Bank of England's Wage and Job Forecasts at Risk as REC Reports Market Slowdown Might be Bottoming

- Written by: Gary Howes

Image © Adobe Images

The UK's labour market remained soft in September according to a key survey, however, there are also emerging signs that a recent soft patch for the sector could be about to come to an end, which could potentially send alarm bells ringing at the Bank of England.

The KPMG and REC, UK Report on Jobs shows demand for staff at UK businesses continues to lose momentum, with total vacancies falling for the first time since February 2021 amid a fresh reduction in permanent vacancies.

It also revealed wage pressures eased further as the rates of starting salary inflation and temp wage growth edged down in September to 30- and 31-month lows, respectively.

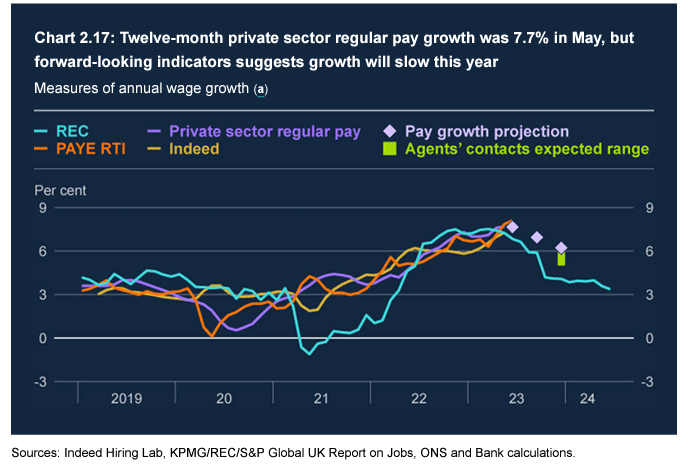

The headlines of the survey will likely be used as evidence by the Bank of England to justify any future decision to keep interest rates on hold. After all, the Bank itself says "the REC measure is an indication of the monthly change in wages for new hires and tends to lead changes in the official measure of annual wage growth."

Above: The Bank of England's projections from the August Monetary Policy Report. The Bank's economists rely heavily on the REC/KPMG jobs survey.

The slowdown in wages is attributed to businesses trying to keep a lid on costs as well as improved labour supply, meaning greater competition for available jobs. Another contributing factor is a reported improvement in the availability of candidates.

The headlines from the REC report apparently validate the Bank of England's decision in October to forgo another rate hike as it said at the time that the official wage data was inconsistent with incoming survey data.

But, the forward-looking elements of the report could spell trouble for the Bank as it appears the deterioration in labour market conditions might be slowing.

The survey finds that although more candidates have become available, the pace of expansion softened further from July's recent high.

The rate of decline in permanent placements was meanwhile the weakest in three months. The survey also found that improved demand for short-term staff helped to drive a modest uptick in temp billings that was the most pronounced since April.

Neil Carberry, REC Chief Executive, says the data suggests the possibility of a turnaround in hiring over the next few months. "This feels like a market that is finding the bottom of a year-long slowdown. And the relative buoyancy of the private sector is likely to be driving this more positive outlook."

"Permanent placements have been falling for a year now from abnormal post-pandemic highs. While permanent hiring activity continues to slow, fewer firms reported a slowdown last month, leading to a much shallower rate of decline than most months recently," he explains.

The Bank of England forecasts a steady increase in the unemployment rate over the coming months to 4.3% by the third quarter of 2024, but this prediction risks being upended if the market is in fact bottoming, as per the REC's assessment.

This points to a risk the Bank is underestimating the resilience of pay growth, which it expects to fall sharply and act as an anchor on domestic inflation.