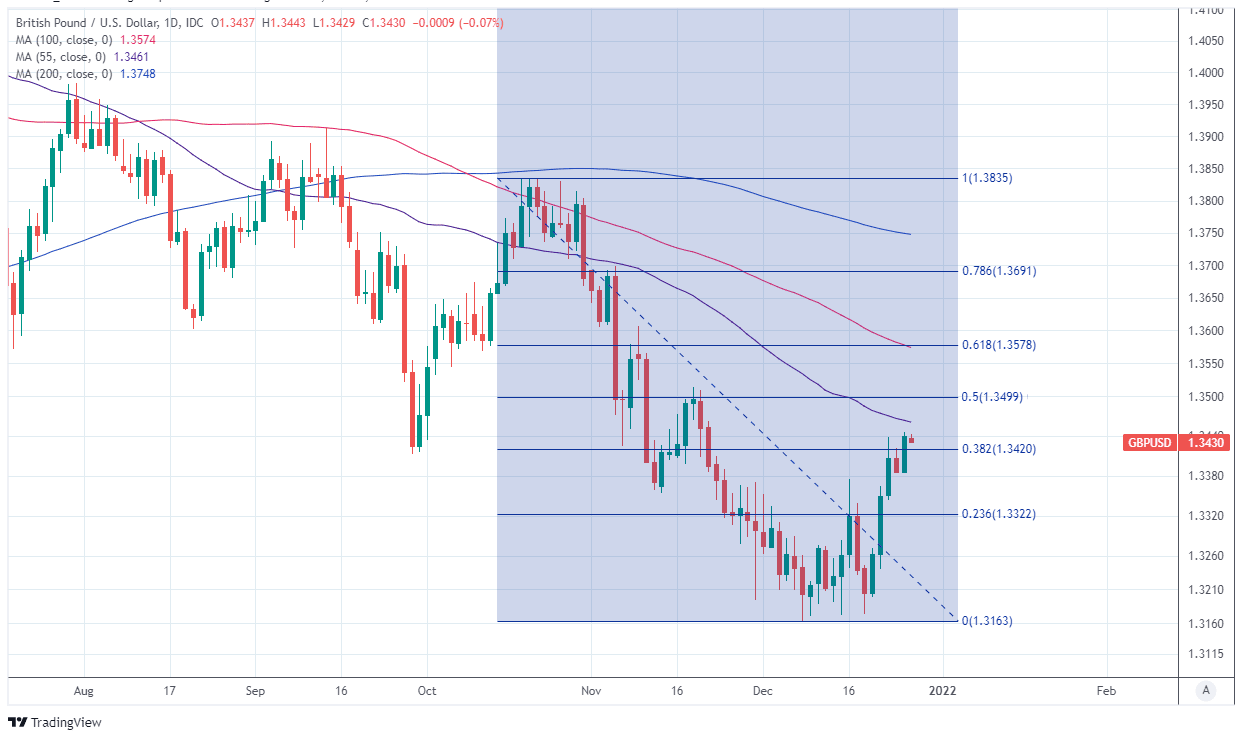

The Pound-Dollar rate overcame a minor technical resistance level at 1.3420 in the opening session the holiday shortened week, giving Sterling a clear path toward its 55-day moving average at 1.3461 and the round number of 1.35.

“A double bottom signal derived from the latest tests of 1.3170 was triggered by yesterday’s move above the Dec 16th high at 1.3370—neatly targeting 1.3570 as the objective over the next 2-4 weeks for Cable,” says Shaun Osborne, chief FX strategist at Scotiabank in a Friday note.

Pound-Dollar gains built further last week in response to studies suggesting the Omicron strain of coronavirus could pose a lesser threat to public health than its predecessors, meaning it may transpire to be a lesser headwind to economies than previously dominant variants.

Above: Pound-Dollar rate shown at daily intervals with major moving-averages and Fibonacci retracements of October fall indicating likely areas of technical resistance to Sterling’s recovery.

- GBP/USD reference rates at publication:

Spot: 1.3456 - High street bank rates (indicative band): 1.3085-1.3180

- Payment specialist rates (indicative band): 1.33362-1.3389

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Those favourable study findings prompted investors to revive hopes of a rise in the BoE’s Bank Rate to 1% or more in 2022, aiding a Pound-Dollar recovery that was also driven substantially by an ebb of the U.S. Dollar ahead of the festive break.

“A weaker dollar acted as the catalyst, but sterling was buoyed by traders betting that the Bank of England will raise interest rates above 1% by the end of 2022, the first time they would be at such a level since 2009,” says Scott Petruska, chief currency strategist at Silicon Valley Bank.

Dollar exchange rates have seemingly taken a breather from what is now a six month rally despite the Federal Reserve indicating strongly in December that it could raise the Fed Funds interest rate as soon as March next year, offering Sterling an additional tailwind.

“We see tactical scope for GBP/USD to move higher into year-end such as to the 50d SMA now at 1.3491 and possibly the top of the channel at 1.36 (which is the top of the channel during the first week of 2022),” says Paul Ciana, chief technical strategist at BofA Global Research, in a recent note.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

There are no central bank policy events or major economic figures due in the week ahead, which leaves only the typically low volumes of holiday market trading conditions to drive price action in Sterling and other currencies.

However, once into the new year market attention will likely be back on the scale of the burden imposed on the economy by the Omicron strain of the coronavirus and government response to it, as well as any knock-on impact on the market’s outlook for interest rates at the BoE.

“I'm short GBP/USD so naturally this move is concerning, but I suspect it’s largely a Xmas market random walk rather than the start of a new uptrend with the positive impulse from BOE rate hikes already largely priced in,” says Jordan Rochester, a strategist at Nomura.

“The BOE is already pretty much fully priced for Feb and 100bp+ priced in for November next year - so I see more scope for US pricing to increase over the BOE (March Fed meeting could end up having another 10bps for example),” Rochester warned in a market commentary last week.

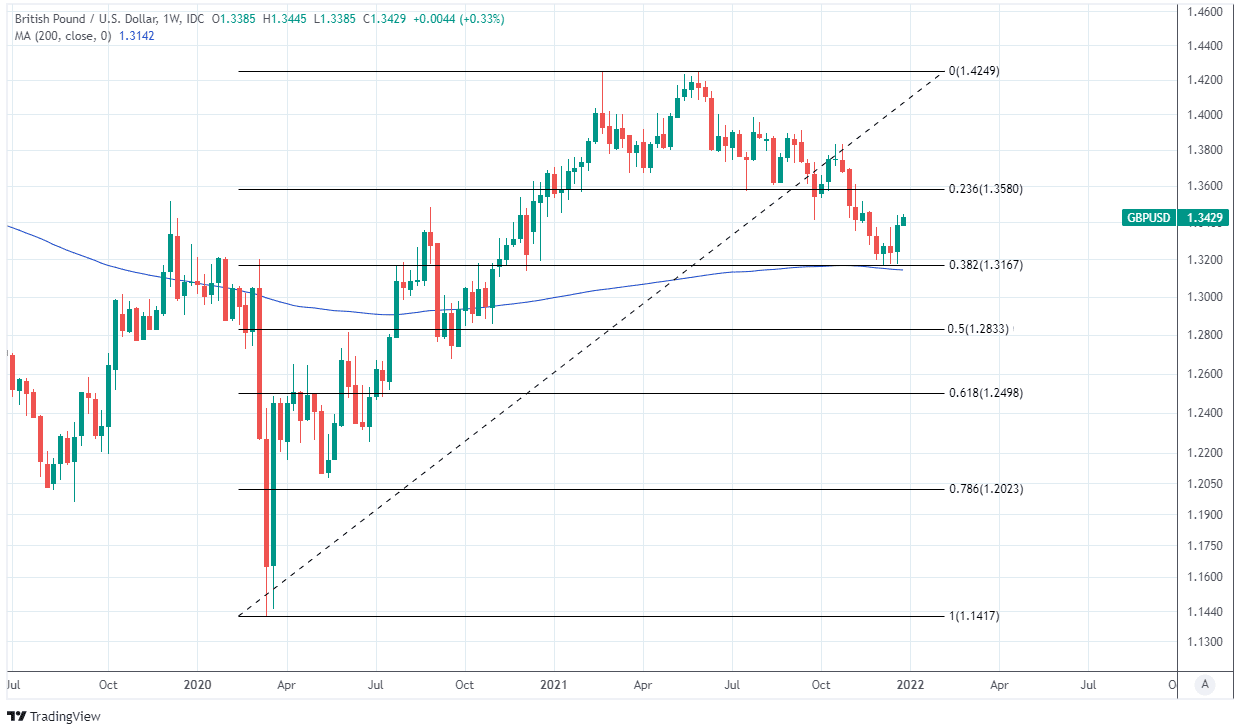

Above: Pound-Dollar rate shown at weekly intervals with 200-week moving-average and Fibonacci retracements of 2020 recovery indicating likely areas of technical support.