Pound-Dollar Week Ahead Forecast: Targeting 1.41+ As USD Loses Altitude

- Written by: James Skinner, Additional Editing by Gary Howes

- GBP/USD's could test 1.41 & Feb highs soon after

- Amid USD declines & global FX rally into summer

- Asian, CEE FX to outperform GBP & other majors

- Including PLN, RON, CZK, RUB, KRW, SGD & MYR

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3964

- Bank transfer rate (indicative guide): 1.3570-1.3670

- FX specialist providers (indicative guide): 1.3830-1.3860

- More information on FX specialist rates, here

- Set an exchange rate alert, here

The Pound-to-Dollar exchange rate starts the new the week above 1.40 amidst a broad based buying of the Pound.

Advances also come on the back of widespread declines in U.S. exchange rates at the end of the previous week, leaving GBP/USD possibly on course to return to February highs over the coming weeks, provided the greenback continues to unravel.

This Monday’s price action will be revealing of the extent to which investors and traders were deterred away from the Pound by political risks that did not materialise over the weekend, although the Bank of England's (BoE) policy outlook and market’s inclinations toward the Dollar are what matter most to GBP/USD’s prospects from here.

“Financial markets are increasingly convinced the FOMC will not prematurely reduce policy support or that Treasuries already reflect a rip‑roaring US economic recovery. Bottom line: the USD fundamental downtrend is intact,” says Elias Haddad, a senior FX strategist at Commonwealth Bank of Australia.

Sweeping upgrades to BoE forecasts for GDP, inflation and a range of other metrics were announced last week but followed closely behind by the observation from BoE Governor Andrew Bailey that such changes and a range of other factors have left risks tilted to the downside for UK economic figures.

Governor Bailey’s cautious assessment in the BoE’s press conference gave the impression that Sterling may already have seen and heard all of the optimism it’s likely to get from the Bank until some of its bullish forecasts have been borne out.

That would elevate the importance of this Wednesday’s first quarter GDP data and all other figures .

“This should show a solid 1.5% YoY, which is considerably ‘less bad’ than feared given the Brexit disruption and the strict lockdown,” says Petr Krpata, chief EMEA strategist for interest rates and FX at ING, who looks for the Pound-Dollar rate to climb sustainably above 1.40 this week.

Office for National Statistics data will reveal on Wednesday whether the BoE is still too downbeat in spite of the huge upgrades to its GDP forecasts, with the bank anticipating a -1.5% quarterly contraction under a third ‘lockdown’ for last quarter, while the consensus and currency market each envisage a -1.6% decline.

An upside GDP surprise could enable Sterling to rise, although it’ll be June and July before the market and BoE policymakers have a clearer idea of whether the pending UK rebound is really going to be as strong as what is now widely assumed.

Fortunately for some however the Pound-Dollar rate would also likely benefit this week from any further declines by the greenback, which is widely expected to fall further over the coming days and could enable Sterling to rise to take a look at the 1.41 level again for the first time since late February.

“Key resistance, remains 1.4018, the March high. A close above 1.4018 will target 1.4238/45, the recent high,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

The Dollar was sold widely after the U.S. economy was unable to repeat the blockbuster jobs feat seen in March this Friday, with April’s job report surprising sharply on the downside of market expectations and appearing to exacerbate an earlier sell-off in U.S. exchange rates.

“Friday’s weaker-than-expected April employment report should help keep US front-end pricing relatively stable, allowing broad Dollar weakness to extend,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs.

There were 266k jobs created or recovered from the coronavirus last month, although economists and markets had expected close to 1 million new positions and even more than the 916k reported previously.

That leaves the U.S. labour market and economy a long way off the preconditions set by the Federal Reserve (Fed) for it to begin thinking about a mere discussion of changes to its policy settings including the 0%-to-0.25% Fed Funds rate range and $120 bn per month quantitative easing (QE) programme.

Above: Dollar quotes and performances over various time frames. Source: Netdania Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Fed is looking to stimulate the economy into growing fast enough for inflation to rise and hold above its 2% target in the coming years before it raises interest rates, and all of the indications are that this is unlikely to happen for some time.

U.S. data still suggests the economy is growing strongly enough to provide a shot in the arm to the global economy, though at the same time makes it clear that the economy is not growing strongly enough to justify investor expectations for the Fed to begin tapering its QE programme or start raising interest rates any time soon.

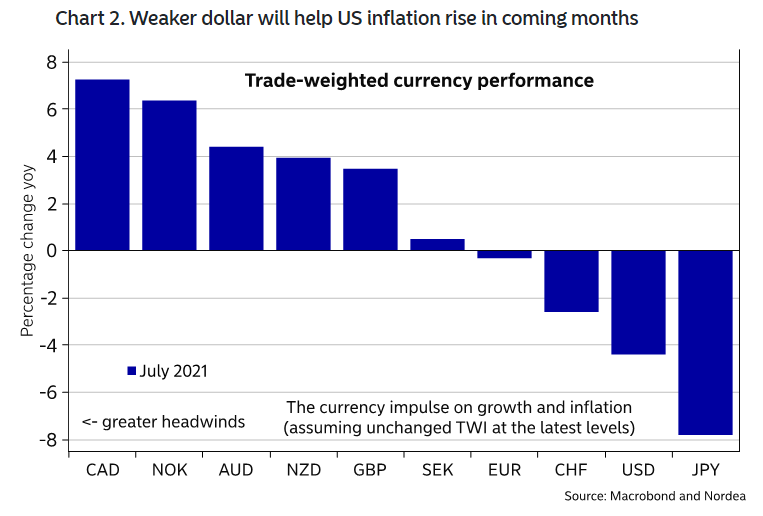

“If the trade-weighted USD holds at today’s level it will be down 5% yoy in July, which will provide an inflationary impulse via greater import costs,” says Martin Enlund, chief FX strategist at Nordea Markets.

The severity of the Dollar downturn seen heading into the weekend could mean the greenback is susceptible to further losses in response to any additional downside surprises in data due out this week, which includes April inflation numbers at 13:30 on Wednesday and retail sales figures at the same time on Friday.

“We think long USD/JPY and USD/CHF are appropriate expressions of a potential strong global growth / higher US yield environment, and we are long both. But our portfolio is generally quite risk positive, and leans bearish on the USD,” says Brian Daingerfeld, head of G10 FX strategy U.S. at Natwest Markets.

Above: Nordea Markets graph showing changes in trade-weighted exchange rates.

Combining U.S. economic data disappointments with the Fed’s lower-for-longer policy stance and recent improvements in economic data elsewhere in the world is a recipe for Dollar losses, which might be likely to benefit most the currencies which underperformed thus far in the year and now have economies that are pulling ahead of peers.

Included among those are the Korean Won, Malaysian Ringgit, Singapore Dollar, Russian Rouble, Polish Zloty, Romanian Liev and Czech Koruna, many of which saw had economies that saw renewed outbreaks of coronavirus in the opening quarter or were seen as adversely impacted by vaccine procurement troubles.

However, each of these offers investors exposure to the recovery in global trade that would typically be expected to accompany any strong increase in U.S. economic growth, and has recently seen economic growth figures surprising on the upside.

In April it emerged that the South Korean economy returned to its pre-coronavirus size in the first quarter, while the Singapore economy surprised with an unexpected expansion alongside the Russsian economy, which also benefits from an elevated oil price.

"A $0.8bn cut in monthly FX purchases to $1.6bn in May, amid a strong oil price environment, recovery in foreign portfolio inflows, and extended foreign travel restrictions, creates a favourable environment for the ruble this month,” says Dmitry Dolgin, chief Russia economist at ING.

Above: AUD/USD shown at daily intervals with USD/RUB.

“The RUB stands to benefit from higher yields on offer in Russia. The CBR has raised rates faster than expected in recent months and has signalled further hikes are likely as it moves the key policy rate closer to 6.00%,” says Lee Hardman, a currency analyst at MUFG.

The author suspects all of those Asia Pacific currencies will outperform the likes of Sterling, the Euro and other majors like the Australian Dollar this quarter, in part because any continued underperformance would subject the trade-weighted Euro, Renminbi and Aussie Dollar to even greater uplift than otherwise as the U.S. Dollar falls.

This would risk drawing the ire of the European Central Bank, could draw further intervention from the Reserve Bank of Australia (RBA) and may even aggrieve Chinese policymakers if lacklustre movements prevent the Renminbi from adjusting where it needs to.

Asia Pacific currencies especially have noteworthy shares of around 2% or more in not only the Euro and Renminbi trade-weighted exchange rates but also the Australian Dollar’s trade-weighted index, which reached a multi-year high this year and may explain why AUD/USD recently appeared to have been the target of intervention by the RBA.

The Aussie Dollar’s earlier appreciation against the U.S. Dollar has as well as underperformance by mainly Asia pacific currencies, which has lifted other Australian exchange rates, subsidised the cost goods imports and is now threatening to scupper the limited painstaking progress made by the RBA toward its 2%-to-3% inflation target.