Pound to Euro Forecast for the Week Ahead: Post-brexit Glass Ceiling

- Written by: Gary Howes

Image © Adobe Images

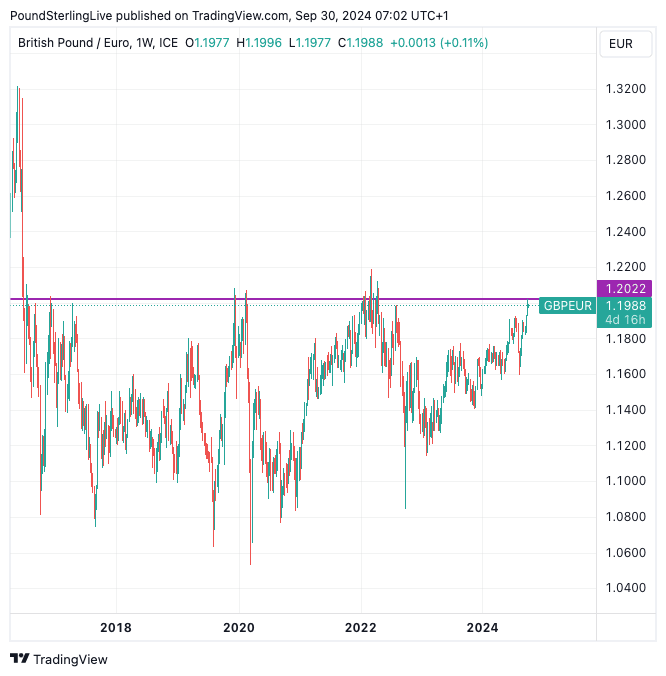

The Pound to Euro exchange rate could register further gains in the coming days amidst ongoing positive momentum. However, significant post-Brexit resistance levels are in play here.

Pound Sterling is already up one per cent in September, registering its second-largest monthly rise since 2024.

1.2022 is the year's peak, reached last Tuesday, and this is interim resistance for the coming week. Downside support is located at 1.1946, where we would expect weakness to fade.

Above 1.2022 are the highs from the first half of 2022, located first at 1.2099, ahead of the post-Brexit high at 1.2188.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

We can't rule out 1.2099 being achieved this week owing to the strong momentum behind Sterling's rally: the Week Ahead Forecast model shows all technical indicators are unambiguously constructive and advocating for further upside.

Momentum is positive, the Relative Strength Index (RSI) is at 65 and is pointing higher.

However, the post-Brexit high peak of 1.2188 would be a multi-week objective that would depend on whether the impetus can be maintained. We think a pullback would evolve before this target is tested.

The bigger picture is important here: the 1.20-1.21 area represents a significant barrier that the Pound has not crossed on a sustained basis since 2016.

Our Week Ahead Forecast series typically uses the daily chart, but we think it is worth using a weekly chart to highlight the historical significance of current levels:

There is a notable risk of a setback from current levels or a protracted period of consolidative trading around here.

If post-Brexit ranges are to be respected then, ultimately, there should be a failure in the rally. A break above here would open the door to a run higher and a potentially higher multi-year range.

For a break to occur, we would require a significant fundamental divergence in the Eurozone/UK economic picture. We are not quite sure that is on the cards amidst a persistent possibility the Bank of England decides at some point to accelerate its interest rate cutting cycle.

The latest Corpay forecast guide, released last week, shows the year-end median and mean forecast target set by over 40 investment banks for the end of 2024 is lower than current levels. The mean and median points are also lower for the first three quarters of 2025 (the guide can be downloaded here). This suggests the Pound to Euro exchange rate could be overvalued on a medium-term basis.

According to the guide, the most bullish forecast for 2025 made by an individual investment bank is set at 1.25.

The Week Ahead Will be Dominated by Central Bank Chatter

Turning to the event risk in the coming days, it is a quiet week in the UK, but the U.S. and Eurozone will be offering up some interesting data.

In the Eurozone, inflation figures for September are due, with Germany releasing its on Monday ahead of the all-Eurozone release on Tuesday, where the expectation is for headline Eurozone CPI to fall below the European Central Bank's 2.0% target, landing at 1.9%.

"The EZ inflation reading for September on Tuesday is of utmost importance for the ECB monetary policy decision on October 17. Should core inflation and service inflation remain high levels, at 2,8% YOY and 4.2% YOY respectively. The ECB may focus on bringing it down although certain European economies, especially the German, are in an urgent need for a more supportive monetary policy," says Ulf Andersson, an economist at DNB.

Last week's French and Spanish inflation figures undershot expectations by a significant margin, raising the odds of another ECB rate cut as early as October.

The market is, therefore, already expecting a weak outcome, which limits any major market reaction (i.e. Pound-Euro upside).

Keep an eye on ECB President Christine Lagarde, who is due to speak later today; markets will want her to address rising odds of an October rate cut in light of the poor state of German data, the decline in Eurozone PMIs in September and the soft incoming inflation figures.

German central bank president Joachim Nagel will potentially also address the issue on Tuesday, as he has a scheduled appearance.

U.S. Data Could Matter More for the Pound

The U.S. will be important for Pound-Euro, as data here impacts global risk sentiment, which is a crucial factor determining how the Pound behaves.

The Pound tends to rise when stock markets are rising, which can continue as long as markets think the Federal Reserve will continue to cut interest rates.

However, any strong data would signal that the pace of cuts will slow, which can cause a setback for the markets.

With this in mind, keep an eye on U.S. PMI survey data on Tuesday and speeches from Fed Open Market Committee (FOMC) members Cook, Collins, Barkin and Bostic. Bowman and Barkin speak on Wednesday.

More U.S. PMI figures are incoming on Thursday (covering the services sector), which will keep markets entertained ahead of the week's highlight, which is Friday's non-farm payroll release.

Here, a headline of 144k is expected. The rule of thumb is that anything slightly below would signal the need for more cuts at the Fed and keep the mood music supportive of global risk and the Pound.

But any big downside miss could backfire as it would suggest maybe the economy is slipping into recession. If the figures give a significant upside suprise, markets will almost certainly fall as investors race to bet the Federal Reserve will slow down the pace of cuts.

This would deal a setback to the Pound.