Pound Sterling Can Gain against Euro, but Not the Dollar says Intesa Sanpaolo in Forecast Update

- Written by: Gary Howes

- European lender upgrades GBP forecasts

- GBP/EUR could go above 1.20 in 6 months

- But GBP/USD capped below 1.40

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1802 | GBP/USD: 1.3830

- Bank transfer rates: 1.1572 | 1.3544

- Specialist transfer rates: 1.1720 | 1.3734

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound has reached its highest levels against the Euro since February 2020 as the UK currency makes progress on reversing its Covid-inspired decline, but sustained gains against the U.S. Dollar remain elusive.

A recovery to the 2020 high at 1.2073 in GBP/EUR is now possible over the coming six months according to new research from one of Europe's largest lenders, although analysts at Intesa Sanpaolo say the UK currency is likely to struggle against the U.S. Dollar and remain capped below $1.40.

"The reaction to the outcome of the BoE meeting was almost imperceptible, but positive," says Asmara Jamaleh, an economist at Intesa Sanpaolo in Turin, in a recent briefing note. "The meeting both officially and de facto confirmed that the policy reversal is nearing."

Intesa Sanpaolo maintain that central bank policy is a key driver of currency valuations in the current market environment, with those central banks hiking rates ahead of peers likely to see their currencies appreciate.

Relative to the European Central Bank (ECB), both the Bank of England (BoE) and Federal Reserve are ahead on this metric.

"We continue to expect a weakening of the pound in the run-up to the Fed’s tapering, but smaller than the euro’s, against which sterling should tend to strengthen as a result," says Jamaleh.

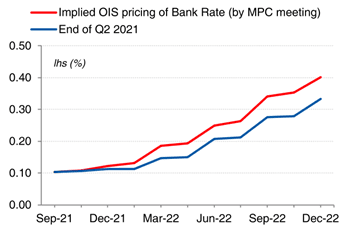

Above: The market's pricing for a BoE rate rise has risen, image courtesy of BMO Capital.

The Federal Reserve looks increasingly set to announce it will start reducing its asset purchase programme (tapering) by year-end, a development that markets see as increasingly likely in the wake of a series of speeches from Fed board members this week.

The tapering of the Fed's asset purchase programme is a prerequisite to an interest rate rise and markets are now viewing a lift-off for rates taking place in late-2022/early-2023, assessing this to be supportive of the Dollar.

This could keep the Pound-to-Dollar exchange rate's upside capped, but the Pound-to-Euro has greater upside potential given the single-currency will possibly be weighed down by the ECB's reluctance to tighten policy measures.

"The BoE will reverse its policy well ahead of the ECB, and this should support the pound against the euro," says Jamaleh.

Current money market pricing suggests the ECB's first rate rise will only fall in 2024, provided no new setbacks befall the Eurozone and global economies.

The Bank of England reformulated guidance on the outlook for interest rates in their August policy update, saying "should the economy evolve broadly in line with the central projections in the August MPR, some modest tightening of monetary policy over the period is likely to be necessary to be consistent with meeting the inflation target sustainably in the medium term".

The market currently expects an interest rate rise at the Bank of England to take place by around the middle of 2022, but the Bank's own forecasts concerning inflation and economic growth must be met to keep the timetable alive.

Therefore, the Pound could be more data-reactive than it has been for some time, particularly now that the political risk premium associated with Brexit that has weighed on the currency since 2016 has largely evaporated.

Intesa Sanpaolo's Jamaleh is eyeing a series of important domestic data releases - starting with this week's economic growth figures - "which if positive will tend to support the pound".

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"The Bank of England improved its assessment of the domestic macroeconomic picture, to the point that some MPC members believe conditions are now in place to initiate the policy reversal, and others, acknowledge that significant progress has been made in that direction, even though these judge that conditions are not met yet fully," says Jamaleh.

Thursday's GDP numbers for the second quarter and the month of June form this week's highlight for Sterling.

The market anticipates UK GDP growth rose by 5.0% quarter-on-quarter, after contracting by 1.6% in the first quarter. The Bank of England said in their August Monetary Policy Report they now forecast growth of 7.25% in 2021, 6% in 2022 and 1.5% in 2023.

This is up from 7.25%, 5.75% and 1.25% respectively in the May Monetary Policy Report.

Beyond GDP numbers, keep an eye on the all-important inflation readings due of August 18.

The Bank's August Monetary Policy Report saw economists revise their forecasts for inflation to 4% in 2021, 2.5% in 2022 and 2% in 2023, from 2.5%, 2%, 2% respectively in the May Monetary Policy Report.

In light of recent developments, Intesa Sanpaolo have revised up their forecasts for the Pound against the Dollar to 1.39, 1.38, 1.38, 1.47 and 1.50 on a 1m, 3m, 6m, 12m and 24m horizon, from 1.37, 1.37, 1.36, 1.44 and 1.48 previously.

Their new point forecasts for EUR/GBP are 0.84, 0.84, 0.83, 0.82 and 0.82 on a 1m, 3m, 6m, 12m and 24m horizon.

This gives a GBP/EUR rate forecast profile of 1.19, 1.19, 1.2050, 1.22 and 1.22.