Bank of England Won't Fight for the Pound: Pantheon Macroeconomics

- Written by: Gary Howes

Image © Adobe Stock

A falling Pound Sterling boosts UK inflation and is therefore a potential concern for the Bank of England as it goes about its business of setting interest rates and trying to stabilise inflation.

The recent fall in the Pound against the Dollar would therefore be of concern to policy makers as it comes at a time of surging inflation, which might have risen by as much as 9.0% year-on-year in April.

But analysts at independent research providers Pantheon Macroeconomics have looked at the data and find the Bank won't shift course in order to support Sterling.

Firstly, they find the majority of Sterling's losses come against the Dollar (down 4.30% in April alone), but the GBP/USD is not necessarily the most important exchange rate to watch.

GBP/EUR is arguably more important given the UK's largest import market is the Eurozone, therefore a stronger Pound against the Euro could help stave off imported inflation.

Indeed, the GBP/EUR has a greater weight in the Pound's Trade Weighted Index (TWI), which measures Sterling's real purchasing power by giving greater weight to the currencies of the UK's most important trading partners.

Therefore, a steadier GBP/EUR helps stabilise the TWI.

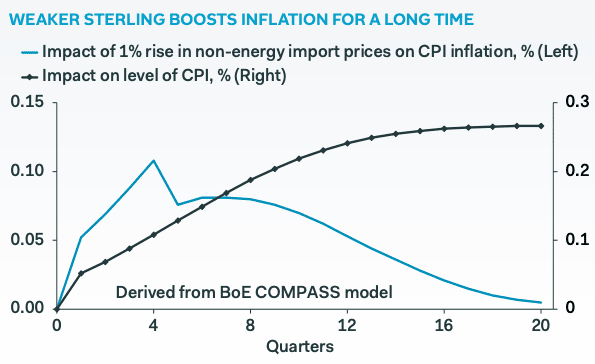

The Bank of England has indicated in the past that it estimates a 10% depreciation of the TWI boosts the headline rate of CPI inflation in two years’ time by 0.75% and 2.75% after four years.

Image courtesy of Pantheon Macroeconomics.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"This implies that the 1.6% decline in the TWI over the last month will boost the headline rate by just 0.12pp in two years' time," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

"That impact is too small for the MPC to dwell on, especially in light of other developments since its last forecast round in February," he adds.

But various options market pricing shows investors continue to bet against the Pound and anticipate further declines, implying the inflationary headwinds caused by a falling Pound will increase and make the Bank of England's job all the more harder.

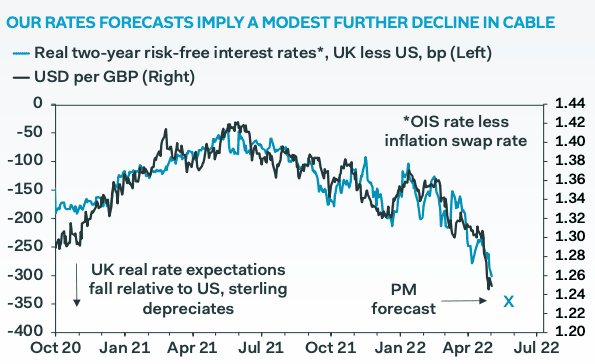

Pantheon Macroeconomics' forecasts however imply only a modest $0.015, or 1.5%, further depreciation of Sterling against the Dollar from here.

Above: Only modest GBP/USD declines are expected from here.

"The MPC surely would be prepared to tolerate that much imported inflation in order to help the struggling economy," says Tombs.

They expect GBP/USD to end 2022 at 1.24 while they see little reason to expect the Pound to fall materially against the Euro.

"We think the MPC still has the flexibility within its mandate to raise Bank Rate at a slower rate than markets currently expect," says Tombs.

Currently markets anticipate about 160 points of rate hikes to come from the UK over the remainder of 2022, with markets fully priced for another 25 basis point hike on May 05.