It's a SOMA Day: U.S. Dollar Likely to Gain as Fed Sucks up Liquidity

Image © Adobe Stock

- Fed to drain $22bn from the economy

- Loss of liquidity to drive up the US Dollar

- Dollar Index marginally higher at time of writing

The U.S. Dollar is more likely to strengthen through month-end owing to an especially high number of bonds held by the US Federal Reserve maturing.

Days on which more than $18bn worth of bonds held by the Fed mature tends to have a positive effect on the Dollar as $18BN worth of liquidity is drained from the global pool of dollars.

These have been dubbed 'SOMA' days by some market commentators such as the team at Nordea Markets, borrowing from the name of the Fed's bond portfolio.

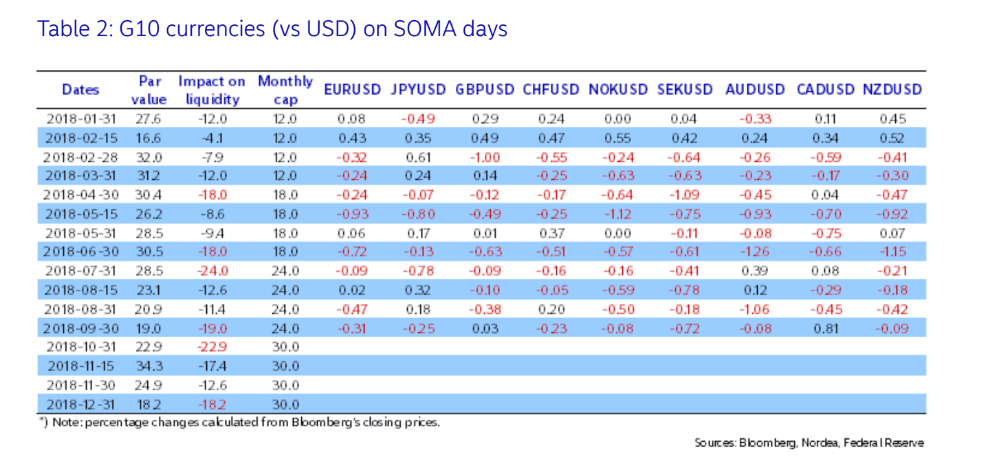

The Dollar has risen against the Euro and the Yen on the four previous $18bn+ SOMA days in the table below which shows a list of all the SOMA redemption days in 2018.

"The SOMA redemption day on October 31 will be a hefty one and will necessitate the second largest liquidity drain ever, after the one at the end of July," says Martin Enlund, chief FX analyst at Nordea Markets.

There was no noticeable effect before 2018 because the Fed used to reinvest the principle it earned from its bonds maturing, back into the economy in buying new bonds, and it was only in 2018 that it stopped this practice.

"On the ten SOMA days since the end of February, EUR/USD has always been lower at CET17:15 vs CET08:00, by an average of 0.25%, and odds are that the USD will perform nicely on Wednesday too, unless offset by month-end rebalancing flows," say Enlund.

The reason why the US Dollar rises on SOMA days is that the repayment of principle takes money, or drains it, out of the economy and hands it back to the Fed - it is like the reverse of quantitative easing (QE) - the process by which the Fed originally injected cash into the financial system by buying the bonds from financial institutions.

The U.S. Dollar is in demand so when the pool of available notes shrinks it pushes the Dollar's value to rise.

"The Fed has gradually been letting its balance sheet shrink at a quicker and quicker pace, with a maximum shrinkage of USD50bn/month reached this quarter (of which 30bn can be bonds and notes)," says Enlund. "From the maturity profile of the Fed’s bond portfolio (the SOMA portfolio) we know when these daily, negative, liquidity impacts will occur."

Has the effect had a noticeable impact on USD?

At the time of writing the Dollar index is only marginally higher by 0.01%, but higher it is, suggesting some SOMA-day effect is taking place.

Advertisement

Bank-beating exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here