Pound / Euro Week Ahead Forecast: Retreating from Highs

- Written by: Gary Howes

- GBP/EUR might have topped out at 1.19

- Technicals show retreat to below 1.18 possible

- Bank of England policy could shake the market

- Goldman Sachs says Bank will disappoint GBP

Image © Adobe Images

- GBP/EUR reference rates at publication:

Spot: 1.1817 - High street bank rates (indicative band): 1.1504-1.1587

- Payment specialist rates (indicative band): 1.1712-1.1760

- Find out more about specialist rates, here

- Or, set up an exchange rate alert, here

Pound Sterling looks set to consolidate below the previous week's highs against the Euro as traders take money off the table ahead of this week's pivotal Bank of England meeting.

The Pound to Euro exchange rate (GBP/EUR) attained a new 20-month high at 1.19 on Tuesday October 26 but selling pressure at this psychological landmark proved intense and the pair subsequently retreated.

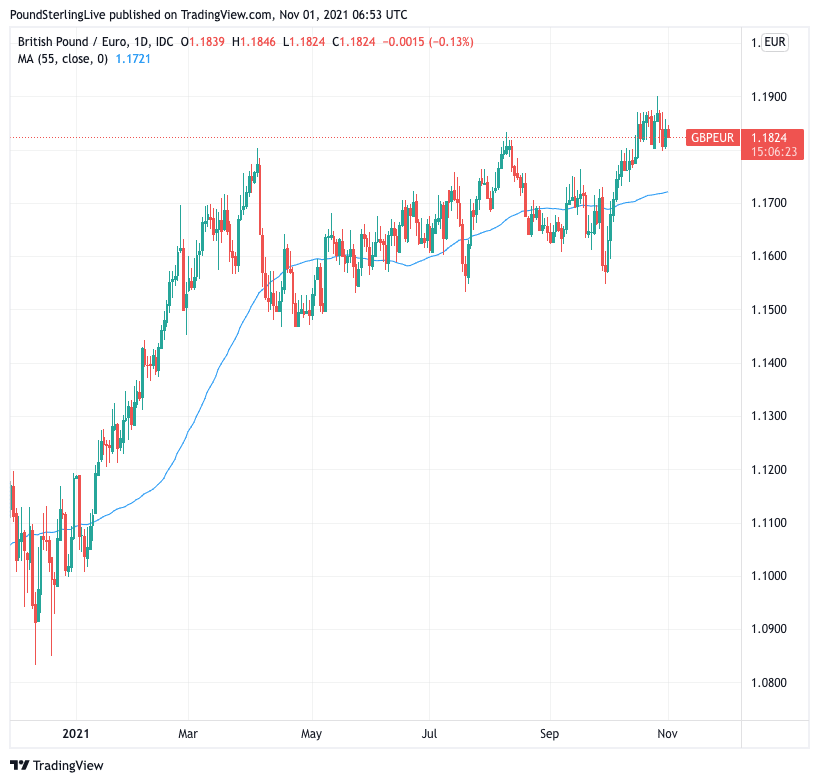

Karen Jones, Head of Technical Research at Commerzbank, says the high was not confirmed by the daily RSI - a technical measure of momentum - and the exchange rate is correcting lower in response.

Indeed, the charts would suggest some consolidation is in order above the 1.18 level.

For their part, Commerzbank identify initial support at 1.1795 and then 1.1765.

Below here lies the 55 day moving average at 1.1725 says Jones, adding that the exchange rate must fall below this key level if it is to alleviate upside pressures.

Above: GBP/EUR daily chart showing the 55 day moving average (blue line).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

A fall below the 55 day moving average could allow for a test of 1.1550 says Jones, levels last seen in May.

But a move above 1.19 would open the door to a test of the 1.2137 high of early 2020, she adds.

Commerzbank's technical analysis team see sideways GBP/EUR action in the short-termm (1-3 week timeline) but see a the long term trend (1-3 months) as favouring the Pound.

Technical considerations will likely remain dominant through the first portion of the coming week and the potential for any substantive moves would likely only come in the wake of the Bank of England policy decision, due Thursday mid-day.

Strategists at Macro Hive said last week they are preparing for the British Pound to potentially breach the long-term range it has held against the Euro as volatility returns to what has been a sleepy market for much of the year.

In a strategy note compiled for CME Group - the giant derivatives provider - Macro Hive says there is a growing chance the Pound to Euro exchange rate pushes above 1.20, however they say a deeper collapse can't be discounted either.

The Bank could raise interest rates by 15 basis points on Thursday, a decision that has been anticipated by investors for much of the past month according to money market pricing.

Faced with surging inflation members of the Bank's Monetary Policy Committee (MPC) have spoken about the need to raise rates in order to ensure inflation expectations amongst businesses and consumers do not start running higher.

The decision to raise rates would therefore be in keeping with the Bank's central role of guarding price stability in the economy.

It is however worth bearing in mind that the odds of a November hike have fallen over the duration of the last week while the odds of a December rise have increased, according to money market pricing:

Above: "A BOE RATE HIKE EITHER IN NOVEMBER OR DECEMBER IS EQUALLY PRICED INTO THE UK OIS CURVE" - UniCredit.

The repricing in favour of a December rate hike over recent days might go some way in explaining why the Pound-Euro exchange rate has lost some upside momentum.

"The probability of a November hike, which jumped to 100% following the hawkish turn by the BoE early this month and tough remarks by BoE Governor Andrey Bailey and other MPC members, has now converged with the probability of a move in December," says Roberto Mialich, a foreign exchange strategist at UniCredit.

Waiting for December will be preferred by some members of the MPC as by then the full official suite of data covering the labour market since the ending of the furlough scheme in September will be available.

This will give a clue to policy makers as to just how robust the labour market is and also suggests the November labour market report could perhaps be the single most important event in the remainder of the year for Sterling.

A better than expected outcome could give the MPC the confidence to move on rates in December, while a softer than expected outcome could provide enough hesitation to push any rate hike in 2022.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

If the Bank forgoes a November rate rise the Pound could fall, but losses might prove shallow if the Bank offers guidance to suggest a December hike is likely - provided the November labour market report is strong.

Such guidance "could reduce the risk of some disappointment regarding the GBP," says Mialich.

But foreign exchange analysts at Goldman Sachs have told clients they are 'bearish' on the Pound's prospects in the near-term as the Bank of England will disappoint.

"The 'rubber meets the road' for the Bank of England, and markets have set a high bar for the MPC to deliver, essentially fully pricing a 15bp hike for this meeting and close to 60bp cumulatively through February," says Zach Pandl, an economist with Goldman Sachs.

The Wall Street bank says it will prove difficult for the Bank of England to significantly over-deliver at this point, and sets up room for disappointment if the MPC guides towards a more "measured" pace.

Such a "measured pace" would be a 15bp hike in November, followed by 25bp in February, which is Goldman Sachs' current expectation.

"This means that the risks are skewed towards GBP downside over the near term," says Pandl.