Dollar Sold Widely but GDP Miss Won’t Stop Fed Taper, Economists Say

- Written by: James Skinner

- USD in broad losses after Q3 GDP misses expectations

- Consumer spending easing from extraordinary Q2 level

- Imports rise as exports, Fed Gov spending turn lower

- Economists say supply chain disruptions also at play

- GDP deceleration unlikely to stop shift in Fed’s policy

Image © Adobe Images

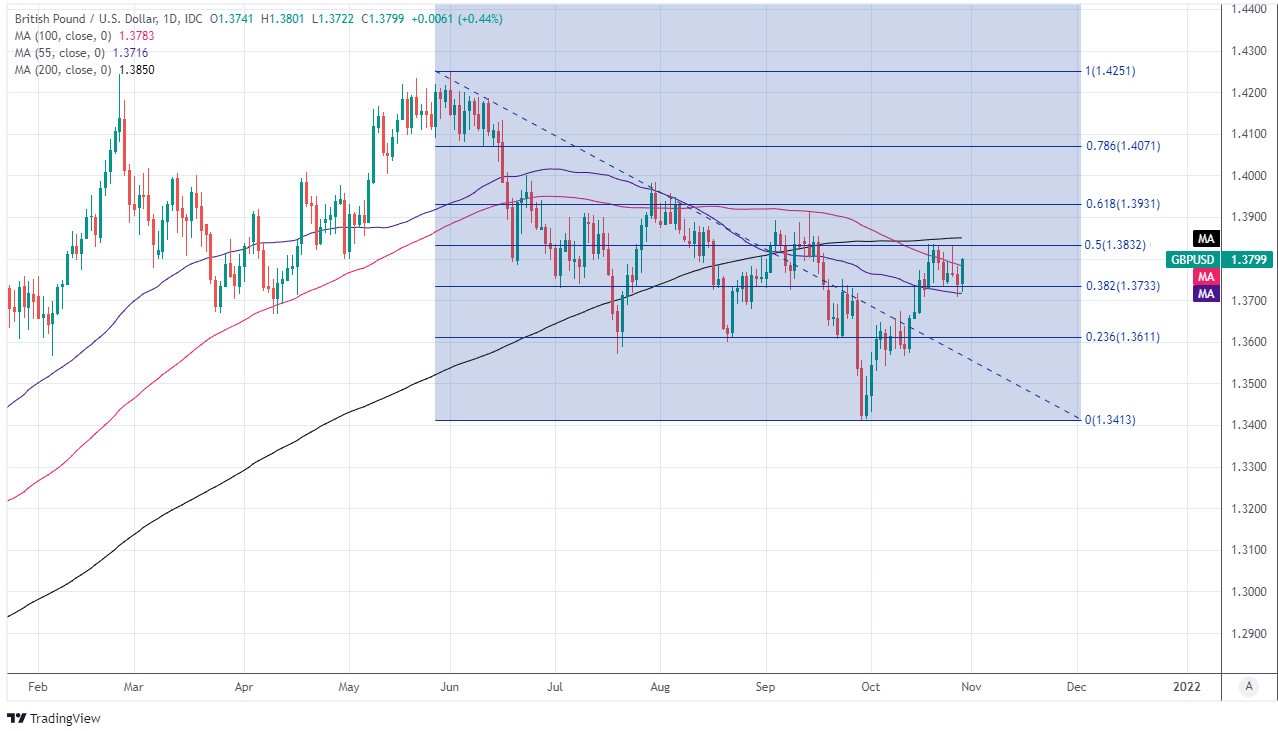

- GBP/USD reference rates at publication:

Spot: 1.3805 - High street bank rates (indicative band): 1.3422-1.3518

- Payment specialist rates (indicative band): 1.3680-1.3736

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Dollar took a drubbing on Thursday, helping to lift the Pound back near to the 1.38 level after third-quarter GDP growth slowed much further than economists anticipated, although some say this isn’t enough to merit halting the nascent shift in Federal Reserve (Fed) policy.

Dollars were sold widely, leading to declines against all in the G10 grouping of currencies while tempering the U.S. unit’s gains over some emerging market currencies on Thursday after the Bureau of Economic Analysis said GDP growth slowed to 2% last quarter, from 6.7% previously.

Various measures of consensus among economists had suggested that markets would be expecting a 2.6% quarter-on-quarter increase, making the outcome a sizable disappointment and explaining why U.S. bond yields fell alongside the Dollar late in Europe’s Thursday session.

“This was mainly due to a slowdown in the previously extraordinarily high pace of consumer spending. In addition, supply bottlenecks weighed on the economy. There are signs of higher growth again in the fourth quarter,” says Bernd Weidensteiner, an economist at Commerzbank.

“The Fed will not be dissuaded by the weaker growth in Q3 from deciding to taper its bond purchases at its meeting next week,” Weidensteiner added.

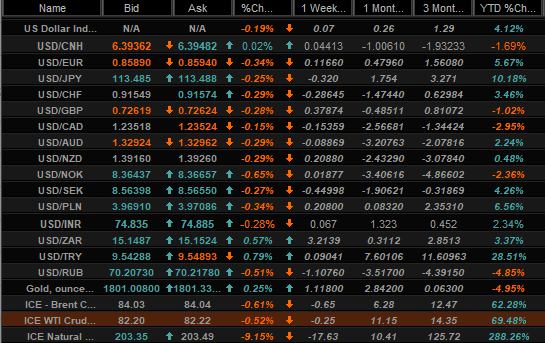

Source: Netdania Markets.

While consumer spending and supply chain troubles were prominent influences, the Bureau of Economic Analysis also flagged a decline in exports, an increase in imports and a fall in federal government spending as among the other factors weighing on GDP last quarter.

“The decrease in federal government spending primarily reflected a decrease in nondefense spending on intermediate goods and services after the processing and administration of Paycheck Protection Program loan applications by banks on behalf of the federal government ended in the second quarter,” the BEA explained in its announcement.

“The decrease in exports reflected a decrease in goods that was partly offset by an increase in services. The increase in imports primarily reflected an increase in services (led by travel and transport),” the Bureau also said.

The third quarter deceleration follows an exceptionally strong performance in the prior period that was aided by the relaxation of coronavirus-related curbs on activity in the parts of the country using such measures as well as an increase in federal government spending associated with an aid package approved by Congress early in the new year.

“Growth was crushed by consumption slowing to just 1.6% from 12.0% in Q2, when spending was boosted by the final round of one-time stimulus payments. The Delta wave and the chip shortage - the latter subtracted nearly 3pp from consumption growth - made things much worse,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Overall, Q3 was grim, but most of the shortfall against our forecast was in the inventory component; that just suggests a bigger contribution to growth in Q4, when final demand also will be much stronger. For now, we look for 8% GDP growth in Q4,” Shepherdson forecasts.

Thursday’s GDP data comes less than a week out from November’s Federal Reserve monetary policy decision in which the bank is expected to announce plans to gradually end its $120BN per month quantitative easing programme in the months and quarters up to the middle of 2022.

It’s possible that Thursday’s Dollar losses were a reflection of concerns about whether or not the bank would still go ahead with that plan.

“The risk is that ongoing high inflation will begin to lead price and wage setters to expect unduly high rates of inflation in the future,” Fed Chairman Jerome Powell said in a panel discussion at the South African Reserve Bank Centenary Conference on October 22.

“So we therefore need to make sure our policy is positioned to address the full range of plausible outcomes and we’ll be watching carefully to see whether the economy is evolving in line with expectations and our policies will need to adapt accordingly,” Powell also said.

Above: Pound-Dollar rate at daily intervals with major moving-averages and Fibonacci retracements of June’s decline indicating possible resistance. Click image for closer inspection.