Pound / Euro Week Ahead Forecast: Buoyant, 1.20 Eyed Multi-week

- Written by: James Skinner

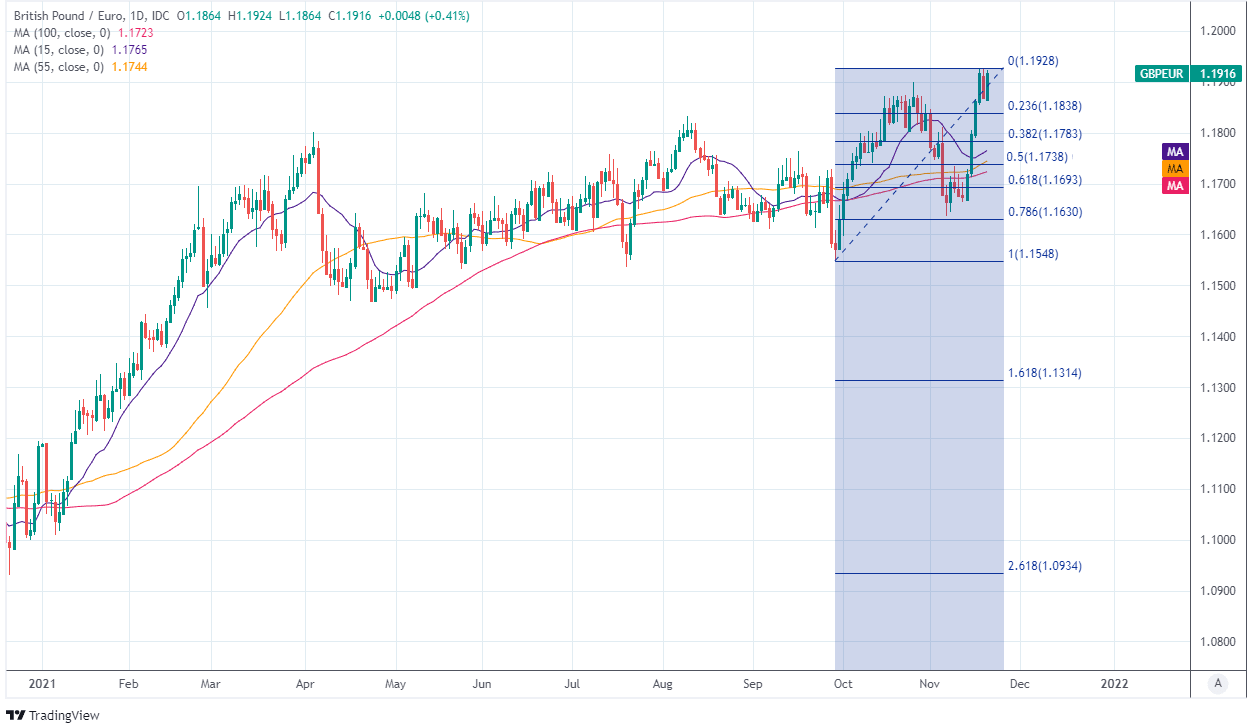

- GBP/EUR supported near 1.1838 & 1.1783

- Meets resistance at 1.1950, scope for 1.20

- EUR’s slide & UK rate outlook underpinning

- Flash PMIs, BoE & ECB speeches in focus

Image © Adobe Images

Pound Sterling has ascended to more than 20-month highs against the Euro but could remain buoyant over the coming days and may even attempt to rise further as relative economic developments reinforce market expectations of a growing gap between Bank of England and European Central Bank monetary policy outlooks.

Pound Sterling enters the new week as the best performing major currency for the latest five day period and has been one of only two major currencies to get the better of an otherwise strong Dollar, while the Euro has been left carrying losses against all but its most risk sensitive counterparts.

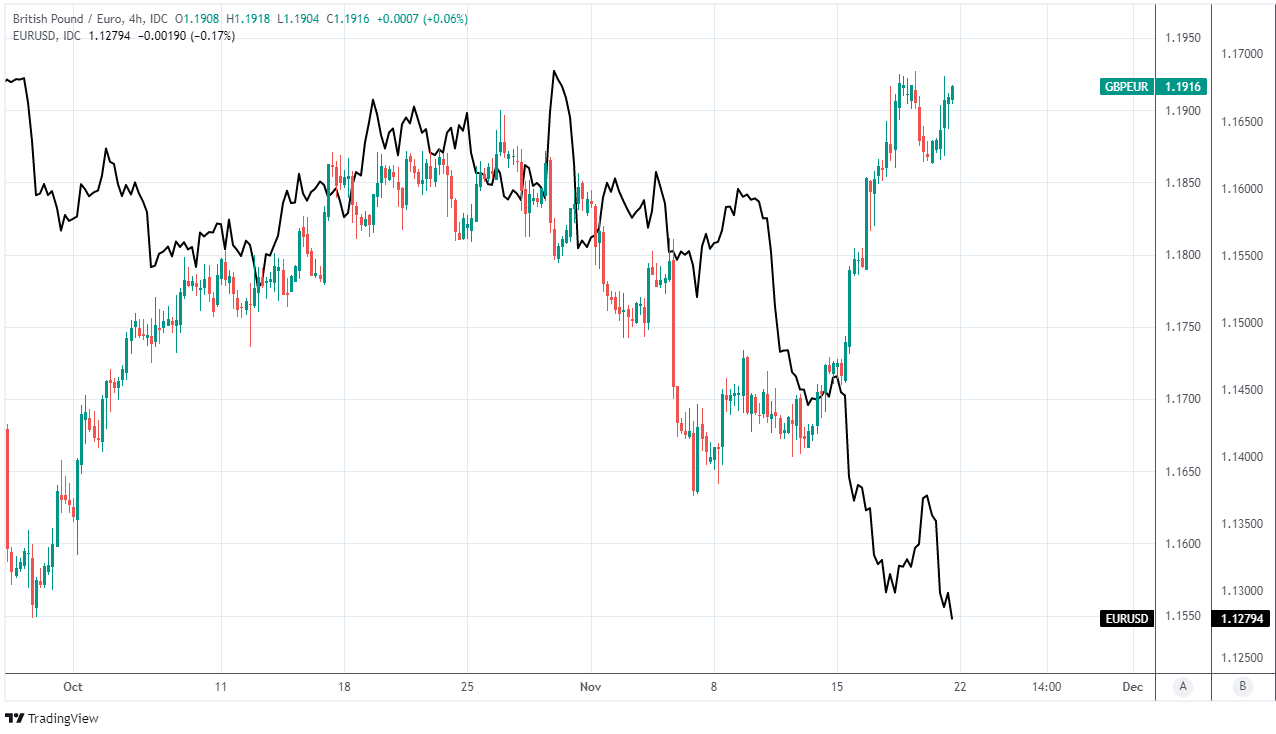

The Pound to Euro rate has risen more than 2% to trade near to 1.19 on Monday, which is close to Sterling’s best since February 2020 and reflects an increase that has been driven mostly by accelerated declines in the Euro.

Euro losses built notably last week after Austria and the Netherlands returned to a form of ‘lockdown,’ dimming the economic outlook for the Eurozone in the short-term and further burdening an already beleaguered single currency.

“Europe-specific factors likely explain the single currency’s weakness against the broader range of crosses. In particular, surging Covid cases have resulted in a new lockdown in Austria and the prospect of activity curbs in other continental economies. For the most part the message from ECB officials has also been steadfastly dovish,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs, in a Friday note.

Euro price action will remain a key influence on the Pound-Euro rate over the coming days when the single currency will be sensitive to any indications that other continental countries could be about to follow in the footsteps of Austria and the Netherlands by opting for new coronavirus related restrictions.

Above: Pound-Euro exchange rate shown at 4-hour intervals alongside EUR/USD.

- GBP/EUR rates at publication:

Spot: 1.1927 - High street bank rates (indicative band): 1.1610-1.1693

- Payment specialist rates (indicative band): 1.1820-1.1867

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Pound-Euro rate has also been aided by an uplift in Sterling following October’s inflation figures, the latest UK employment data and parliamentary testimonies of Bank of England policymakers last Monday, which the market saw as improving the odds of a December interest rate rise.

“An unambiguously strong labour market release has emphasised that December’s MPC meeting is very much live. A repeat of this strength in next month’s release, which will be published two days before the MPC’s decision, could easily be enough to generate a majority for a pre-Christmas rate hike,” says Andrew Goodwin, chief UK economist at Oxford Economics.

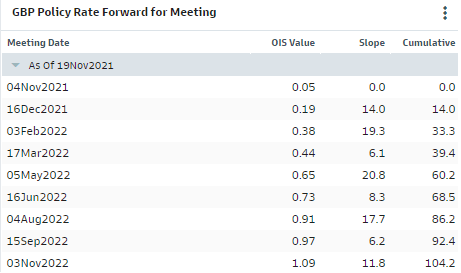

Rates in the overnight-indexed-swap market have moved to suggest there’s as much as a two thirds probability that the BoE could lift Bank Rate to 0.25% in December following last week’s data and ahead of November’s flash PMI surveys of the manufacturing and services sectors from IHS Markit.

The data showed inflation reaching a decade high and the employment figures revealed no sign of upset in the labour market during the weeks after HM Treasury’s furlough scheme ended while the BoE’s policymakers said nothing to discourage the market’s view in various appearances.

Above: Market expectations for BoE’s Bank Rate by month. Source: Goldman Sachs.

Meanwhile, President Christine Lagarde reiterated the European Central Bank’s stance on Friday when arguing that long-term Eurozone inflation pressures are insufficient to merit an interest rate any time until far into the future.

President Lagarde is set to speak publicly at the ECB Legal Conference 2021 on Thursday and Friday in what are the scheduled highlights for the Euro.

“It’s hard for GBP not to outperform EUR. With the BoE actually willing to consider rate hikes and the ECB firmly on hold the UK will continue to attract financial inflows,” says Jordan Rochester, a strategist at Nomura.

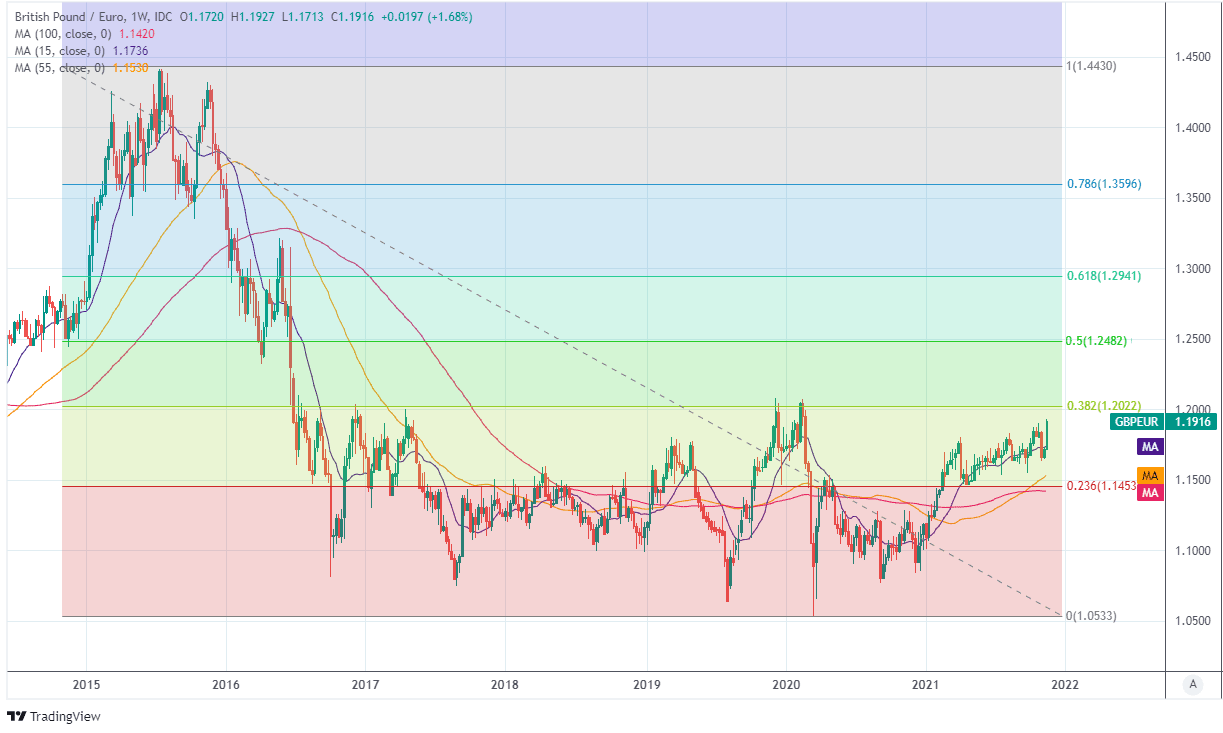

“We have 0.83 [GBP/EUR: 1.2048} as a target in mind for the pair, with key supports around 0.8280 [GBP/EUR: 1.2077]to watch,” Rochester wrote in a research note last week.

Expected divergence between BoE and ECB monetary policies is a big part of why Nomura sees the Pound having scope to trade above 1.20 over the coming weeks and months.

Above: Pound-Euro exchange rate shown at daily intervals with selected moving-averages and Fibonacci retracements of October recovery indicating possible areas of technical support.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Currently the market is bouncing from the base of the 2021 down channel at .8377. This should hold the initial test. Below here attention should revert to the .8239 [GBP/EUR: 1.2137] 2019 low and the 200-month moving-average lies at .8167 [GBP/EUR: 1.2244],” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. “Initial resistance is .8471, the April 2021 low [GBP/EUR support at 1.1804].”

The week ahead offers little by way of major economic figures for either Sterling or the Euro with Tuesday’s IHS Markit PMI surveys the sole highlights.

However, BoE Governor Andrew Bailey and other members of the Monetary Policy Committee are set to address relevant topics in various public engagements throughout the week.

These begin with a Tuesday talk about inflation from Jonathan Haskel at the Adam Smith Business School in Glasgow and culminate in an appearance by chief economist Huw Pill, who’s set to discuss the economic outlook at an online event hosted by the Confederation of British Industry on Friday.

Sterling will in the meantime face technical resistance around 1.1950 and 1.2022 once above Monday’s market and may be likely to find technical support around 1.1804, 1.1840 and 1.1780 in the event of any weakness seen over the coming days.

Above: GBP/EUR shown at weekly intervals with selected moving-averages indicating possible areas of technical support while and Fibonacci retracements of 2015 downtrend highlight possible resistances.