Pound to Krona Rate: SEK Down on "Dovish" Riksbank Move

- Written by: Gary Howes

Image © Adobe Stock

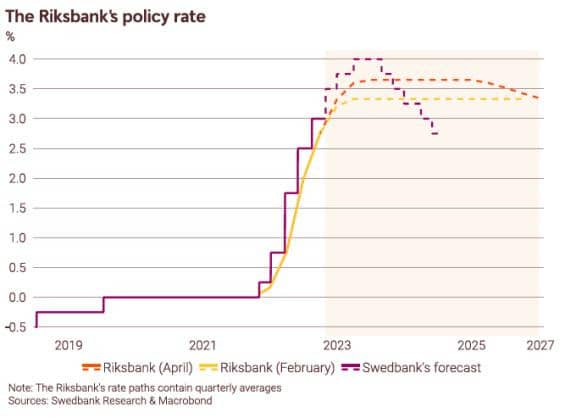

The Krona was weaker after Riksbank, Sweden's central bank, hiked its policy rate by 50bp to 3.50% but gave 'dovish' guidance that implied it was close to ending its rate hiking cycle.

The size of the hike was largely anticipated by the market and the rate path was also revised higher, indicating a peak at 3.65%, up from Riksbank's previous estimate of 3.33%.

However, two policymakers, Breman and Flodén, were in favour of a smaller rate hike of 25bp to keep more optionality.

While the market expected the rate hike, some analysts are interpreting the Riksbank's guidance as more dovish than expected.

Susanne Spector, an analyst at Nordea Bank, said her initial impression was dovish, while Carl Nilsson, an economist at Swedbank AB, noted that "the forward guidance was more dovish than expected."

"The rate path peaks at 3.65%, indicating that the policy rate will only be hiked by a final 25 bps either in June or September," explained Nilsson.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Swedish Krona was weaker following the announcement, with the Pound to Krona up half a per cent at 12.85 and the Euro to Krona up 0.63% at 11.38.

The Riksbank justified its "dovish" guidance by highlighting that it has raised rates rapidly over the past year, and monetary policy is having a tightening effect on the economy. "Furthermore, the rate path indicates that the Riksbank will cut interest rates starting in 2025," added Nilsson.

According to Nilsson, the Krona has been "persistently" weak, and the Riksbank cannot afford to deliver just one more hike. Instead, they will be obliged to try and keep pace with the European Central Bank, which Nilsson expects will raise rates by a further 75 basis points.

This is why Swedbank expects two more 25bp hikes before the cycle is paused.

If this prediction is correct, some upside surprises ahead could ultimately deliver the SEK with some support.

There was a further 'dovish' impulse: "Unlike in February, the central bank steered clear of adjusting its balance sheet, which back at their last meeting provided the basis for SEK inflows as it increased liquidity within Sweden’s bond market," says Simon Harvey, Head of FX Analysis at Monex Europe.

Harvey says Riksbank is still showing an explicit preference for a stronger SEK and today’s response by markets will undoubtedly raise the spectre of FX intervention.

"However, with limited reserves and depreciation pressure from a more hawkish ECB yet to moderate, we continue to think that this is an unlikely outcome in the near term," adds Harvey.