Pound Slumps after PMIs Signal Drastic Economic Slowdown in May

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling sunk like a stone following the release of PMI data that suggests the UK economy was close to contracting in May and conditions are deteriorating faster than was the case during the pandemic.

The S&P Global flash PMI release for May showed the services sector barely grew with a PMI reading of 51.8, this is down from 58.9 previously and far below the 57 forecast by analysts.

Such a drastic fall from one month to the next is nearly unprecedented: the month-on-month loss of momentum in May was the fourth-largest on record and exceeded anything seen prior to the pandemic.

The manufacturing sector held up a little better however with the Manufacturing PMI reading at 54.6, down from April's 55.8 and below the expected reading of 55.

The Composite PMI Flash for May - which gives a broader snapshot of the economy - came in at 51.8, below the expected 56.5 and the previous month's 58.2.

"The chunky fall in the composite activity PMI for May suggests economic growth has continued to slow to a crawl," says Nicholas Farr, Assistant Economist at Capital Economics.

Above: S&P Global / CIPS Flash UK PMI Composite Output Index. Sources: S&P Global, CIPS, Office for National Statistics.

"No surprise that this nasty PMI mixture this morning is nailing the pound. GBPUSD now back below 1.25," says Simon Harvey, Head of FX Analysis at Monex.

The Pound sunk on the news: the Pound to Euro exchange rate was down 0.80% in the minutes following the release at 1.1666, the Pound to Dollar exchange rate overturned a positive start to the day to go 0.60% lower to 1.2495.

The data and the Pound's reactions underscore why JP Morgan have branded the UK the "poster child" for stagflation when they slashed their Pound forecasts earlier this month.

The data also contrasts unfavourably with figures out of Europe just 15 minutes earlier: PMI data for the Eurozone showed a continued robust growth in May.

"A potential reason is that the UK removed Covid-restrictions earlier, meaning that the rebound is further along already," says Salomon Fiedler, an economist at Berenberg Bank.

Above: GBP/EUR gapped lower on the PMI data release.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

S&P Global reports UK private sector firms signalled a sharp slowdown in business activity growth during May as escalating inflationary pressures and heightened geopolitical uncertainty acted as constraints on customer demand

Indeed, the data indicated the fastest rise in operating expenses since this index began in January 1998.

Furthermore, concerns about squeezed margins and weaker order books resulted in a considerable drop in business expectations for the year ahead.

S&P Global also reported the UK's poor trade dynamics were a drag on activity with manufacturers reporting the steepest drop in export orders since June 2020.

A number of goods producers cited Brexit-related trade frictions as the main factor contributing to lower export sales in May especially in relation to new customs rules, extra documentation requirements and other complexities with EU trade, said S&P Global.

However the data showed a robust rise in employment numbers as firms continue to catch up on unfinished work, reports S&P Global, although the rate of job creation eased slightly since April and was the least marked for 13 months.

The findings should continue to underpin expectations for wages to remain robust going forward.

Inflationary pressures remain a concern as average cost burdens increased rapidly in May, with input price inflation at private sector firms hitting a fresh survey record.

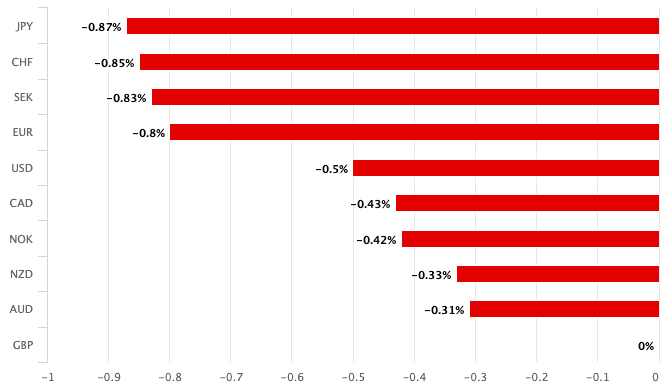

Above: GBP is down against all major peers on May 24.

This was driven by an accelerated rise in cost pressures in the service economy, with this index at its highest level since the survey began in July 1996.

"High commodity prices and a tight domestic labour market are continuing to add to inflationary pressures," says Farr.

"All told, the survey implies that a weaker economy isn’t yet filtering through into an easing in price pressures. That suggests the Bank of England will press ahead with hiking interest rates for the fifth consecutive meeting on 16th June," he adds.

But Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics, says the huge fall in the PMI data "kiboshes markets’ bets on a further substantial increase in Bank Rate".

Tombs says pricing power and growth in labour demand likely will soften materially soon, easing pressure on the Bank of England to raise interest rates further.

Pantheon Macroeconomics expect demand to remain depressed over the coming months and that the Bank of England will be sensitive to current momentum in economic activity.

"We continue to expect the MPC to raise Bank Rate only by a further 25bp this year, with the further hike more likely coming in August than in June," says Tombs.

"Even after the PMIs, markets are pricing in a 60bp rise in Bank Rate by August, implying near certainty that the MPC will hike by 25bp at its next two meetings, and a small chance of a monster 50bp hike. The risk now surely is the MPC bottles it at one of those meetings," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes