Pound-Dollar Week Ahead Forecast: Fed and Global Market Risks Linger as 1.3580 Offers Support

- Written by: James Skinner

- GBP/USD looking to stabilise above 2021’s low

- Underpinned by pocket of supports near 1.3570

- Global markets driving GBP into key Fed speech

- Jackson Hole a double-edged sword for the USD

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3656

- Bank transfers (indicative guide): 1.3278-1.3374

- Money transfer specialist rates (indicative): 1.3533-1.3560

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar exchange rate entered the new week near 2021 lows but could be aided back onto its feet over the coming days if global markets continue to stabilise and the increasing proximity of the Federal Reserve’s (Fed) Jackson Hole Symposium encourages caution among Dollar bulls, although analyst commentary suggests the risk is of Sterling remaining on its back foot.

The Pound-to-Dollar rate fell to an annual loss last week that saw Sterling handing over to the greenback its earlier position as the best performing major currency of the year after UK economic data put the frighteners on some investors and following further indications that a Fed policy shift is now well and truly in the pipeline, all of which came amid rising market concerns about the global growth outlook.

“Our economists reduced their forecasts for Q3 GDP growth in both the US and China over the past week,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs. “Given the large role global growth expectations seem to have played in recent G10 FX performance, we will need to have more confidence that the delta outbreaks are waning before recommending fresh pro-cyclical Dollar shorts.”

Important Chinese economic figures surprised on the downside for July last week and New Zealand's previously-outperforming economy joined Australia’s in a fresh shutdown while Israel, one of the most vaccinated countries of all out there, was reported to also be toying with the idea of a fresh ‘lockdown’ in what delivered a triple blow to the global economic outlook.

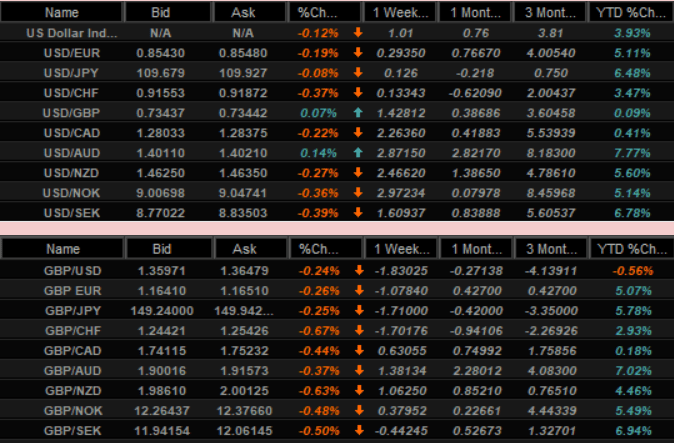

Above: U.S. Dollar and Pound Sterling quotes and performances against currencies of G10 economies. 2021 performance in the right column.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

While global markets had stabilised before entry into the new week the U.S. Dollar was lifted across the board previously amid coronavirus-inspired risk-aversion, and all currencies as well as markets will remain prone to periodic instability the entire time that governments favour economically calamitous or otherwise cumbersome measures in attempts to rid the world of the disease.

However, the evolving Fed policy outlook has also been a driver of the Dollar move following the release of minutes from July’s meeting, and will be in focus again this week in light of Friday’s address from Chairman Jerome Powell at the annual symposium of central bankers in Jackson Hole, Wyoming scheduled for 15:00 London time.

“While hardly new, the FOMC minutes continue to push the Fed’s taper conversation forward, which presents a challenge for risk assets against a backdrop of adjusting global growth expectations. Jackson Hole may give a similar push, but we don’t expect September to be the announcement of taper - we see November as more likely,” says Brian Daingerfeld, G10 head of FX strategy for U.S. at Natwest Markets.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

July’s minutes suggested a majority of the bank’s rate setters would be happy to commence the process of winding down its quantitative easing (QE) programme this year if the economy develops in line over the coming months with the projections set out in June.

As a result market pricing has shifted from implying a 62% chance of an interest rate rise at the Fed before year-end 2022, to a 68% chance, despite last week’s minutes clearly casting Federal Open Market Committee members as being keen to stress the absence of a “mechanical link between the timing of tapering and that of an eventual increase in the target range for the federal funds rate.”

“The dollar rally has sent GBP/USD sharply lower and there is a meaningful risk we’ll see a break below the 1.3570 July lows in the week ahead,” says Francesco Pesole, a strategist at ING. “The Jackson Hole symposium will likely be the key driver, and with the risks skewed towards another leg lower in risk and leg higher in the dollar, the pound may struggle to recover just yet.”

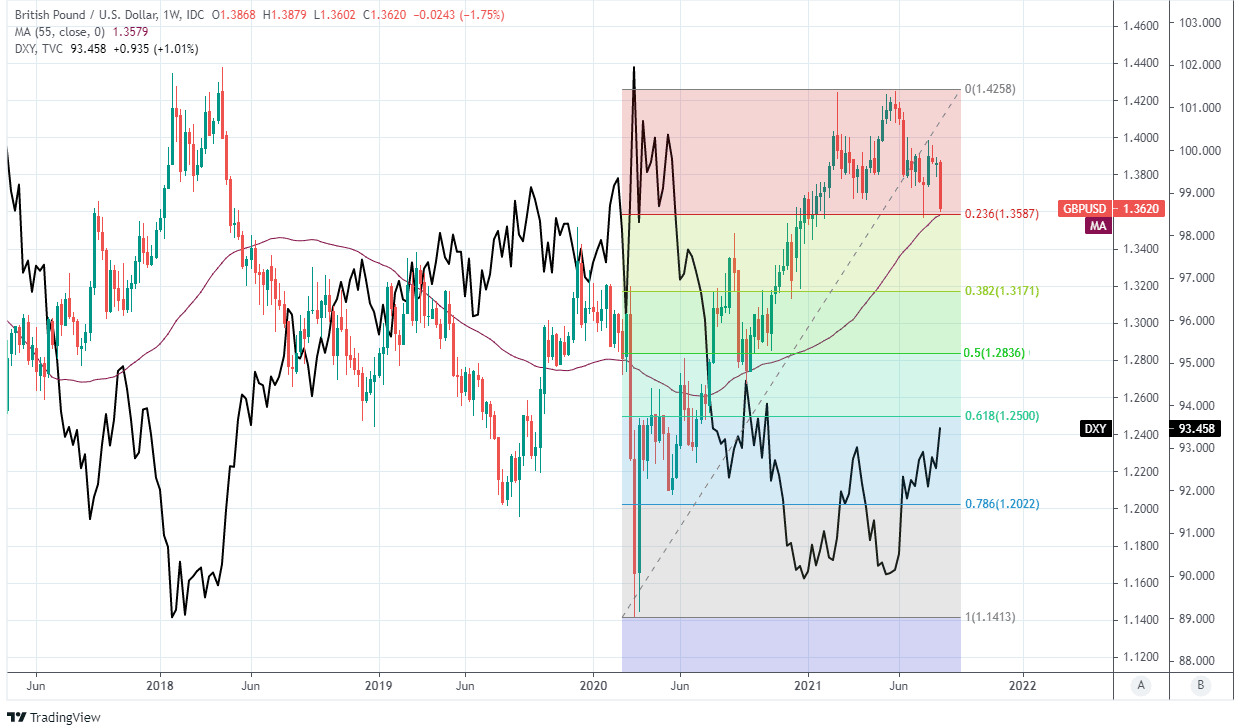

Above: Pound-Dollar rate at weekly intervals with 55-week moving-average and Fibonacci retracements of 2020 recovery indicating possible technical support, shown alongside the U.S. Dollar Index.

It’s possible that uncertainty about Powell’s message will encourages caution among recently ascendant Dollar bulls going into the address, and there’s also scope for market disappointment to weigh on the Dollar after the fact if the Fed Chair says anything to suggest that market expectations for timing of a tapering announcement or an initial interest rate rise have become too ambitious.

However, a range of analysts suggest the risk is of Sterling remaining on its back foot this week, which could see market attention fixated on the nearby triple-barreled layer of technical support between 1.3570 and 1.3580 over the coming days.

This encompasses the Pound-Dollar rate’s July low and coincides loosely with its 55-week moving-average at 1.3579 as well as the 23.8% Fibonacci retracement of the entire recovery trend from March 2020 lows, which collectively make for a considerable layer of support that might necessitate a further meaning catalyst for it to be sustainably undermined.

“As we move into winter there is justification for investors to incorporate the risk of COVID being far more dominant than was assumed just a few months ago which is likely to ensure continued USD support over the coming weeks, and possibly months,” says Derek Halpenny, head of research, global markets and international securities at MUFG.

“The deterioration in risk sentiment has been made worse by the rhetoric from Fed officials and the FOMC minutes this week indicating a growing chorus in favour of moving faster with tapering. However, given COVID developments these voices may well become less evident in the coming weeks,” Halpenny adds.