Dollar's Advance in Wake of Bumper Jobs Report Exposes the Market's Preference for Pounds over Euros

- Written by: Gary Howes

- U.S. unemployment drops sharply

- Dollar broadly bid

- GBP/USD outperforms EUR/USD

- GBP/EUR tests new 4-month best in response

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1797 | GBP/USD: 1.3900

- Bank transfer rates: 1.1567 | 1.3617

- Specialist transfer rates: 1.1714 | 1.3810

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The U.S. Dollar found fresh bidding interest in the wake of a strong U.S. employment report for July although this strength was more evident against the Euro, suggesting a more robust Pound-to-Dollar exchange rate profile going forward.

U.S. nonfarm payrolls came in at 943K for July, which is better than the 870K the market was expecting and an improvement on the previous month's 938K.

The U.S. unemployment rate fell to 5.4% in July, beating analyst expectations for a decline to 5.7% from June's 5.9%.

The Dollar was bought in the wake of the data as investors interpreted it as providing further confirmation that the economy is evolving in a manner consistent with the withdrawal of monetary stimulus at the Federal Reserve (Fed).

"The market's prior USD bid confirmed in that net employment gain and upwards revision to June," says Simon Harvey, Senior FX Market Analyst at Monex Europe.

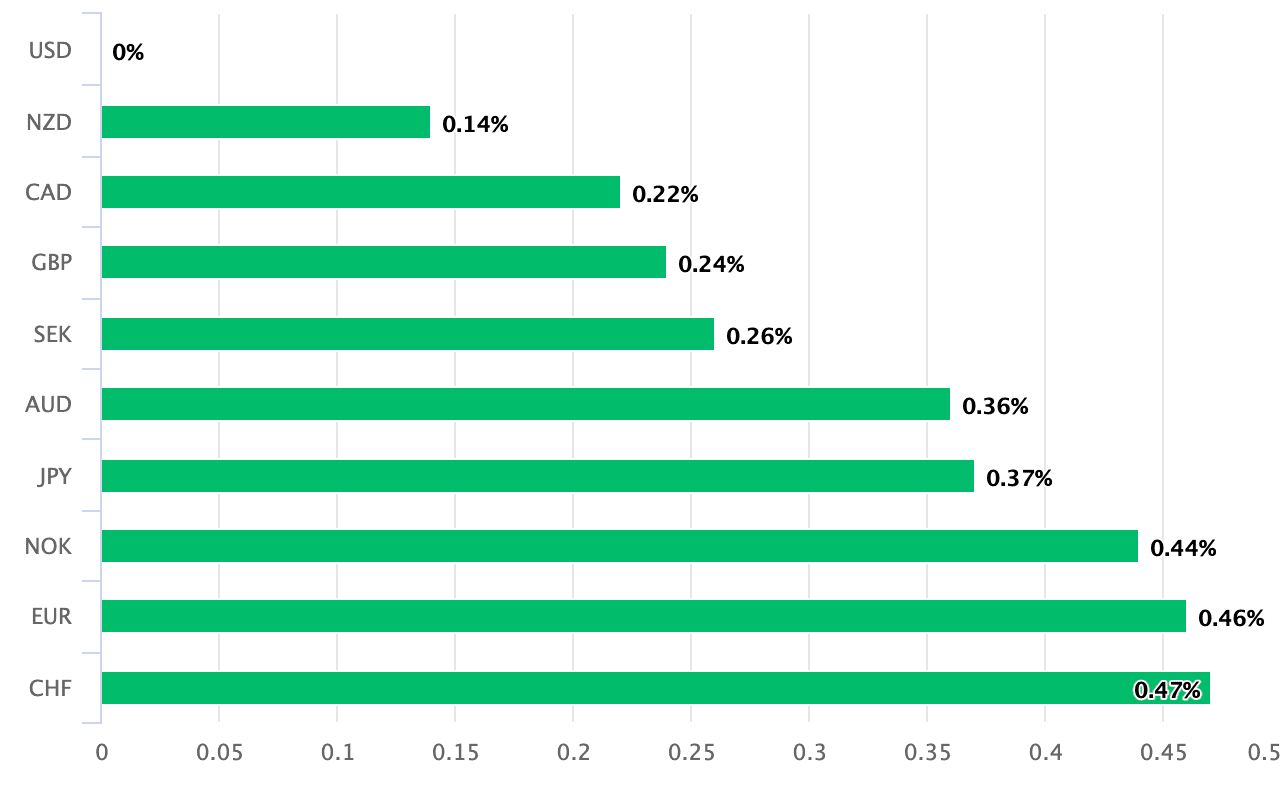

Above: The USD was bid against all rivals on Aug. 06

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Fed has long said it would only commence the withdrawal of monetary support once it felt the U.S. economy had recovered sufficiently.

Market developments - including the Dollar rally - suggests the Fed will be justified in announcing a plan to reduce asset purchases under its quantitative easing programme (taper) at upcoming meetings.

"Big fall in the US unemployment rate. Suggests labor market improving and pent-up job gains from prior misses. Labor force participation up. Wages beat too. Nothing in this jobs report that doesn't suggest to the Fed that labor market progress is being made," says Viraj Patel, Strategist at Vanda Research.

U.S. average earnings rose 0.4% month-on-month to July, which is faster than the 0.3% the market expected.

Annual wage growth stood at 4.0% in July, stronger than the 3.8% the market was anticipating.

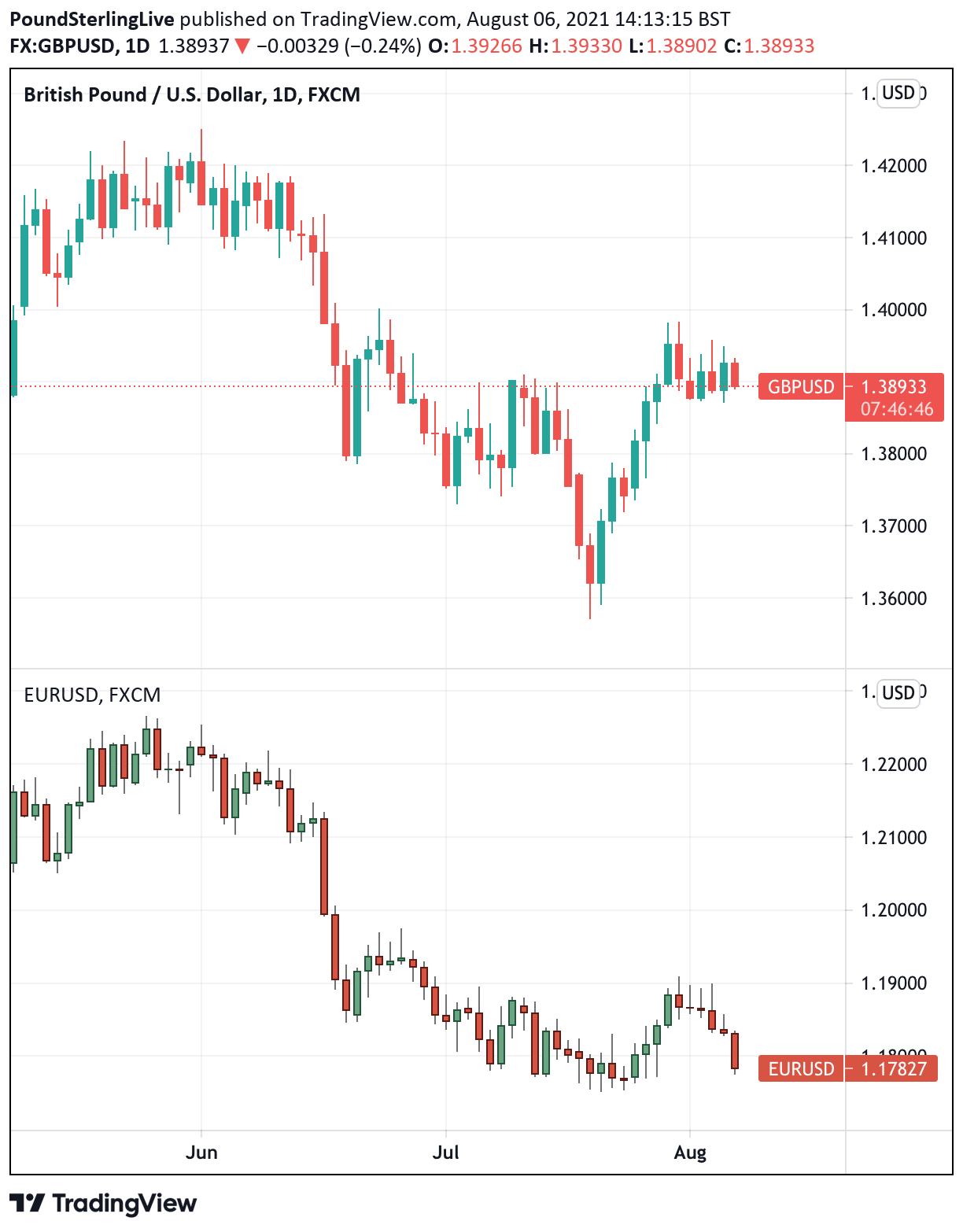

In the wake of the data the Pound-Dollar rate fell back by 0.20% to quote at 1.3897, the Euro-Dollar exchange rate meanwhile sustained a more notable 0.40%.

This divergence in Dollar performance on the two exchange rates left the Pound-Euro cross bid by 0.20% at 1.18, which represents a fresh 4-month high, confirming the centrality of the Dollar to the broader FX market.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

That the Pound-Dollar exchange rate weather the Dollar buying better than Euro-Dollar suggests a preference for Pounds over Euros in a market that is keenly focussed on central bank policy.

While the Fed might be heading to a higher interest rate future, so too is the Bank of England.

The Bank revealed in its August policy report on August 05 it was likely to raise interest rates in 2022, two years ahead of current expectations for a similar move at the European Central Bank.

But before the U.S. Federal Reserve offers a more concrete guidance on higher interest rates it must taper its quantitative easing programme, and a string of solid job reports "makes the prospect of tapering seem closer at hand," says Ima Sammani, FX Market Analyst at Monex Europe.

The data provides "all the reasons for dollar traders to take a bullish stance today. The dollar’s strength was also supported in the Treasury market, with 10-year yields rallying back towards 1.3% after spending much of the week below the 1.2% handle," adds Sammani.

Looking at the jobs report details, the employment recovery in July was once again driven primarily by the leisure and hospitality sector.

Employment in this sector rose by 380k in July.

The number of jobs also increased for the trade and transport sector (47k), business services (60k) and education and health (87k).

For the remaining private industries there were smaller changes.

"The improvement of the labour market implies that the Fed is getting closer to signal tapering. We believe that one more strong monthly report would be enough to substantiate “substantial further progress” towards the maximum employment goal," says Knut A. Magnussen, Senior Economist at DNB Markets.