Prepare for Pound / Euro Exchange Rate Volatility says Macro Hive

- Written by: Gary Howes

Image © Adobe Images

- GBP/EUR reference rates at publication:

Spot: 1.1817 - High street bank rates (indicative band): 1.1504-1.1587

- Payment specialist rates (indicative band): 1.1712-1.1760

- Find out more about specialist rates, here

- Or, set up an exchange rate alert, here

Strategists at Macro Hive are preparing for the British Pound to potentially breach the long-term range it has held against the Euro as volatility returns to what has been a sleepy market for much of the year.

In a strategy note compiled for CME Group - the giant derivatives provider - Macro Hive says there is a growing chance the Pound to Euro exchange rate pushes above 1.20, however they say a deeper collapse can't be discounted either.

Arguing for Sterling upside - which could take the exchange rate above post-Brexit highs - is a Bank of England that looks increasingly eager to raise interest rates, but arguments for a move lower include weakening UK economic growth rates.

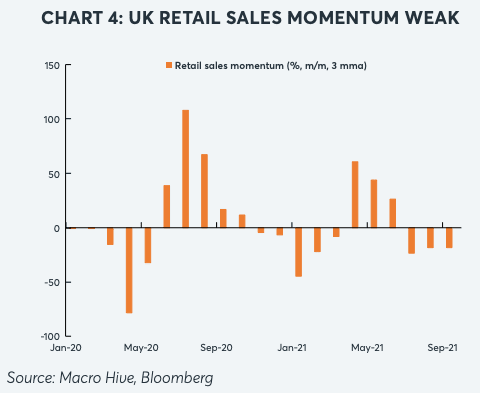

"UK growth momentum is weakening, which could see EUR/GBP turn," say Macro Hive, an independent provider of global macro and financial market research.

Strategists are therefore more confident in their view that a big move is coming than they are in calling the Pound's direction.

They therefore recommend a trade that would look to take advantage of increased volatility in the exchange rate: buying straddles in EUR/GBP.

A straddle is a strategy that aims to profit on elevated volatility by buying underlying options in a given financial product.

Straddles are typically deployed by highly experienced traders; but for most readers of this article the relevant takeaway is that volatility in the Pound to Euro exchange rate might be about to pick up.

A look at the GBP/EUR exchange rate's daily chart will show meaningful volatility has been in short supply for much of the year with the pair settling into a relatively unremarkable sideways orientated range since April.

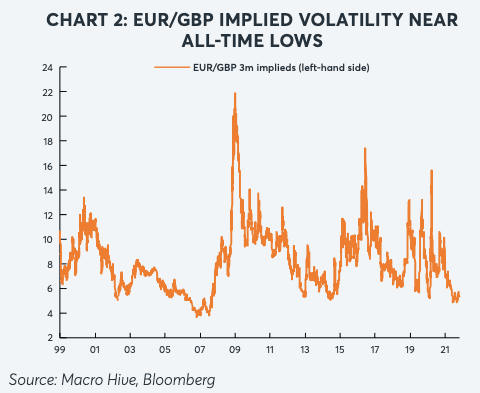

MAcro Hive present this range-bound nature via a EUR/GBP chart, given these are the options they are looking to deploy:

"EUR/GBP implied volatility is trading close to its lowest levels in history. Three-month implieds are currently trading in the eighth percentile. These are attractive levels to be long volatility. We therefore favour buying EUR/GBP straddles," says the strategy note.

But late September and October has seen an increase in excitement in the pair as foreign exchange traders gear up for a Bank of England interest rate hike in either November or December.

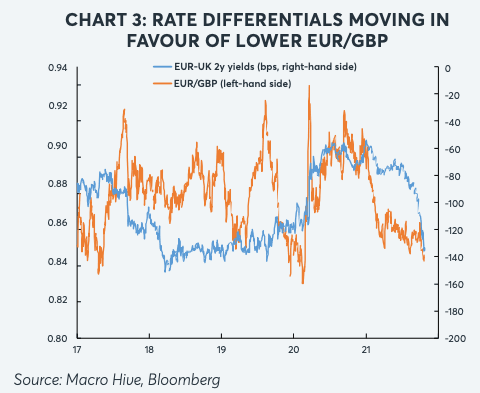

"UK markets have come to life with a dramatic rise in UK yields and an associated rally in the pound (GBP)," says Macro Hive.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Pound-Euro exchange rate has hit a series of fresh 20-month highs in October, with 1.1900 being printed on October 26. (The low in Euro-Pound was at 0.8400).

"Some of the pound strength has come on dollar weakness, but it has also strengthened against the euro. This has resulted in EUR/GBP falling almost to the bottom of its post-Brexit vote range," says Macro Hive.

The add the recent moves opens the possibility of a breach of the range and the Euro falling to new lows against the Pound.

Conversely, strategists note EUR/GBP could respect recent support and stay in the range and rebound, as it has done for the past five years.

"Either way, we could see further large moves in EUR/GBP in either direction in coming months," says Macro Hive.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The straddle trade looks for the Euro-Pound rate to break out of its long standing range: the greater the move out of these bounds the greater the profit the trade books.

But were volatility to remain low and the exchange rate bumbled along near current levels then the trade would come at a cost.

"The worst-case scenario would be if EUR/GBP remained unchanged at expiry, when the premium paid for the straddle would be lost," says Macro Hive.

Rationale for an expectation for increased volatility includes the looming Bank of England decisions in November and December, either of which is anticipated to see a rate rise delivered.

The expectation for higher rates pushes up the yield paid on UK government bonds and other debt-based assets, which makes these assets increasingly desirable to foreign investors.

The inflow of capital creates a steady bid for the Pound.

"However, EUR/GBP was falling even before interest rates moved in favor of the UK. This likely reflects ongoing euro-area weakness, where energy concerns and China growth challenges have hit the region and hence the currency," says CME.

Regardless, the combination of these forces has set up the possibility that EUR/GBP could plumb new post-Brexit vote lows say strategists.

They do however warn that slowing UK growth rates - that come amidst rising inflation, elevated Covid-19 cases and energy price surges - will complicate the pro-Sterling picture.

"This weak growth backdrop could provide the trigger for GBP weakness and hence for EUR/GBP to rebound off its lows and return to the middle or upper half of its five-year range," says Macro Hive.

They say we could therefore easily see EUR/GBP test above 0.88 (the five-year average) or probe below 0.82 as it has done when the low end of the range has been tested in recent years.

This equates to a GBP/EUR test of below 1.1363 or go above 1.22.