GBP/NZD Week Ahead Forecast: Upside Targets Identified

- Written by: Gary Howes

- GBP/NZD short-term momentum positive

- Initial targets identified

- But, medium-term direction is still tilted lower

- Watch NZ business sentiment this week

- UK calendar is busy with inflation, wage data

Image © Adobe Stock

The New Zealand and Australian Dollars are two underperformers at the start of the new week, undermined by a surprise decision by the People's Bank of China to maintain interest rates at unchanged levels.

Markets had bid the two currencies in the closing stages of the previous week in anticipation of another hike following the release of below-consensus inflation numbers.

"China’s central bank kept its medium-term lending rate unchanged on Monday, disappointing many investors who were anticipating a small cut," says Raffi Boyadjian, Lead Investment Analyst at XM.com.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The Pound to New Zealand Dollar exchange rate is at 2.0542 as a near-term uptrend extends with further gains possible over the coming days, although a busy UK calendar could provide some volatility.

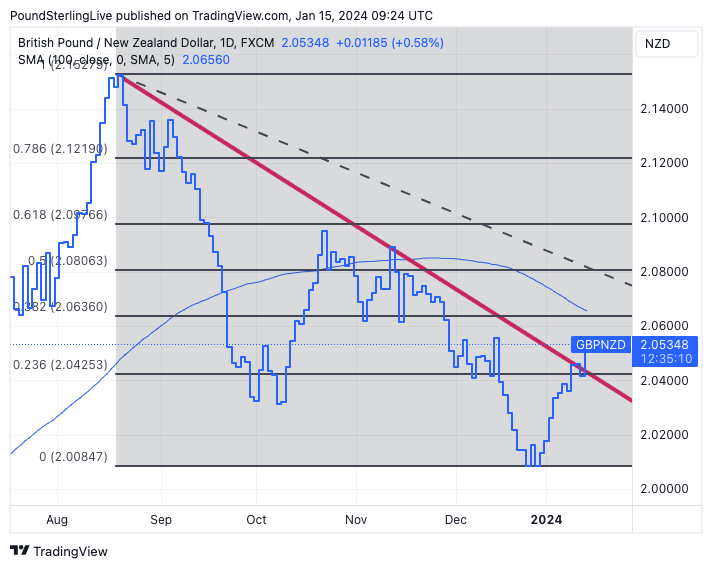

The pair has risen 1.60% already in 2024, as it corrects from the sharp selloff endured at the end of 2023. In fact, the daily chart confirms a medium-term downtrend has now been in place since August.

This downtrend provides a backdrop of medium-term weakness, and the current rebound looks corrective in nature, particularly given the exchange rate remains below the 100- and 200-day moving averages.

Nevertheless, this corrective rebound has further room to expand, and we look for this to occur over the coming days.

The initial target is the 38.2% Fibonacci retracement of the August-December downtrend at 2.0636.

We note the presence of the 200-day MA in the vicinity at 2.0589, suggesting some technical supports are layered up ahead. Gains can likely extend until these interim targets.

Above: GBP/NZD at daily intervals, showing the fibonacci retracement levels and 100-day moving average. Track GBP and NZD with your custom rate alerts. Set Up Here.

Regarding the New Zealand Dollar, "we are bearish for the week ahead," says Martin Whetton, a strategist at Westpac.

He explains the New Zealand Dollar benefited from the broad USD slide in November and December, and a "corrective pullback" is warranted "during the next week or two".

The Westpac strategist is targeting a retreat in NZD/USD to the mid-60s, resulting in further gains for GBP/NZD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

This is particularly likely given the Pound has been matching any USD strength during the start of 2024, allowing GBP crosses to match any USD gains.

"Markets have arguably priced too much Fed easing," explains Whetton.

The Dollar has recovered as markets 'price out' the scale of U.S. Federal Reserve rate cuts during 2024, which has, in turn, capped equity market and commodity strength, and weighed on the commodity currencies.

That said, when the Fed does start to ease later in the year, Westpac looks for enduring New Zealand Dollar strength to emerge.

Money markets show investors are now priced for an 80% chance of a rate cut from the Reserve Bank of New Zealand in May and a total of -100bp by year-end.

Should this pricing increase, the Kiwi can fall, but this would require a noticeable deterioration in domestic data, which looks unlikely in the near-term.

The coming days will see a number of second-tier releases from New Zealand that should underscore an economy that is struggling but with no major fresh deterioration.

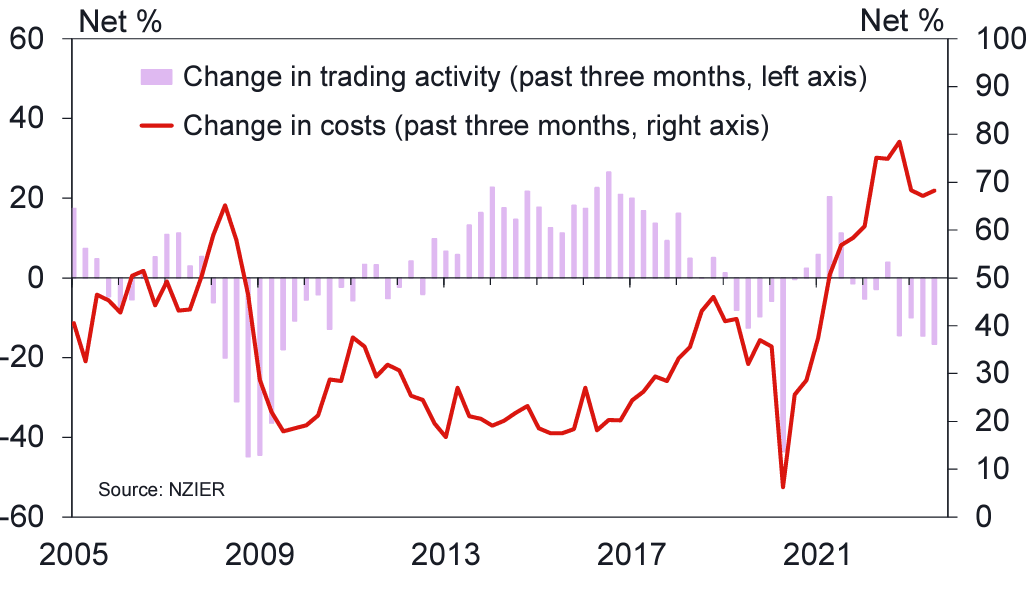

January 16 sees the general business confidence survey, which last read at –52.7.

Above: The NZ quarterly survey of business opinion has shown depressed sentiment amidst a high inflation backdrop. Image courtesy of Westpac.

"We expect that the December survey will show that economic conditions have continued to cool through the back part of the year," says a preview note from Westpac. The survey is also expected to reveal economic conditions have continued to cool through the back part of the year.

Retail card spending is due midweek, and house price figures are due Thursday.

Both should give further insights into how the rise in interest rates has impacted activity.

Any strong reads could lower the odds of a May rate cut, offering the Kiwi some support at the margin.

Note, however, that the global picture is likely to be of greater importance this week.

Keep an eye on the release of Chinese GDP figures midweek, as China often proves to be the major factor in New Zealand Dollar price action owing to its status as NZ's main trading partner.

Chinese GDP is expected to read at 5.2%, and any surprise deviation could move the Aussie.

We have seen the NZD supported on disappointing Chinese data of late, as this boosts bets for additional stimulus announcements, which suggests downside risks to NZD from the data are limited.

"The headline read will be critical for confidence in the economy, but the partial indicators for the December month will arguably convey more information about prospects going forward," says Westpac.

Regarding the Pound side of the GBP/NZD equation, it is a very busy week ahead, with wage data, inflation and retail sales all up for release.

For a preview of these data and their implications for the Pound, please see here.