Pound / Dollar Week Ahead Forecast: Corrective Rebound Vulnerable amid USD Ascendancy

- Written by: James Skinner

GBP/USD in short-term relief, downside risks remain

Rallying USD eyes litany of Fed speakers, retail data

After inflation surge drives shift in market’s Fed view

BoE’s parliamentary testimony the highlight for GBP

Latest job, inflation and retail data also key for GBP

Image © Adobe Images

The Pound to Dollar exchange rate opens the new week with a hat-trick of declines in its wake on the charts and although Friday’s rebound could still have further to run, the greenback remains in the ascendancy while an action-packed economic calendar poses both up and downside risks to Sterling.

Sterling decline under the weight of an oncoming Dollar in the latter half of last week after October’s U.S. inflation numbers surprised significantly on the upside of market expectations, prompting investors to wager more heavily that the Federal Reserve could lift its interest rate in the later stages of next year.

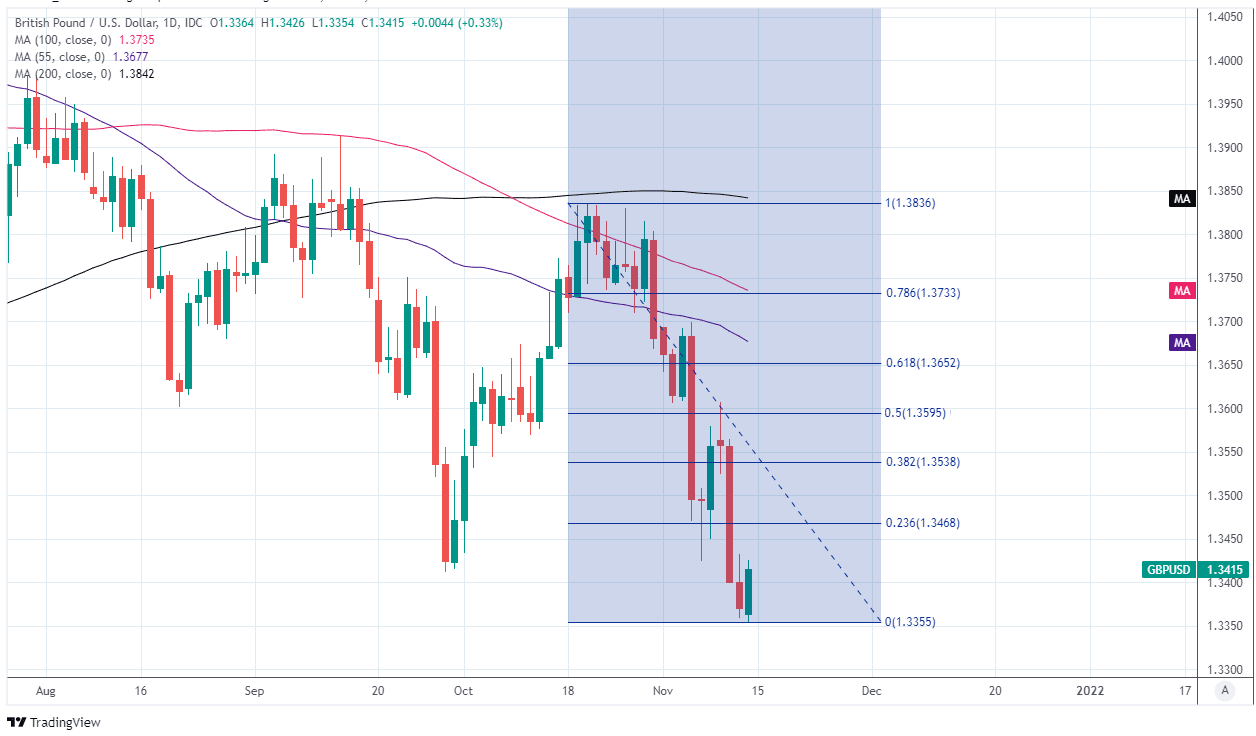

The Pound-Dollar rate set a new 2021 low of 1.3357 before rebounding on Friday to end the week at 1.3415, although some analysts have noted technical indications that this corrective move could extend further over the coming days, which will also see Sterling cues from Bank of England (BoE) policymakers’ testimonies in parliament as well as employment, inflation and retail sales figures.

“The intraday chart reflects a “rounded low” developing through the overnight session as investors accumulate GBP on weakness; a small “cup/handle” pattern seems to be developing as a result and we think gains should extend above 1.3410 intraday. A daily close above 1.3415 may provide the GBP with broader relief,” says Juan Manuel Herrera, a strategist at Scotiabank, writing in a Friday afternoon note.

Friday’s rebound came alongside declines in many of the major Dollar exchange rates that makes profit-taking by investors an easy if not likely explanation for it, although any further relief seen during the opening stages of the new week could be limited in its scale and duration.

Above: Pound-Dollar rate shown at daily intervals with selected moving-averages and Fibonacci retracements of mid-October decline indicating areas of possible technical resistance.

- GBP/USD reference rates at publication:

Spot: 1.3433 - High street bank rates (indicative band): 1.3063-1.3157

- Payment specialist rates (indicative band): 1.3312-1.3366

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Pound-Dollar rate remains in a multi-month downtrend that some analysts say could eventually take it as low as the 200-week moving average located at 1.3165 on Friday, although much will depend over the coming days on the raft of UK data due out this week as well as on whether the Dollar’s recently steepened uptrend continues.

“It is under pressure and viewed as being on course for the 200-week ma at 1.3165. Interim resistance lies at 1.3607, the market is directly offered below here,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, who’d been a seller of the Pound-to-Dollar rate until exiting the position on Friday morning.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Dollar strengthened markedly after last week’s inflation data led the market to fully price-in a 0.25% increase in the Federal Funds rate range for each of the third and final quarters of 2022, with market pricing also implying that equivalent rate steps are becoming likely for each quarter of 2023.

These 2023 rate steps are not yet fully priced-in however, and so there is still room for the market to wager more heavily on this prospect, as well as to price-in further interest rate rises in 2024 in part because as recently as June 2019 the top end of the 25 basis point Federal Funds rate range was set at 2.5%.

This puts a floor under the Dollar and keeps upside risks alive for the greenback as well as the downside risks in place for the Pound.

Above: Pound-Dollar rate shown at weekly intervals with selected moving-averages, and Fibonacci retracements of May 2021 & March 2021 recoveries each indicating possible areas of technical support for Sterling.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“We use a variety of models to translate changes in Fed expectations to Dollar crosses. For the average G10 currency, a 75bp increase in two-year-ahead Fed expectations should raise the Dollar by roughly 4.5-5.0%, holding all else equal,” writes Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs, in the bank’s 2022 Macro Strategy Outlook.

While the Federal Reserve said in November that it remains confident inflation will ease back toward the 2% target next year and that rate setters at the bank are likely to wait patiently until the third quarter for this to happen, the latest guidance didn’t stop the market from reacting somewhat violently when the annual U.S. inflation rate topped 6% for October last week

“If the problems relating to the lack of parts, labour shortages and shipping goods internationally persist, inflation will probably remain high. Still, if, as our scenarios predict—and the Fed’s officials expect—these pressures ease, inflation will gradually go back to about 2%. The tapering of quantitative easing measures and the start of interest rate hikes expected in 2022 will also help moderate inflation expectations,” says Francis Geneux, a senior economist at Desjardins.

Chinese retail sales, industrial production and fixed asset investment data could feature as an important influence on investor risk appetite and demand for the Dollar on Monday, although U.S. inflation and the outlook for it will be back in focus soon after with no less than 15 speaking engagements scheduled for seven Federal Reserve policymakers throughout the week.

Above: U.S. Dollar Index shown at monthly intervals. Breaks above 38.2% Fibonacci retracement of fall from 2020 highs and 55-month moving-average in November, having recovered a decade long upward-sloping trendline.

“The US dollar strengthened following the CPI release, with broad USD gains extending to 2-3sd on most pairs as US rates and the equity market sold off on a reevaluation of the Fed's reaction function. The DXY is now at its strongest level - and EURUSD at its weakest level - since July 2020. We expect more strength ahead,” says Ben Randol, a G10 FX strategist at BofA Global Research.

The various Fed speeches are interspersed on the U.S. side with key economic figures including Tuesday’s retail sales and industrial production numbers for October as well as November’s reading of the Philadelphia Federal Reserve manufacturing index on Thursday.

Meanwhile, Sterling will pay close attention on Monday to Bank of England Governor Andrew Bailey and colleagues when they appear before the Treasury Select Committee at 14:30 on Monday to answer parliamentary questions about November’s Monetary Policy Report, which could be likely to prompt inquiries about the outlook for Bank Rate and could impact market expectations for borrowing costs as well as the Pound.

The Treasury Select Committee hearing comes ahead of the first in a number of pivotal moments for the BoE interest rate outlook when September’s unemployment rate and October’s new unemployment claims data are released at 07:00 on Tuesday, while those figures are followed by October’s inflation and retail sales data on Wednesday and Thursday morning.

“The labour market data (due on Tuesday) will probably show that the end of the furlough scheme was not a disaster. The inflation figures (due on Wednesday) may show inflation jumping to 4.0%,” says Ruth Gregory, a senior UK economist at Capital Economics.

“A sharp fall in fuel sales is unlikely to be enough to offset the strong rise we’ve pencilled in for non-fuel retail sales. All told, retail sales volumes may have increased by 0.8% m/m. That would leave sales 5% above their February 2020 peak,” Gregory also said.