Pound Sterling Can Eke Out Gains against Euro, but Advances Could be Slow

- Written by: Gary Howes

- EUR/GBP a sell this week says Crédit Agricole model

- Equals Money notes GBP/EUR to be in an uptrend

- GBP boosted by CBI data on Monday

- But EUR can count on further ECB hawkishness

Image © Adobe Images

The Pound to Euro exchange rate (GBP/EUR) could be poised to edge higher over the coming days but gains are likely to be slow as the market continues to chop around a well-beaten range.

GBP/EUR slumped by over a per cent at one stage on Tuesday and Wednesday last week but has since recovered over half those losses in subsequent days, with the highs at 1.1450 now being considered the near-term objective and ceiling.

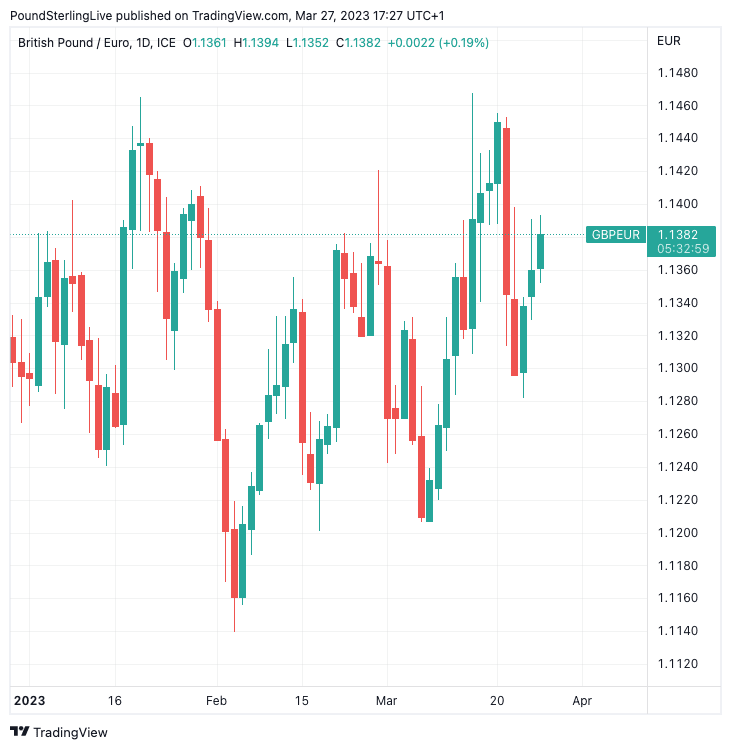

A look at the daily chart below shows the churn around current levels, with 1.1450 being the approximate point the pair failed at last week.

Above: GBP/EUR at daily intervals. (Consider setting a free FX rate alert here to better time your payment requirements.)

But Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, says his bank's tactical trading model favours gains beyond 1.1450 as calculations fair-value has shifted in the Pound's favour of late.

"EUR/GBP’s fair value fell from 0.8706 to 0.8674 on a fall in the Eurozone UK short-term rates differential due to strong UK data and a BOE rate hike," says Marinov, in a weekly briefing.

(EUR/GBP at 0.8706 and 0.8674 equates to a rise in GBP/EUR fair value from 1.1486 to 1.1529).

According to Crédit Agricole's FAST FX model, EUR/GBP has been resilient and is now more than 1.5 standard deviations overvalued. "So the FAST FX model has triggered a short EUR/GBP trade." (To short is to sell).

Marinov eyes a potential move in EUR/GBP to 0.8674, (GBP/EUR to 1.1529, which is the current fair-value level proposed by FAST FX).

The FAST FX model made 0.71% last week and is up 13.24% over the past year with a hit rate of 66%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

GBP/EUR fell to a low of 1.1279 last week as the Euro recovered rapidly amidst news Swiss authorities had brokered the sale of struggling bank Credit Suisse to UBS, easing banking stocks.

The Pound has in fact been one of the better performers during recent banking sector concerns in the U.S. and Europe, therefore it could have some ground to return when these stresses ease.

"The pound stands out as one of the better performing currencies in G10 and EM combined since the outbreak of the banking turmoil almost three weeks ago. The performance can be tied to confidence in the UK banking sector (outperformance of FTSE350 banks vs Euro and US counterparts), the brightening in UK economic prospects and a partial covering of short GBP positions by speculative accounts," says Kenneth Broux, a strategist at Société Générale.

Pound Sterling was higher at the start of the final week of March amidst indications the UK economic rebound can extend over the coming weeks after the CBI reported retail sales in March consolidated near the highest level since October.

"March’s CBI survey suggests that a gradual recovery in retail sales beginning to take hold," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

He says the sales-for-the-time-of-year balance — which has a slightly better relationship with the official data than the main balance (which was at +1) — increased to +12 in March, from +6 in February.

It is therefore now well above its average of -2 in the prior 35 years.

Thanim Islam, an analyst at Equals Money, says the Pound remains within the confines of a gentle uptrend against the Euro and this could extend.

"The higher low from Thursday last week seems to suggest that the GBPEUR pair could well continue the uptrend since the lows experienced in February," says Islam in a weekly currency briefing.

Image courtesy of Equals Money.

However, the December / January / March resistance level - as per the above - still remains a key level to break for GBP/EUR to continue its run higher, he adds.

"GBP/EUR came off resistance levels, dropping over the course of Tuesday and Wednesday last week. However, a new support seems to have formed, adding to the notion that we are seeing a GBP/EUR uptrend," says Islam.

The Pound's rally against the Euro could however be frustrated by ongoing expectations for the European Central Bank (ECB) to potentially raise interest rates more than the Bank of England does over the coming weeks.

On Monday ECB Governing Council member Joachim Nagel said it must be resolute in fighting inflation: "we'll continue to move forward resolutely on the path of monetary normalization until inflation is contained and price stability is restored."

Germany's economy is meanwhile recovering and will likely rebound into growth from spring onwards, according to economists.

"Germany is now on track to return to growth from spring onwards. This is underlined by today's strong ifo survey results. The overall business climate jumped to 93.3 in March from 91.1 in February – exceeding our own (91.5) and Reuters consensus expectations (91.0)," says Salomon Fiedler, an economist at Berenberg Bank.

The Eurozone's economic hub is therefore likely to offer some support to the Euro over the coming weeks.

Recent market action, combined with signs of improvement in both Eurozone and UK economies, therefore suggests the GBP/EUR will continue to move at a slow pace as rallies are met with temporary setbacks.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes