Pound Sterling Forecasts against Euro and Dollar Slashed at Capital Economics

- Written by: Gary Howes

- GBP forecasts lowered at Capital Economics

- As FTSE 100 no longer set to outperform

- BoE tipped to only raise rates in 2023

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1675 | GBP/USD: 1.3756

- Bank transfer rates: 1.1450 | 1.3470

- Specialist transfer rates: 1.1600 | 1.3660

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

Forecasts for the British Pound at a leading independent economics research house and consultancy have been downgraded, in part due to a giant disconnect between when when the market thinks the Bank of England will raise interest rates and when it will actually do so.

Capital Economics says the downgrades to their forecasts for the Pound also have roots in an expectation that UK stocks won't outperform global peers over coming months, depriving the currency of an additional fundamental source of support.

But in a nod to the Pound's sensitivity to global conditions, Capital Economics says the continuation of the global economic recovery should prove supportive of the currency.

Sterling proved on Monday July 19 it remains highly sensitive to global sentiment after it fell sharply against the Euro and Dollar in response to a significant stock market sell-off.

The Pound recovered through subsequent days as investors found their balance again and bought the dip. Capital Economics agrees with this sentiment and say the spread of the Delta Covid variant does not pose significant downside risks to the global economy.

"The pound may rise a bit further if the global recovery proves to be reasonably resilient," says Paul Dales, Chief UK Economist at Capital Economics.

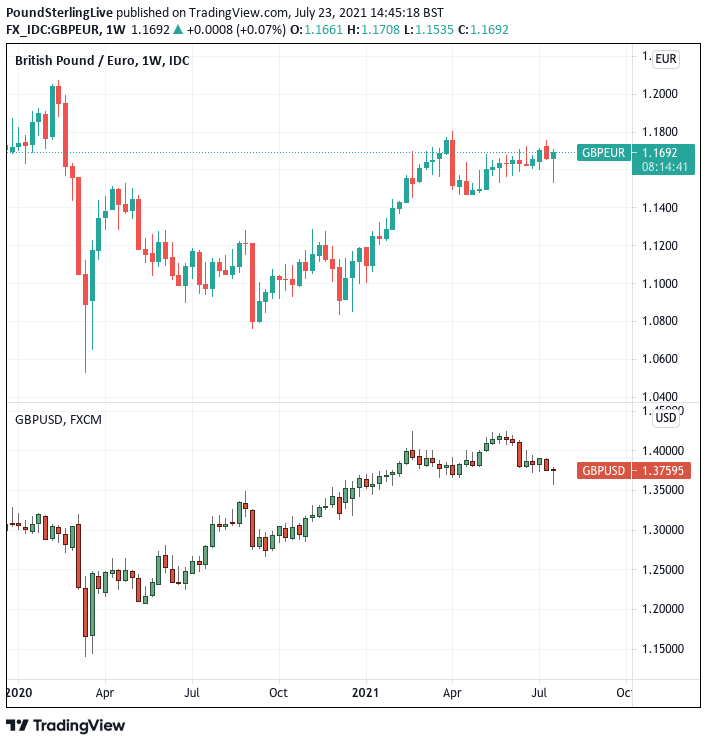

Above: Weekly chart showing GBP/EUR (top) and GBP/USD (bottom) performance since 2020.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

But, Capital Economics says there are signs that the pace of the UK economic recovery may proceed a little more slowly than previously anticipated which suggest the existence of domestic headwinds to Sterling.

The view has been confirmed by a slew of short-term data out over recent days that shows the pace of the recovery is slowing, most recently by the PMI survey for July out on July 23.

The regular monthly survey of UK businesses conducted by IHS Markit shows businesses recorded robust growth in July, although shortages of staff and materials hindered the recovery.

The IHS Markit Manufacturing PMI read at 60.4 in July, down on the 62.7 reading the consensus was expecting and 63.9 reported in June. The Services PMI read at 57.8, disappointing against the 62.0 the market expected and the 62.4 reported in June.

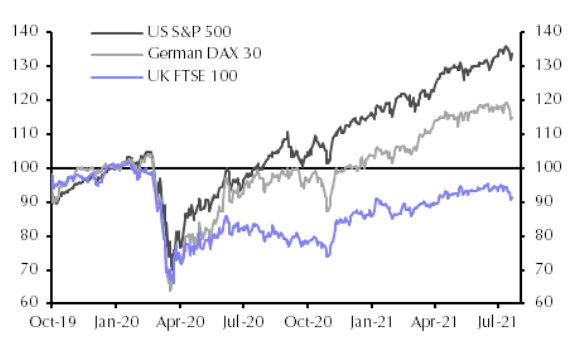

Above: Don't expect the FTSE 100 to close its underperformance gap says Capital Economics.

The Composite PMI - which weights the Services and Manufacturing readings according to each sector's share of the economy - read at 57.7, lower than the market had expected at 61.9 and lower than June's reading of 62.2.

Although the economy is effectively fully open hundreds of thousands of people are now in self isolation having been instructed to do so by the NHS Test and Trace application.

As a result swathes of businesses are facing staff shortages which has impacted supply chains in what is colloquially referred to by the media as the 'pingdemic'.

With the country in the midst of a third wave of infections consumer and business confidence has also understandably taken a hit, and this is now being reflected in the data.

"We no longer expect the pound to significantly strengthen," says Dales. "The rise in worries about the resurgence in COVID-19 cases that has recently hurt risky assets like equities have also hit the pound."

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The shape of the economic recovery will in turn influence decisions made at the Bank of England, particularly the all-important calls on when to end the quantitative easing programme and raise interest rates.

Bank of England policy has come back into focus following a series of speeches from various member's of the Bank's Monetary Policy Committee (MPC), which revealed some are now inclined to end the extraordinary stimulus the Bank is providing.

Such a decision would rest with a view that the current round of high inflation in the country is at risk of becoming entrenched, something the MPC has thus far seen as a low probability risk.

But a number of MPC members including Dave Ramsden and Michael Saunders are shifting their view as they are concerned high inflation might become more sticky and it is therefore necessary to start considering a world where interest rates normalise to higher levels.

For the Pound, such views are supportive via the higher yields they tend to place on government and corporate bonds.

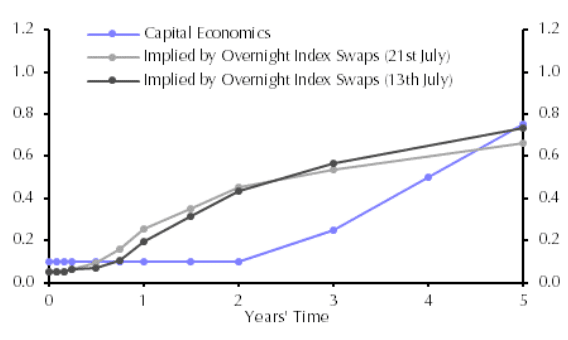

Money market pricing now shows investors to be of the view that an interest rate rise might now materialise towards the middle of 2022.

But for Capital Economics these expectations are wildly misplaced and they have lowered forecasts for UK sovereign gilt yields as a result.

Above: The market is wrong on Bank of England hike expectations says Capital Economics.

"We now think the Bank of England will tighten policy in August 2023 instead of in February 2024. But that’s still later than the mid-2022 priced into the markets," says Dales.

In addition, Capital Economics no longer thinks UK equity markets will significantly outperform equity prices overseas, suggesting limited support for Sterling via this channel.

Capital Economics expect oil prices to trend lower, which will hit the energy-heavy FTSE 100, while a lethargic move to higher interest rates at the Bank of England will ensure financial names will remain unattractive.

As such they no longer forecast the Pound-to-Euro exchange rate ending 2021 at 1.22, while the Pound-to-Dollar exchange rate will no longer make the 1.40 level.

Instead, the targets are lowered to 1.17 and 1.35, levels which apply for the entire 2022 period.