Pound-Dollar Week Ahead Forecast: Lower Range Takes Hold as Fed, U.S. Data Set Direction

- Written by: James Skinner

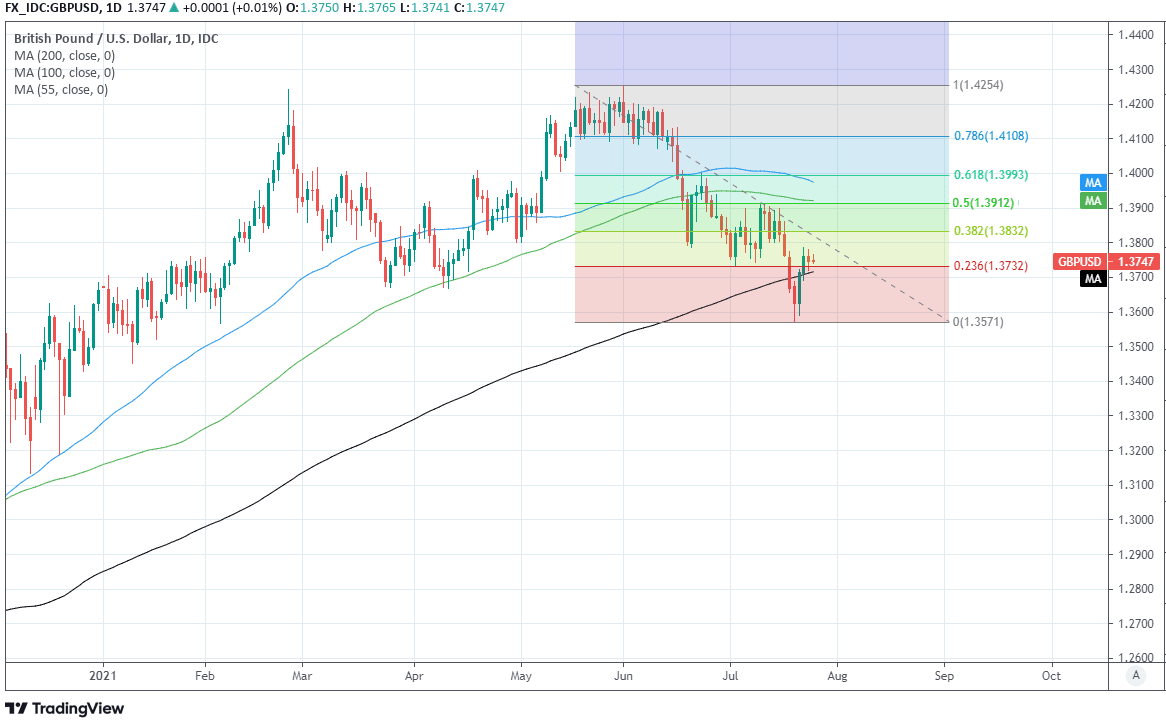

- GBP/USD facing resistance at 1.3830, 1.3912

- Risks becoming trapped in a new, lower range

- With floor extending to 1.3567, potentially lower

- Fed decision, U.S. data & USD in driving seat

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3763

- Bank transfers (indicative guide): 1.3380-1.3478

- Money transfer specialist rates (indicative): 1.3639-1.3667

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar exchange rate was rattled last week and now risks becoming confined to a much reduced trading range over the coming days, with the outcome hinged on the market’s reading of Wednesday’s Federal Reserve (Fed) decision and a pending flurry of U.S. economic data.

Sterling fell briefly to a year-to-date loss against the Dollar during an early sell-off last week and was unable to convincingly recover its footing ahead of the weekend, leading GBP/USD to open the new week just below 1.3750 and with its short-term outlook hanging in the balance.

The Pound now faces technical resistance around 1.3830 and further up at 1.3912 upon any protracted rebound, which might require a Dollar-bearish reading of the looming Fed decision or the U.S. GDP and inflation figures due out over the latter half of the week in order to materialise.

"Above 1.3749 would suggest the recovery can extend further to 1.3791, with 1.3830/40 needing to cap in order to maintain the top and our tactical bearish outlook," says David Sneddon, head of technical analysis at Credit Suisse.

"Support is seen at 1.3690 initially, below which should see a move back to 1.3643/49, with this seen as the trigger to a retest of 1.3571/67," Sneddon adds.

The danger is now that without that fresh turn lower by the greenback those resistance levels prove to be too tall an order, and that this leads the Pound-to-Dollar rate to become trapped in a new and lower range.

The floor of that range could could be as far down as recent lows at 1.3567, if-not lower.

Above: Pound-to-Dollar rate shown at daily intervals with Fibonacci retracements of June fall indicating possible resistances and selected moving-averages (200-day in black).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

This is with recently faltering confidence in the UK’s recovery and fresh doubt in the market that a policy shift at the Bank of England (BoE) is becoming any more likely having tempered market enthusiasm for the Pound last week.

There’s little by way of major data expected from the UK during the week ahead, which leaves the Dollar and international factors in the driving seat during what is a busy period for the U.S. calendar, the highlight of which is the 19:00 Fed decision on Wednesday.

“GBP/USD has been struggling due to both specific negative news on sterling and the declining EUR/USD. Next week should offer no real changes, with the July FOMC meeting posing a downside risk to low yields vs the dollar should the Fed drop some hints about Jackson Hole or tapering in September,” says Petr Krpata, chief EMEA strategist for currencies and interest rates at ING.

“While it may not specify exactly when it is ready to taper, the tone should generally support the view that tapering should emerge in 4Q this year, with the possibility of a first hike coming in 4Q22,” Krpata adds.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

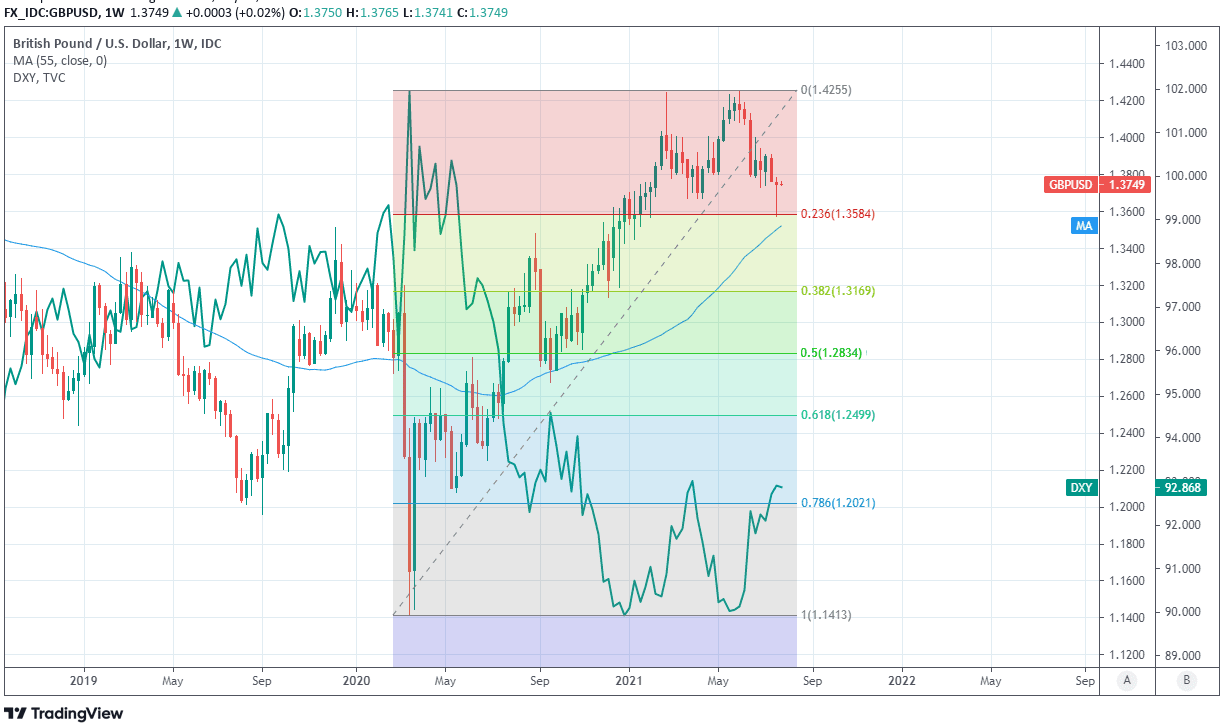

Much of the Pound-to-Dollar rate’s seven-week decline has been driven by widespread appreciation of the greenback rooted in the Fed’s June indication that it could raise its interest rate sooner than previously guided for and that it may announce plans in the months ahead to end its $120BN per month quantitative easing programme some time soon after.

The Federal Open Market Committee (FOMC) member forecasts conveying those messages were inspired by the recent performance of a stimulus-pumped U.S. economy and sharp spikes in inflation rates that have been widely billed as temporary pandemic-related developments, but which could yet turn out to be longer-lasting and may potentially lead the market to anticipate a stronger eventual interest rate response from the Fed.

“We continue to argue that US inflation is the most important call for the months ahead. The market’s addiction to Fed support should be clear by now. As long as US inflation remains under control and comes down, close to the 2% target, after base/temporary effects fade, the Fed could in theory manage its exit without risking market turmoil,” says Athanasios Vamvakidis, head of FX strategy at BofA Global Research.

“More persistent inflation could force the Fed to choose between its inflation and market stability mandates. Or at least the market may start pricing such a Fed dilemma,” BofA’s Vamvakidis adds.

Above: Pound-to-Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 recovery, 55-week moving-average and U.S. Dollar Index.

While a majority of the FOMC rate setting committee have indicated they could be minded to lift interest rates as soon as 2023, the more senior members of the Fed’s committee including Chairman Jerome Powell have insisted that recent inflation pressures are likely to fade of their own accord over time and have stuck with the view that the bank can afford to be patient in waiting for them to do so.

“It won't take forever for us to be able to see that. And if we do see that inflation expectations are moving up and inflation is on a path to move well above our goals and risks sending us off on a period of high inflation then we'll use our tools to guide inflation back down to 2%” Chairman Jerome Powell said on July 14 in response to a question from Rep Frank D Lucas of the House of Representatives’ Committee on Financial Services.

“It would be a mistake to do it at a time when we really do believe, and virtually all forecasters believe it will come down as the economy reopens, Honestly it would be a mistake to act prematurely,” Powell said.

The financial markets have however continued to assume that above-target inflation rates will turn out to be more persistent than the Fed believes and investors have continued to bet the bank eventually lifts interest rates sooner than it is currently guiding for which, along with recent coronavirus-inspired market concerns about the outlook for the global economy, has continued to lift the Dollar in recent weeks.

The danger is this week that with the Fed’s preferred measure of inflation set to be released on Friday and expected to show annual price growth in excess of 3% for the third month in a row, the market continues to call the Fed’s bluff and the Dollar remains on its front foot as a result, irrespective of whether the bank continues to push back against the popular view on Wednesday.

In between those two points GDP data for the second quarter will be released on Thursday at 13:30 and is widely expected to show the U.S. economy continuing to draw a line under last year’s coronavirus-inspired declines.

“GDP growth is widely anticipated to have been exceptionally strong—we continue to look for an increase of 10.5% annualized growth. Meanwhile, with inflation picking up any upside surprise with the employment cost index (forecast 0.8%) and core PCE prices (forecast: 0.445%) would be noteworthy,” says Kevin Cummins, chief U.S. economist at Natwest Markets.