"Frightening" Inflation and IMF Warnings Unlikely to Sway Bank of England

- Written by: Gary Howes

- UK inflation surges to 5.0%

- Forecast to rise to 6.0% by April

- Small businesses express alarm

- Further inflation rises forecast

- But Bank of England to keep rates at record lows

Image © Adobe Stock

UK inflation came in hotter than investors were expecting, only a day before the Bank of England meets to decide on whether or not to raise interest rates from record-low levels.

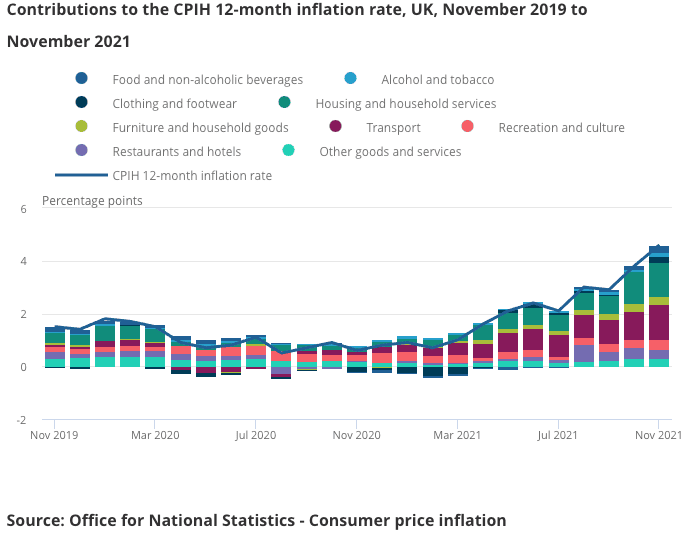

CPI inflation rose from 4.2% to 5.1% year-on-year in November said the ONS on Wednesday, well ahead of the 4.7% the market was positioned for.

The month-on-month reading fell from 1.1% to 0.7% in November, but this was again in excess of the 0.40% the market was looking for.

"Inflation hitting a decade high is another hammer blow for consumers and businesses alike. Runaway inflation coupled with decreasing footfall due to the current Covid situation is seriously restricting the recovery of our local high streets at what should be peak festive trading," said Dr. Jackie Mulligan, a member on the Government's High Streets Task Force and founder of Shoplocalonline.org.

Core CPI - the kind the Bank of England is particularly interested in given its domestic credentials - rose from 3.4% to 4.0%, which was well ahead of the 3.7% consensus was looking for.

The ONS said the upward contributions to the change in inflation between October and November 2021 were broad based.

The Bank of England is tasked with a mandate to target inflation at 2.0%, but policy setters on the Bank's Monetary Policy Committee have opted to maintain interest rate levels at record lows since 2020, saying they feared the jobs market was not robust enough to sustain hikes.

"When will the MPC start to take rising inflation seriously?" asks Andrew Sentance, Senior Adviser at Cambridge Econometrics and former member of the MPC.

He says in addition to CPI inflation rising to 5.1%, factory gate prices are up 9.1% and input costs up 14.3% on a year ago.

"With more inflation in the pipeline, CPI inflation could easily hit 6 percent or above in the coming months! Big wake-up call for MPC," adds Sentance.

The Bank will decide on December 16 whether they should respond to surging inflation, although markets and the majority of institutional analysts anticipate they will sit on ultra low rates until early 2022.

"This frightening level of inflation is creating an impossible dilemma for so many small businesses. Not only do prospective customers have less money in their pockets, but they have to decide whether to up their prices to help cover their own living costs, which risks losing sales. Our small indies are a resilient bunch but they are being tested to the limit right now," says

The IMF issued an extraordinary warning to the Bank just two days ahead of the meeting, saying it would be costly to maintain a policy of inertia.

"It would be important to avoid inaction bias, in view of costs associated with containing second-round impacts [of inflation]," Kristalina Georgieva, IMF managing director, said on Tuesday.

Delivering an annual assessment of the UK economy the IMF said the Bank of England needs to withdraw the exceptional monetary support provided during 2020.

The IMF forecasts UK inflation to rise 5.5% early next year.

The Bank of England "has the tools to address volatility including the discretion to manage the path of inflation back to its targeted level," said Georgieva.

But, the MPC is likely to keep rates low despite a solid jobs market and surging inflation, citing fears that the Omicron variant will hit economic growth.

The Pound was largely flat in response to the inflation numbers, betraying a sense that the market senses the Bank of England is now largely immune to inflation readings.

"Welcome to the winter of discontent. Alongside raging inflation and its impact on households, there is a looming threat of another lockdown to contain the Omicron variant and we now have a scandal in Number 10, just when we needed strong leadership most. Sadly, things look as though they’re set to get worse," said Lewis Shaw, founder of Shaw Financial Services.

Economists are of the view the Bank of England is unlikely to raise rates in light of the emergence of the Omicron variant, an outcome made all the more likely after policymaker Michael Saunders said last week he would probably vote to keep rates unchanged in December.

Saunders is considered a 'hawk' and voted for a hike at the November meeting. He says he now wanted more information about the impact of the new Omicron coronavirus variant before deciding how to vote this month.

"Prices don’t look so transitory right now and seem set to linger for much longer," says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. "Policymakers may be hot and bothered but are likely to stay in wait-and-see mode tomorrow."

Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics says looking ahead, the headline rate looks set to remain near November’s rate over the following four months.

He says the influence of a decline in motor fuel inflation, primarily due to base effects, will be offset by further increases in food and core goods inflation, linked to recent increases in producer prices.

Pantheon Macroeconomics forecast headline inflation to peak at 6.0% in April.

Noting that wholesale prices for electricity and natural gas have surged over the last fortnight Pantheon Macroeconomics calculate Ofgem will increase its default tariff price cap by about 40% in April, assuming that wholesale prices remain at their current levels.

"Underlying services inflation also will pick up in April, if the government sticks to plans to raise the rate of VAT by hospitality and tourism businesses to 20%. Thereafter, however, the headline rate should fall quite sharply," says Tombs.