Bank of England to Raise Interest Rates In August say Nomura

Analysts at Nomura Securities - the global financial services giant - say the Bank of England will raise interest rates by 0.25% at their August meeting, increasing the official bank rate to 0.50%.

This goes against consensus estimates in the analyst community who see no change being delivered at the meeting.

If Nomura are correct, the Pound should receive a positive boost as this is an agressive sign of intent that the Bank of England is fast losing patience with elevated inflation in the UK.

Nomura base their forecast on recent strong rises in UK wages which implies 'organic' inflation is on the rise.

The first three months of 2017 confirms wages growth is accelerating - a rise of 1.0% over the first-quarter when extrapolated to the end of the year would add up to a robust 4.0% annual rise in wages.

They see the rise in wages as symptomatic of the fall in unemployment via the Taylor rule which is the economic theory linking labour market tightness to rises in wages and then inflation. So when unemployment falls, wages have to start going up.

The increasingly robust wage growth reflected in the data could very well lead to more Bank of England (BOE) officials voting to raise interest rates at the August meeting, especially after governor Carney softened his hard-line dovish position at Sintra and chief economist Andy Haldane likewise expressed a more hawkish view in an interview not long after the July meeting.

Nomura thus see the August meeting as “live” and capable of causing an upset in markets if the BOE does in fact go ahead and raises interest rates.

Such a move would lead to a strong rise in the Pound as higher interest rates tend to be supportive of currencies by increasing the attraction of the currency jurisdiction to international investors seeking somewhere to park their money and watch it grow.

Pay on the Rise?

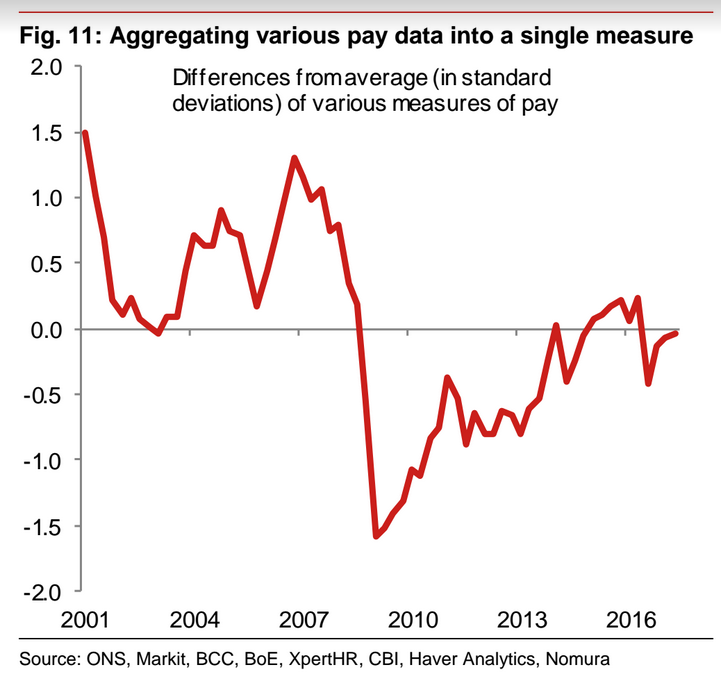

Nomura base their conclusions on some in-depth analysis of the various different gauges of earnings available to policymakers, and conclude that in aggregate they point to a much improved pay diorama in the British Isles.

“We consider the array of earnings data available to us in this article (of which the official average weekly earnings series is just one) and collate them into a single summary indicator of pay growth. This metric has returned to what might be deemed ‘normal’ levels,” they say.

Although Namura acknowledge nominal pay (ex inflation) still has a long way to rise to offset the surge in inflation and impact on real earnings they nevertheless see the return to a more normal level as compelling evidence for the BOE undertaking a rate hike in August.

“While annual pay growth needs to rise further in order to offset in real terms rising inflation, the Bank will be less able to point to weak earnings growth as a reason not to take back some policy accommodation next month. As a result, we retain our view of a 25bp hike from the Bank of England (BoE) in August,” they said.

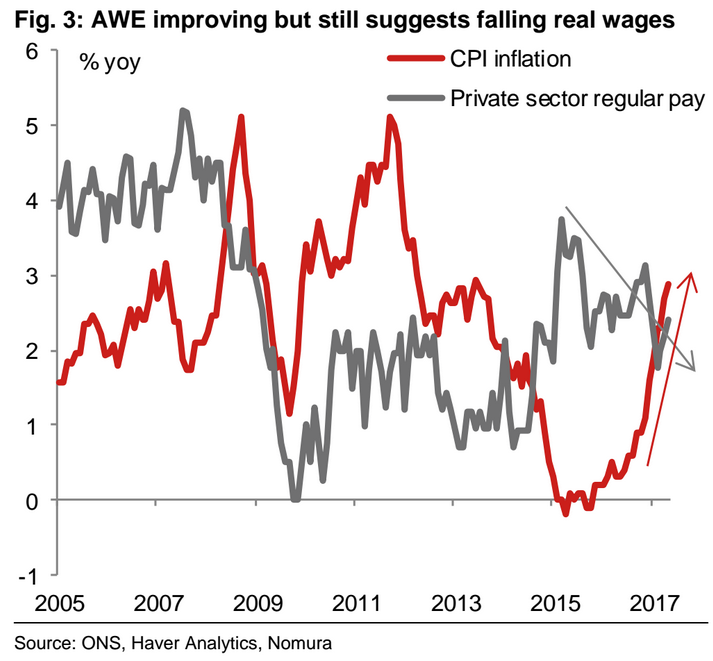

The most common metric used to gauge wages is Average Weekly Earnings published by the Office of National Statistics (ONS).

Nomura says the metric is not as representative of recent trends as other metrics because of the methodology used to calculate it, which is to take total pay in the economy and divide it by total number of employees.

Unfortunately, this can make it slow to show changes in wages at the sharp end of the economy, for example, if wages were rising rapidly at the point of hiring, rather than for employees within existing roles.

Average Weekly Earnings (AWE) also does not distinguish between full and part-time roles and a disproportionate rise in part-time roles, which are arguably paid less, can skew the results lower even if full-time roles are gaining better pay deals.

Regardless of methodology AWE (for private sector) is rising, but not quickly enough to outpace inflation, leading to the familiar conclusion that wages are not rising quickly enough to outstrip inflation so everyone is actually poorer off rather than better off.

Markit’s Report on Jobs (RoJ)

A metric which is more sensitive to recent changes in market conditions according to Namura is Markit’s Report on Jobs (Markit of PMI fame), which shows a very close correlation between rises in pay and lack of availability of staff, reinforcing the view that lower unemployment is pushing up pay.

RoJ is a survey based metric rather than hard data.

Currently the RoJ for pay growth is at 60.1 for permanent employees – a very high level and well into the territory representing growth which is above 50, rather than contraction which is below 50.

Plotted against availability of staff there is a close correlation showing the lack of staff increases pay as it gives jobseekers more bargaining power.

Wages Linked to Productivity

Another metric used to interpret wage growth is the unit cost or wage cost of a specific ‘quantity’ of productivity.

The lower the metric the most productive staff are and the greater the possibility they will receive a pay rise presumably.

These are released quarterly by the ONS and the most recent data shows a rather flat trajectory with growth at 2.1% for four straight quarters and at risk of stalling in Q2 due to base effects from last year’s Q2 showing a disproportionate rise.

Nomura’s conclusions, however, are that wages referenced against productivity remain rather stagnant:

“Indeed, looking at the recent run-rate of ULC growth, taking the last two published quarters together we have seen no growth at all.”

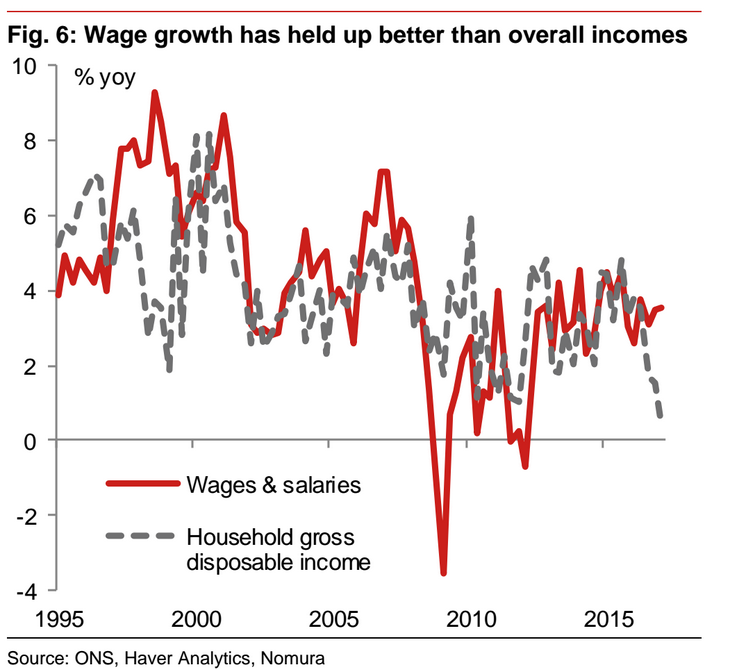

Aggregate Household Income

Not all money which comes to an individual is ‘earned’ as such, some may come from other sources such as investments, savings and rental income; taken together all sources of a household’s income supply another metric used to measure how much money people make called Aggregate Household Income (AHI), or Household Gross Disposable Income.

This measure has actually started falling recently even though it was gaining previously, and despite the wages element gaining.

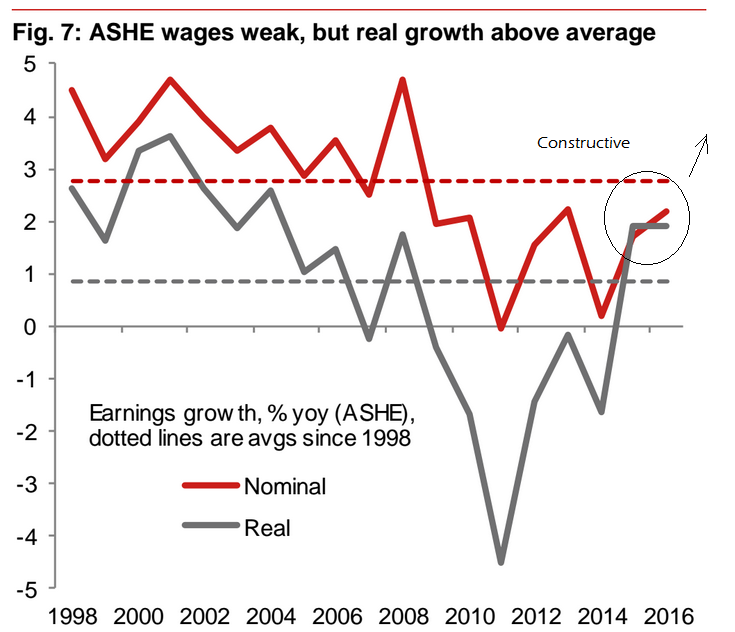

ASHE – The Annual Survey of Hours and Earnings

One of the most comprehensive measures of earnings is the Annual Survey of Hours and Earnings (ASHE) which is calculated using detailed information from the inland revenue, however, the problem is that the data is only processed once a year based on data at the end of the official financial year in April.

The last ASHE, based on data up to April 2016, showed wages rising by 2.2% compared with an average annual rate of income growth running up to the great financial crisis of 3.6%.

The next ASHE will need to show wages rising by 2.7% to offset inflation and show a real rise in wages.

The chart looks quite constructive, however, especially for Nominal ASHE.

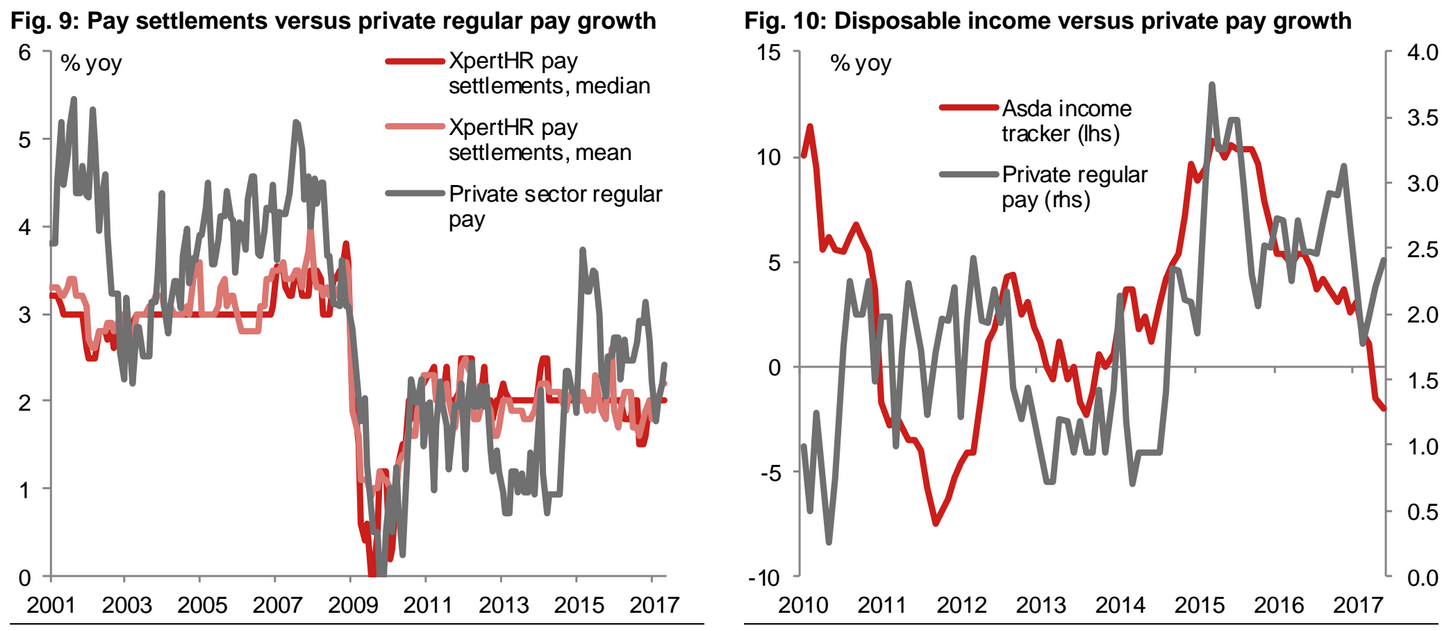

Nomura also discuss other metrics such as average changes in pay settlements supplied by XpertHR however, these have shown little change.

The only other gauge they mention of interest is probably the ASDA Income Tracker which measures disposable income, and has shown a fall in, not surprisingly, due to higher inflation biting into consumer’s buying power, which accounts for its divergence with rising nominal pay.

The Nomura Composite Pay Metric

After combining most of the above metrics into one indicator of pay growth Nomura come up with a chart which shows a steadily recovering wage market, but still, in our opinion slightly vulnerable to weakness.

In their conclusion Nomura admit that whilst wage gains have been strong over the first three months of 2017 it is risky to extrapolate those gains over the whole course of 2017 and generate a handsome annualize pay growth rate of 4.0%.

Nevertheless, their composite points to a ‘normalization’ of pay to a level which makes the current ultra-low interest rate of 0.25% inappropriate.

Nomura’s conclusion is, therefore, that the BOE will probably raise interest rates a quarter of a percent at the August MPC.

Such a policy decision would extremely uplifting for Sterling and show strong gains in all pairs, but especially those where central bank policy is not set to normalize or tighten very rapidly, such as versus the Yen, or possibly the Dollar, but not the Euro.