GBP/NZD Rate Week Ahead Forecast: Giving the Pullback Some Space

- Written by: Gary Howes

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate remains in a multi-week uptrend but could decline in value over the coming five days. Tuesday's local jobs report and Friday's U.S. labour report will be the week's two relevant highlights.

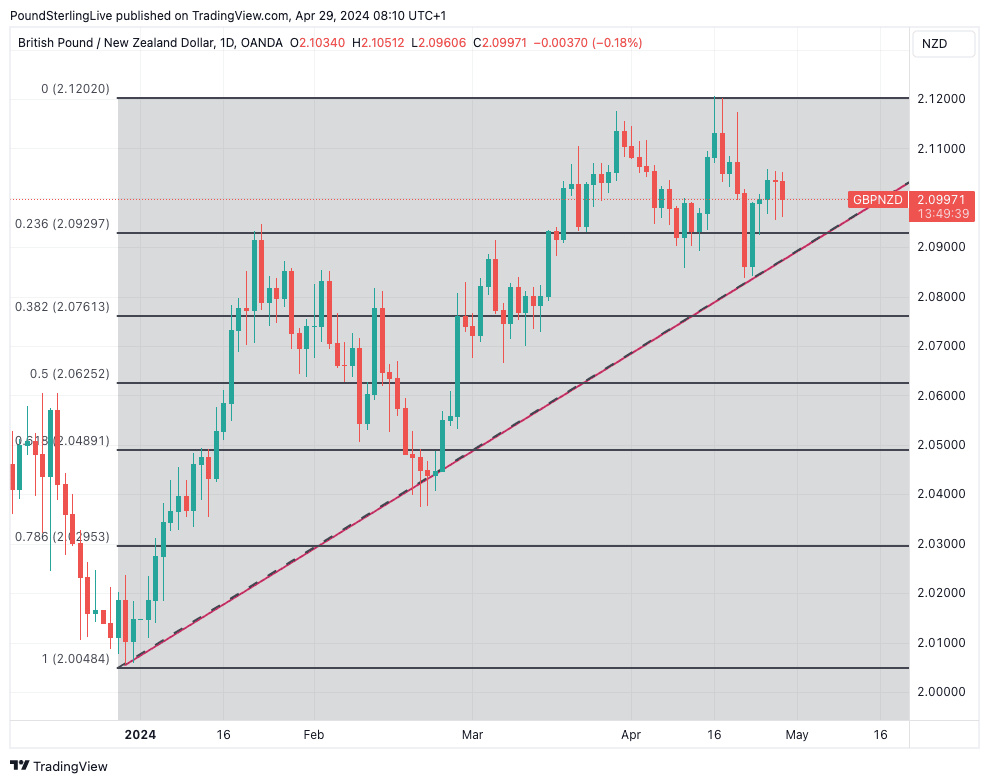

The GBP/NZD exchange rate peaked at 2.1204 in mid-April and has since retraced part of that move as overbought conditions unwound.

Yet the key momentum indicators we watch are all still positive, and there is some way to go before the decline flips the market from the upside to the downside.

The rally from February to April was impressively fast, and it is natural to see the market reset in the manner that is currently underway:

Above: GBP/NZD at daily intervals. Track GBP/NZD with your own custom rate alerts. Set Up Here

The above chart shows the 23.6% Fibonacci retracement of the rally at 2.0935; we are looking for this area to provide the first level of short-term support for the exchange rate.

Note, too, that the test of the level could coincide with the 2024 uptrend line (red) annotated on the chart at some point later in the week.

A break below here would delay any prospect of a retest of the 2024 highs, which should put NZ Dollar buyers on alert that the uptrend might be at risk of fading.

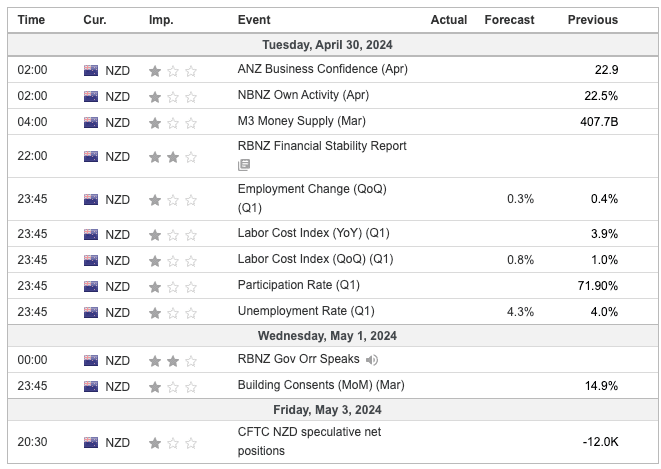

The domestic highlight in the coming week will be New Zealand's labour market statistics for the first quarter, due Tuesday, where the market looks for a 0.3% quarter-on-quarter change, down from 0.4%..

"Record net migration continues to drive strong population growth, providing a boost to both labour supply and demand. But at the same time, high interest rates are clearly weighing on activity," says a note from Westpac.

An unexpectedly large increase in unemployment would potentially put the New Zealand Dollar on a soft footing.

Image courtesy of Investing.com

"Employment is still rising modestly, but not fast enough to absorb the growth in the labour force," says Westpac. Analysts expect the pace of wage growth to have slowed in the March quarter, though remaining above what would be consistent with the RBNZ’s 2% inflation target.

The RBNZ is expected to cut interest rates towards the fourth quarter as a strong labour market and still-high inflation means cutting too soon risks boosting inflation.

"They are definitely going to be late to the rate cut party, could potentially be one of the last to arrive. NZD should outperform somewhat, given this set up," says Brad W. Bechtel, Global Head of FX at Jefferies LLC.

New Zealand's interest rate advantage relative to elsewhere is a source of support for the New Zealand Dollar, even if global market conditions have been unsupportive of late.

"We continue to expect that the RBNZ will require considerably more certainty before contemplating cuts," says Sharon Zollner, Chief Economist at ANZ.

Global market sentiment resulting from shifting Federal Reserve interest rate expectations will likely remain the dominant driver of NZD in the coming week.

Markets have been steadily lowering expectations for the quantum of rate cuts to come from the Fed in 2024 amidst surprisingly strong U.S. data, which has weighed on global equity markets and associated 'risk on' currencies such as the New Zealand Dollar.

With this in mind, the Federal Reserve policy meeting due midweek and Friday's U.S. job report could prove to be the more important calendar dates of the week.

We would expect a decent NZ Dollar rally if the headline non-farm payroll figure undershoots the 210K the market expects.

But, this is an economy that seems to perpetually surprise to the upside, so we wouldn't hold our breath. Another beat would send the Pound-New Zealand Dollar rate back above 2.11.