GBP/EUR Rate "May Get a Lift in March" - Analysts

- Written by: Gary Howes

Image © Adobe Images

Improved sentiment saw Pound Sterling recover from its lowest levels since September and end February with a gain against the Euro, and March could see further gains according to some analysts we follow.

The Pound to Euro exchange rate approached the key 1.11 support level in the wake of the February 02 Bank of England decision but was back at 1.14 at the start of March, amidst improved domestic data and an agreement between the EU and UK on the Northern Ireland Protocol.

The deal signals the potential for improved relations between the two sides that could unlock progress in other areas that are of more significance to the wider UK economy.

"As for sterling, everything now depends on DUP support for the Windsor Framework. Some negotiation may be required, but IF support is forthcoming, we might see EUR/GBP get back below 0.86," says Kit Juckes, head of FX research at Société Générale. "Even GBP may get a lift in March".

Such a move in EUR/GBP below 0.86 gives a rise in the Pound to Euro exchange rate (GBP/EUR) above 1.1630.

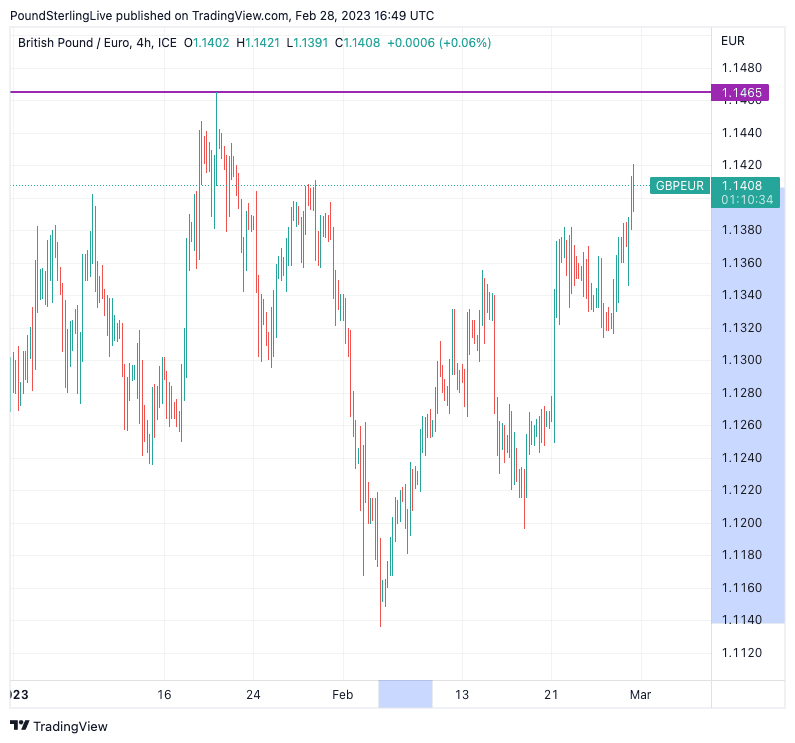

Above: GBP/EUR has recovered some 2.40% since its February 03 lows. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

GBP/EUR advanced 0.70% in February, a gain that comes despite the pair trading at its lowest point since September 2022 at the start of the month.

"The GBP/EUR uptrend off the 6th February lows continues after the pair posted a new higher high from a charts perspective. Renewed optimism of the UK economy seems to be the driving factor for now, as well as some unwinding of the optimism in the eurozone," says Thanim Islam, Head of FX Analysis at Equals Money.

A key event this month is the March 15 Budget, where the Chancellor Jeremy Hunt is expected to announce a better-than-expected fiscal position owing to an ongoing fall in UK wholesale gas prices and strong tax receipts.

A more upbeat tone to Hunt's budget would add to the improved business and household sentiment in the UK that was reported in the February PMI report from S&P Global.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The British Pound jumped against the Euro, Dollar and other currencies after the UK Composite PMI rose to 53 in February, smashing expectations for a reading of 49 and signalling a return to growth for the economy.

This represents a significant step-up in activity on January's 48.5. Importantly, the surveys also suggested an improved sentiment amongst businesses for the coming months.

Sentiment might be further boosted by signs that 'peak divergence' in UK and EU relations has passed following the signing on February 27 of the Windsor Framework, an agreement aimed at smoothing out issues in the Northern Ireland Protocol.

But what's at stake goes beyond just Northern Ireland as disagreement over the protocol has long held back UK and EU relations in broader, more economically important areas, such as financial services, research and development.

Prior to the signing of the deal, the EU had taken the UK to court for non-compliance over the Northern Ireland Protocol, the UK had meanwhile introduced legislation that would allow it to unilaterally override some parts of the protocol.

This raised the prospect for a potential for a tit-for-tat trade war, something that analysts say would have been holding back UK assets over recent months, including the Pound.

"Given the importance of the EU as an export destination, a trade war could have been very damaging for the UK. So eliminating this downside risk is a positive development and – as yesterday's strengthening of sterling demonstrates – should provide some short-term support for risk assets," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

"The direct impact on activity of freer trade between GB and NI will be small, but in effectively killing Johnson's NI protocol bill, yesterday’s agreement is a significant step back from potential trade war between the UK and EU," says Adam Cole, Chief Currency Strategist at RBC Capital Markets. "We are tactically long GBP (against EUR) in this week’s Trade of the Week, against our medium-term negative bias."

George Vessey, FX and Macro Strategist at Convera, says the Pound is likely still carrying a risk premium over lingering fears of an EU-UK trade war.

"But the deal has significantly reduced this risk and supported sterling demand," he says.

At the time of writing GBP/EUR spot has risen back above 1.14, the 2023 high is located at 1.1465. (Consider setting a free FX rate alert here to better time your payment requirements.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes