Euro-Dollar: "Path of Least Resistance is Clearly to the Downside"

Image © Adobe Images

The Euro fell 1.47% against the Dollar on Tuesday and is left vulnerable to further losses says analyst Fawad Razaqada of City Index. He writes:

It is not a secret that the Eurozone economy is not doing great, with the outlook also looking bleaker by the day.

The fact that the EUR/USD is trading at its lowest levels since 2022, reflects this miserable macro outlook.

The weakness is driven by rampant inflation, concerns over energy and rising borrowing costs. We have seen consumer, business and investor sentiment all take big hits, with PMIs also falling

Ongoing tensions between Europe and Russia over natural gas supplies means business sentiment in Germany in particular is unlikely to improve any time soon.

This should keep the manufacturing sector under pressure.

At the same time, the European Central Bank’s determination to fight inflation with rising interest rates will continue. This will come at a cost, but they have no other choice.

It is a vicious circle.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The threats of dwindling economic growth and stubborn inflation should keep risk assets undermined.

This is precisely why German investor sentiment is at a new record low. That’s what the latest Sentix survey revealed on Monday.

There was more bad news from Germany.

The Eurozone’s largest economy reported its first monthly trade deficit in three decades.

Surging prices of imports obviously had the biggest impact, with energy, food and parts used by manufacturers rising by more than 30% in May compared to a year ago.

But it also points to weak demand from abroad, which is hardly a surprise given how much the economic outlook has deteriorated in recent months.

Where next for the EUR/USD?

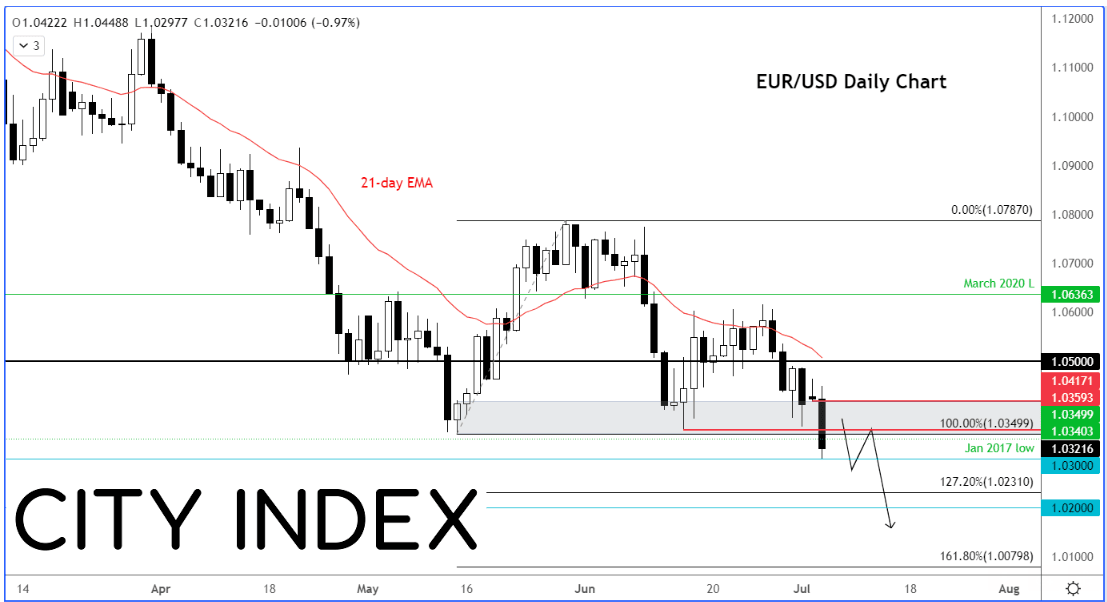

The path of least resistance is clearly to the downside and we could soon be talking about 1.02, then 1.01 and so on.

Something must change fundamentally to turn the tide. Any recoveries we get in the interim will be driven by short-covering mainly. Key resistance is now the base of today’s breakout and former support around 1.0350 area.

Looking ahead, the focus will turn to the US as we go deeper into the first full week of July and third quarter.

In the afternoon, we will see the latest factory orders data, which is expected to show a monthly rise of 0.5%.

The FOMC’s last meeting minutes will be in sharp focus on Wednesday as investors try and figure out exactly how hawkish each member is and how do they see interest rates evolving in the months ahead.

Then, on Friday, the US monthly nonfarm jobs report will put the dollar and gold into focus.

The NFP is becoming less and less relevant for the markets as the focus has turned to inflation and economic growth than employment.

Thus, the only thing that will matter from the jobs report is the wages bit. Workers will be demanding higher pay to keep up with inflation. Watch average earnings for upside surprises.

At the time of writing the Euro to Dollar exchange rate is at 1.0249.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes