Pound Extends Rebound After Bank of England Plays Down Odds of a December Rate Cut

- Written by: Gary Howes

Image © Adobe Stock, Pound Sterling Live.

Pound Sterling rose in response to indications that the Bank of England will maintain a cautious approach to cutting interest rates.

The Bank's Monetary Policy Committee voted 8-1 to drop Bank Rate 25 basis points to 4.75%, as per expectations.

The cut was never the big story, as the foreign exchange market wanted to know the Bank's plans for future rate cuts. On Thursday, we received the signal that December 19 would be too soon for a follow-up cut.

"Based on the evolving evidence, a gradual approach to removing policy restraint remains appropriate," said the Bank in a statement.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Caution was the watchword. The Bank judged that last week's budget would boost inflation by 0.50 percentage points relative to previous forecasts and raise GDP growth by 0.75 percentage points.

The heightened upside risks to inflation would preclude any acceleration of the easing cycle, and suggests the MPC will be content to pursue a quarterly pace of cuts.

This can ensure the Pound retains support from the UK's elevated interest rate settings, particularly relative to the Eurozone, where the European Central Bank looks set to cut rates further.

The Pound to Euro exchange rate is 0.10% higher on Thursday, taking in 1.2024. The Pound to Dollar exchange rate is now 0.70% higher on the day after hitting 1.2968.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

To be sure, the FX market remains preoccupied with events elsewhere, with Sterling having shown a sizeable reaction to the U.S. presidential election outcome and news that Germany's government has effectively collapsed.

Given the external uncertainties posed by Donald Trump's new administration and political uncertainty in Europe's largest economy, the Bank will be happy with as mild a reaction as possible.

For Threadneedle Street, now is not the time to rock the boat.

Simon French, an economist at Panmure Gordon, says "gradual" is the key retained word in the Bank of England’s latest monetary policy summary.

"Doesn’t close the door completely to a December rate cut - but would probably need significant disinflationary surprises in the data to pull the next UK rate cut forward from February 2025," he explains.

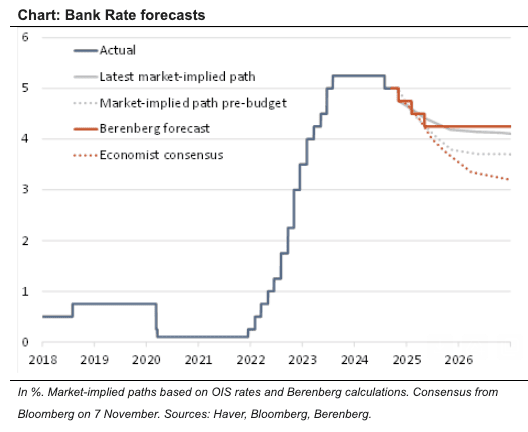

There has been a significant shift in market expectations for the future of UK interest rates over the course of the past month, with investors now thinking they will fall far less than was the case prior to the budget.

A look at money market pricing (the OIS curve) reveals that investors are pricing the Bank Rate some 40 basis points higher this time next year than in August.

The budget was inflationary as Chancellor Rachel Reeves announced the government would spend more than previously planned. On paper, this requires the Bank to be more cautious when cutting interest rates and market expectations have adjusted accordingly.

The Pound's outperformance in 2024 rests on an expectation that UK interest rates will remain at higher levels than elsewhere for longer. A sizeable adjustment had already taken place ahead of Thursday's latest guidance, and because of this, it is hard to see UK monetary policy expectations become more 'hawkish' for the Pound.

Rates will stay higher for longer, but for the Pound, much of the adjustment might have already taken place, which can limit further outperformance potential.

Analysts at ING Bank think that, if anything, there is greater scope for Bank Rate to fall faster than markets are anticipating.

Although the Bank might forgo another cut in December, 2025 could still see an acceleration in pace, says James Smith, Developed Markets Economist at ING Bank.

"Markets are pricing fewer than three rate cuts from here on in. That would leave UK rates more than two percentage points above the European Central Bank in a year or so. We don’t think that sounds particularly realistic."

However, Andrew Wishart, Senior UK Economist at Berenberg Bank, says the Bank is already halfway through the rate cutting cycle.

"We continue to think that, with the labour market at capacity, strengthening demand in 2025 will cause inflation to be more stubborn than the BoE anticipates – see Table again. Against a backdrop of improved growth and above-target inflation, we forecast that the BoE will keep Bank Rate on hold at 4.25% after two more cuts," he says.

He explains that the Bank sees no urgency to cut, given it sees a "less pronounced" slowdown in services sector inflation. At the same time, it is not overly concerned about slowing economic growth, given it thinks demand remains some way above supply for the time being.

"The pound’s rebound should be encouraged by today’s BoE policy update which alongside the US election outcome has increased downside risks for EUR/GBP heading into early next year," says Lee Hardman, an analyst at CIBC Capital Markets.