GBP/EUR Rate Still Destined for Crisis-era Lows again says Morgan Stanley

- Written by: Gary Howes

- GBP/EUR could fall below 1.10 says Morgan Stanley

- Such levels are associated with 'crisis'

- GBP to fall as UK growth deteriorates again

- EUR tipped to benefit from repatriation flows

Image © Adobe Images

Morgan Stanley maintains a bet for the British Pound to weaken significantly against the Euro over the coming weeks and months which could ultimately take the exchange rate back to crisis-era levels.

The bank says the Euro is likely to benefit as Eurozone investors repatriate capital now that Eurozone debt markets are offering better interest rates, the UK economy is meanwhile expected to deteriorate.

"We remain buyers of EUR/GBP, which also acts as a good medium-term trade as the EUR is likely to benefit from longer-term flow of funds back into the region," says Wanting Low, G10 FX Strategist at Morgan Stanley.

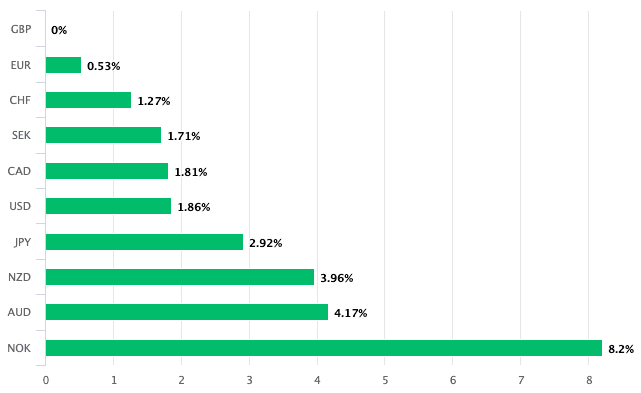

The Pound is the best-performing major currency of 2023 at the time of writing, aided by a succession of economic data releases that have come in at stronger levels than the major institutions were expecting.

The Bank of England last week said it was revising its second-quarter GDP forecasts to flat, from the -0.4% projections made in February. This also means their August 2022 forecast for a multi-quarter recession to start at end-2022 has failed to materialise.

The improvement in the UK's growth prospects means the prospects of a period of protracted stagflation have eased and the Pound to Euro rate rallied to a high of 1.1402 earlier this week.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

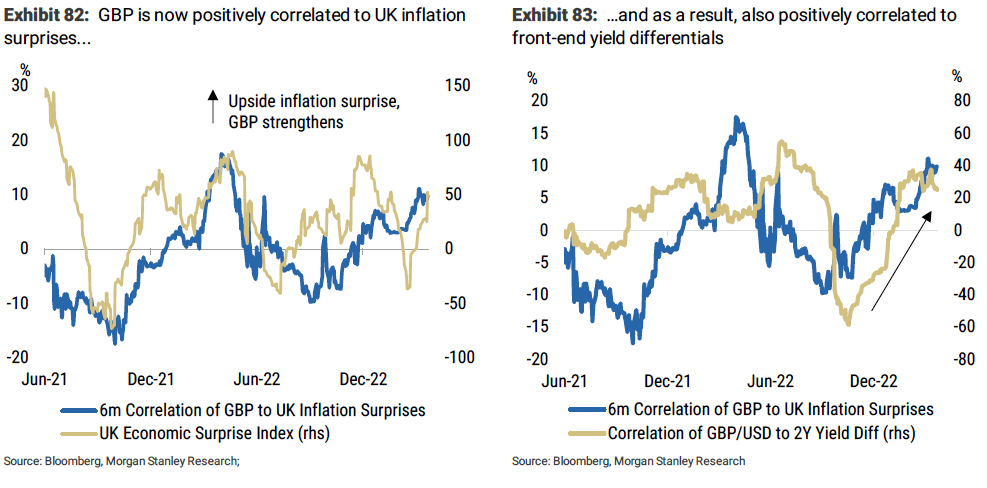

According to Low, the improved economic growth outturns have meant that high inflation readings in the UK have once again become supportive of Pound Sterling.

It wasn't too long ago when high inflation readings were associated with a weaker Pound owing to elevated stagflationary fears.

In short, inflation is good for a currency when the economy is in better health as it implies governments and companies will be better placed to service their debt.

It also implies that 'real' yields are more attractive.

"Stagflationary concerns have been ameliorated as UK data began to surprise to the upside. This has allowed the usual relationship of 'higher inflation, more rate hikes, stronger currency' to return, with GBP turning positively correlated to front-end yield differentials," says Low.

Euro Still Preferred to the Pound

Looking ahead, Morgan Stanley's economists expect the Pound to see another key source of support fall away.

The Bank of England is expected to leave interest rates unchanged in May, which in turn will deny UK bond yields of upside support.

The European Central Bank (ECB) is meanwhile expected to hike up to three more times, offering EUR/GBP upside support.

The UK economy is meanwhile expected to disappoint.

"A further deterioration in growth data, in addition to the weak UK PMIs this week, could bring back the "high inflation, weaker currency" dynamic. This relationship is something we will be watching closely," says Low.

Above: GBP is 2023's top-performing major currency. Image: Pound Sterling Live.

Morgan Stanley's economists looking for another weak monthly private sector pay print to be reported on April 18 amidst signs of weaker hiring and a mild pick-up in the participation rate.

On April 19 the release of inflation data for March is predicted to see a headline print of 9.8% with core at 5.9%; a drop from February.

"Risks skewed to the downside, in our view," says Low.

PMI data for April, due on April 21, will meanwhile reveal weaker hiring intentions and softer prices charged according to Morgan Stanley expectations, with headline readings falling back to around the neutral 50 mark.

How Low can it Go?

Given the above, Morgan Stanley is a buyer of EUR/GBP, targetting an eventual move to 0.93, giving a potential Pound to Euro (GBP/EUR) downside target at 1.0752.

For context, the last time the pair was trading at such a level was on September 26 when Sterling cratered in response to the ill-fated 'mini budget' of Liz Truss and Kwasi Kwarteng.

Prior to this, the exchange rate was regularly quoted around this level in 2020 when the Covid crisis battered financial assets and the Pound.

The level targeted by Morgan Stanley is therefore associated with 'crisis' lows in the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes