GBP/USD Exchange Rate: 1.40 Still Possible says Westpac's Riddell

- Written by: Gary Howes

The Prime Minister Boris Johnson and the Chancellor Rishi Sunak visit FourPure brewery in south east London following the Autumn budget announcement, image (c) HM Treasury, Gov.uk.

- GBP/USD reference rates at publication:

Spot: 1.3754 - High street bank rates (indicative band): 1.3373-1.3470

- Payment specialist rates (indicative band): 1.3630-1.3685

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Pound can still advance in value against the Dollar says a leading strategist we follow, supported in part by the stimulatory fiscal impulse provided by this week's budget announcement, although for now gains will likely be capped ahead of next week's central bank updates.

The autumn budget and spending review saw the UK Treasury announce more spending than had been anticipated, but this seemingly pro-growth stance has failed to lift the British Pound against the U.S. Dollar, although it does certainly offer some support when looking to coming months.

UK chancellor Rishi Sunak confirmed government plans to raise public expenditure as a percentage of GDP to levels not seen since the 1980s thanks to measures taken to lessen the burden on lower earners in the face of rising inflation.

"The combination of a better starting point and a rosier economic forecast gave the Chancellor more room for manoeuvre. He has partly made use of this by increasing public spending by more than previously planned," says Rhys Herbert, economist at Lloyds Bank.

An unexpected announcement came in the form of an 8% cut to the Universal Credit 'taper rate', meaning around two million families will keep on average an extra £1000 pounds a year.

This - as well as raising the minimum wage - should be supportive of consumer confidence, which is an engine of UK economic growth.

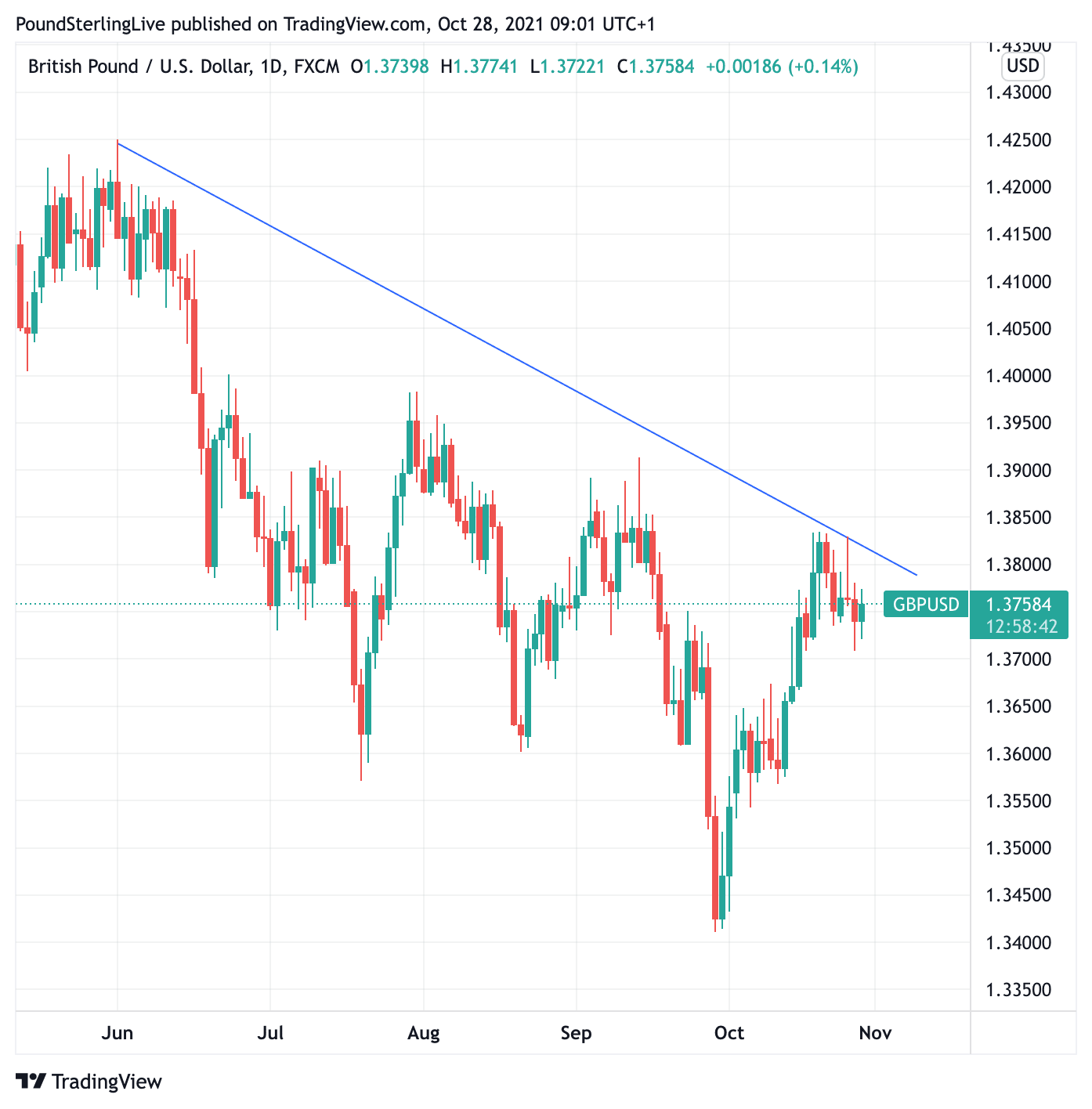

The Pound to Dollar exchange rate had been rising through October in a recovery following September's slump, but it now appears this recovery has faded somewhat just below 1.38.

As the below shows, a downward trend line in place since the May highs at 1.4250 were rejected remains intact:

Above: GBP/USD daily chart showing. downtrend from April.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Consolidation in the 1.37-1.38 area looks to be a likely prospect given the significant risk events that lie ahead: month-end rebalancing, the November 03 Federal Reserve policy update and the November 04 Bank of England policy update.

The Bank of England and the Fed will both issue landmark decisions: the former is tipped by markets to raise rates while the latter is tipped to begin the process of ending quantitative easing with a view to 2022 interest rate hikes.

Confirmation of market expectations is not guaranteed, posing the potential for a repricing in either currency.

Although the Pound has pulled back, one strategist says the October rebound can extend.

"Despite GBP/USD dipping below 1.3750, a push to 1.40 anticipated range resistance could still develop," says Tim Riddell, a strategist with Westpac in London.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Much will of course depend on how the first week of November plays out with regards to the Fed and Bank of England.

The British Pound was softer right across the board through the midweek session in sympathy with a fall in the yield paid on long-duration UK government bonds, which could be linked to expectations for lower government borrowing requirements in coming years.

The cost of financing government bonds fell into, and in the wake of, the autumn budget statement delivered by Chancellor Rishi Sunak where it was revealed UK borrowing requirements over coming years would be lower than anticipated.

In response, the yield on UK 10-year government bonds dropped 10 basis points to 1.003%.

Above: The yield paid on ten-year government bonds, image: FT.com

This is the biggest one-day fall since March 2020 and is linked to a combination of falling inflation expectations and a belief the UK government will not be required to issue as much debt as previously expected.

Net borrowing is set to decline to £44.BN (88% of GDP) in 2026/27.

The UK Debt Management Office has meanwhile anticipated a £57.8BN fall in planned bond issuance in 2021/22, with the potential for a substantive reduction in issuance through the forecast period.

A lower supply of bonds issued to fund borrowing implies higher bond prices, all being equal, as investors chase a limited supply.

Given yields move in the opposite direction to bond prices the net result is lower bond yields

A lower supply of bonds issued to fund borrowing implies higher bond prices, all being equal, as investors chase a limited supply.

Given yields move in the opposite direction to bond prices the net result is lower bond yields.

International investors tend to chase higher yielding bonds, providing a source of support for the local currency.

Therefore, the fall in UK ten-year yields deprives the Pound of a bid.

As foreign exchange is a relative game what matters for Sterling is how fast UK yields fall or rise relative to those in other currency areas, for instance we know UK and German ten year yields have fallen faster than their U.S. equivalent.

This implies some ongoing support to the Dollar relative to the Euro and Pound.

"Though yields are lower, on lower debt burdens, if BoE updated forecasts reflect these improvements, risk of an early hike will persist," says Riddell.