Pound Sterling Hammered on 'Dovish' Bank of England Rate Hike

- Written by: Gary Howes

Image © Pound Sterling Live, Still Courtesy of Bloomberg TV.

The British Pound came under notable pressure after the Bank of England raised interest rates but warned the economy was due to slow sharply over coming months and that inflation might even peak at 10% later in the year.

The Bank of England raised interest rates by 25 basis points to 1% on Thursday May 05, as expected.

The Bank's Monetary Policy Committee (MPC) voted by a majority of 6-3 to increase Bank Rate with the three dissenters looking for a more substantial 50 basis point hike.

MPC members Haskell, Saunders and Mann were in favour of the more agressive response to surging inflation, according to the minutes of the policy meeting.

This vote share was therefore on balance 'hawkish' and would have supported the Pound had the remainder of the policy update and associated economic forecasts in the Monetary Policy Report proven so 'dovish'.

The economic forecasts and assumptions presented by the Bank provides a potent mix of negativity regarding the UK economic outlook and investors accordingly sold the British Pound, which fell sharply against all the major currencies.

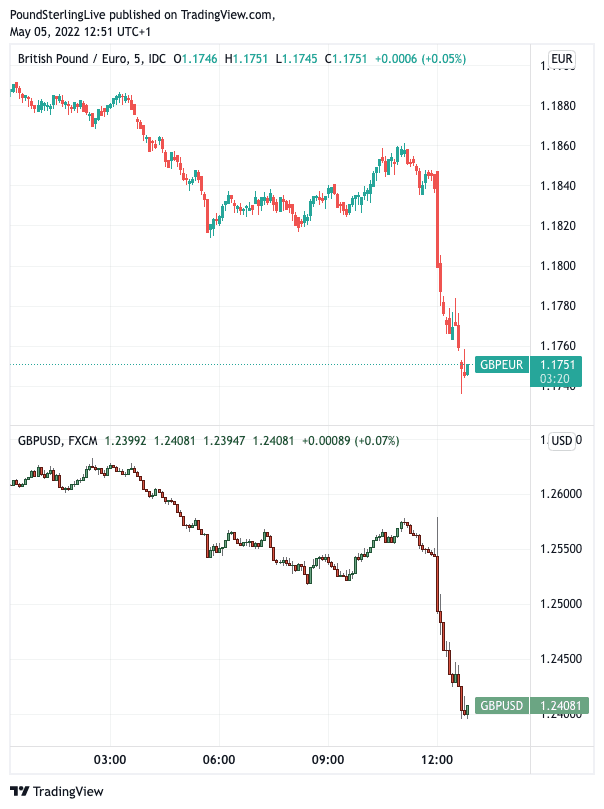

The Pound to Euro exchange rate slumped 1.00% to 1.1750 in the wake of the Bank's update, the Pound to Dollar exchange rate fell 1.75% to trade at 1.2399. (Set your FX rate alert here).

Above: GBP/EUR and GBP/USD at 5 minute intervals showing the impact of the Bank of England policy update.

The Bank also proved more cautious on committing to quantitative tightening - the process whereby it sells bonds purchased under quantitative easing back to the market - something it said it would start once Bank Rate reached 1.0%.

The Bank said it would now only start considering quantitative tightening and this could have contributed to the market's assessment this was a 'dovish' policy event for the Pound.

"We continue to see more downside risks for GBP on the back of an imminent sharp growth slowdown, a record-high real disposable income hit weighing on the UK consumer, and increased political uncertainty that's yet to be priced into the currency, in our view," says David S. Adams at Morgan Stanley.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The projections in the May Monetary Policy Report showed CPI inflation is expected to rise further over the remainder of the year, to just over 9.0% in the second quarter of 2022, and averaging slightly over 10% at its peak in the fourth quarter of the year.

CPI inflation is projected to fall to a little above the 2% target in two years’ time, suggesting a sharp slowdown.

The Bank sees elevated inflation expectations becoming embedded, saying companies now generally expect to increase their selling prices strongly in the near term, following the sharp rises in their costs.

The energy price cap meanwhile means inflation will peak later in the UK (prices will rise again in October), and stay elevated longer relative to other countries.

Forecasts meanwhile shows a central projection for UK GDP growth to slow sharply over the first half of the forecast period.

In fact economic growth will contract in the final quarter of this year as the cost of living crisis bites and calendar year GDP growth is predicted to be broadly flat in 2023.

Although the unemployment rate is likely to fall slightly further in the near term, the Bank now expects it to rise to 5.5% in three years as a result of a falling economic growth rates.

"Growth downgrades and extended and elevated price pressures do not sit comfortably against a backdrop of enduring political uncertainty. Overall there seems little to commend as regards Sterling in the near term," says Jeremy Stretch, a strategist at CIBC Capital Markets.

The language of the report meanwhile suggests further rate hikes are likely, with the Bank noting "the Committee judge that some degree of further tightening in monetary policy may still be appropriate in the coming months".

The UK economic outlook is resolutely gloomy ensuring the outlook for the Pound is pivoted lower.

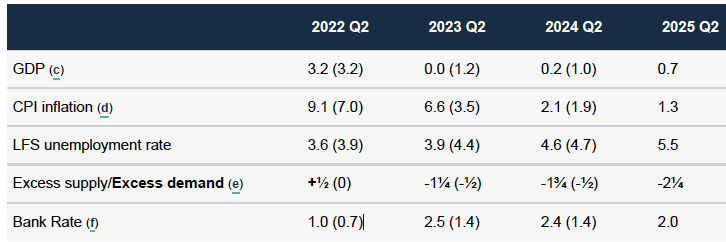

Above: BoE economic projections for May, compared to February's forecasts (in parentheses).

The above economic forecasts are made based on the market's assumption that interest rates at the Bank of England will rise to 2.5% in 2022, before falling back to 2.0% in 2025.

This is important in that the Bank is effectively communicating that based on current assumptions for rate hikes the UK economy will stall and risk falling into recession.

This will inevitably force a rethink by markets which will likely lower expectations for the number of future rate hikes at the Bank.

It is this revision in expectations that is weighing on the Pound.

The market had been expecting a further 25bp hike for each of the rate meetings over the course of the year.

But economists at Commerzbank expect the Bank will start taking breaks between meetings, avoiding a run of consecutive rate hikes.

"If this emerges after today's meeting rate hike expectations on the markets might get corrected slightly to the downside, which would put pressure on Sterling," says You-Na Park-Heger, a FX Strategist at Commerzbank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Most headline grabbing was the BoE's growth forecasts," says Robert Wood, UK Economist at Bank of America.

The Bank cut their full year GDP growth forecast for 2023 by 150bp to -0.25%, if current market expectations for future interest rate rises are met.

It is worth pointing out that the Bank's projections show a far more benign set of outcomes were the Bank rate to stay at the current 1.0%. Under this scenario GDP would continue to grow during all quarters in the forecast timerame:

Above: GDP outcomes if rate hike expectations follow the market's assumptions vs. if Bank Rate were kept steady at 1.0%

But, under a scenario where Bank Rate remains at 1.0% inflation projections are materially higher than under the scneario where Bank Rate follows the market's trajectory higher:

The Bank will therefore continue to raise rates, but at a much reduced pace to ensure it lands in an inbetween land where inflation comes down but while minimising the impact to growth.

Bank of America stick to their call for three more 25bp hikes in addition to May's hike and a cut in 2023.

"We continue to expect the BoE to hike rates 25bp in June, August and November, with risks shifting today in our view to the BoE hiking only twice more," says Wood.

The market will inevitably lower the number of rate hikes they expect on the back of the May Bank of England event, taking the Pound lower alongside.

But the Bank does appear to be ahead of the curve here: the UK is in no worse a position than many other developed countries in terms of inflation and slowing growth prospects.

Therefore it is highly likely that other major central banks start communicating a similar message as the reality of the upcoming growth slowdown emerges. It would be at this point that the Pound can start making a material recovery.

This is however at least a couple of months away.

"Remember the BoE were amongst the first to hike... and they're leading the G10 central bank tightening cycle. Today's BoE narrative = tomorrow's Fed narrative (and the ECB is well behind the curve). This could be an important inflection point for DM bond markets," says Viraj Patel, FX & Global Macro Strategist at Vanda Research.