Hot U.S. Job Report Would Deal a Killer Blow: The GBP/USD Rate Week Ahead Forecast

- Written by: Gary Howes

The Pound to Dollar exchange rate recovered last week but was unable to hold 1.25, and a hawkish Federal Reserve update and a strong payroll print could result in more of those gains being returned.

Although it fell 0.80% against the Pound, the Dollar ended the week on a stronger footing thanks to a strong PCE price index reading and follow-through buying that followed Thursday's impressive consumer spending data.

That said, signs of fatigue are creeping into the Dollar's 2024 rally, with markets demanding ever-hotter figures to keep the train moving forward. This makes us confident we won't see fresh lows below 1.23 in the next five days.

The risk for Dollar bulls in the coming week is that U.S. data disappoints, and a portion of the bloated long USD positioning is closed out of the market, prompting a deeper retracement in the Greenback.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

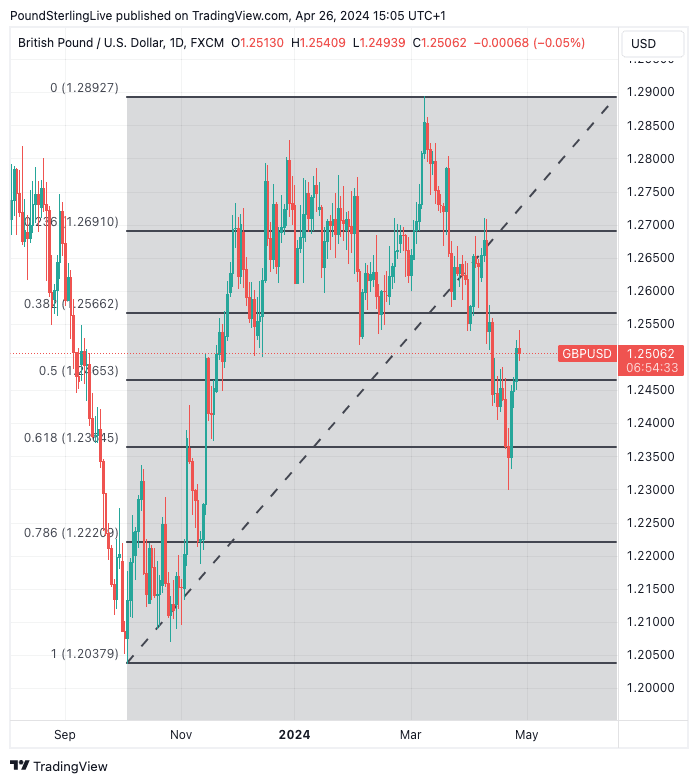

This outcome would allow the Pound-Dollar exchange rate to capitalise on last week's recovery in the coming days and we look for any rally to take in 1.2566, which is the 38.4% Fibonacci retracement of the October-March rally.

Gains could initially stall here owing to the historical support-resistance levels located in the vicinity.

Above: GBP/USD at daily intervals with the Fibonacci retracement of the late-2023/early-2024 rally indicated. Track GBP/USD with your own custom rate alerts. Set Up Here

We note, however, that all manner of momentum indicators are negative and continue to point to further Pound-Dollar weakness. For instance, the exchange rate trades below its 50-, 100- and 200-day moving averages.

We would only turn more bullish on various timeframes when we see these levels pierced and held.

From a technical perspective, therefore, we look for any further Pound-Dollar upside to be regarded as a relief bounce in a broader downtrend. Ultimately, strength will be sold into and we would suggest to those looking to sell Sterling to be nimble as we do not see the making of an uptrend at this point.

But, there are some important dates on the U.S. calendar that could really set the tone for early May in the coming week and offer tactical opportunities for those watching this market.

With market expectations for the first rate cut at the Federal Reserve having receded to December following last week's hot consumer spending figures, the coming week's figures will determine whether a 2024 rate cut is even on the cards or whether we will have to wait until 2025.

Wednesday's Federal Reserve policy update will be the first key test for the Dollar as investors will be interested to know whether the Fed is ready to validate market expectations for the first rate hike to come in December.

Recall, the Fed's most recent dot plot forecasts showed policymakers expect three rate cuts in 2023. The Fed will have to concede this is a tad ambitious in the face of the incoming data which shows the economy is starting to generate heat again.

The Dollar will strengthen if the Fed cautions its previous expectations look to generous.

The big data event of the week will be Friday's job report: weakness here will signal that finally a turning point is coming. We would expect a sizeable stock market rally and a drop in the Dollar if the headline non-farm payroll figure undershoots the 210K the market expects.

But, this is an economy that seems to perpetually surprise to the upside, so we wouldn't hold our breath. Another beat would send the Pound-Dollar rate below the 1.25 level once more.