Pound Sterling: Robust Wage, Jobs Data to Keep UK Currency Supported against Euro, Dollar

- Written by: Gary Howes

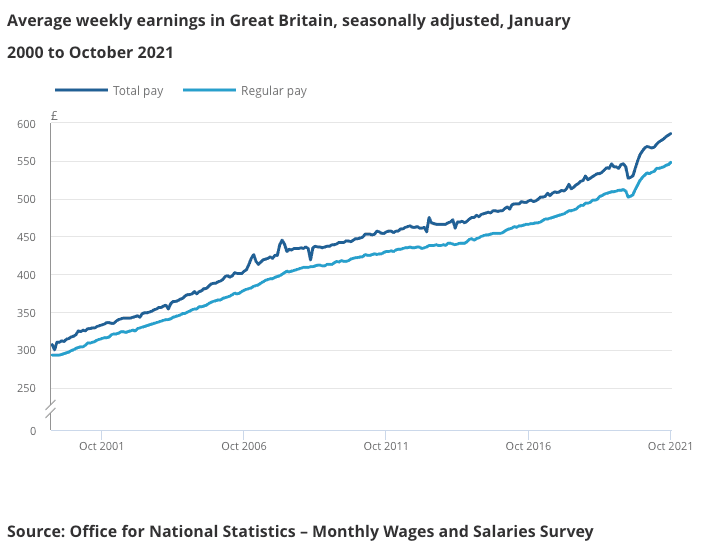

- UK wages increase 4.9% in October

- GBP supported against EUR and USD in wake of data

- Employment rises 149K in three months to October

- Data comes just two days ahead of Bank of England decision

Image © Adobe Stock

UK labour market statistics for the October-November period showed a stronger than expected rise in UK wages, suggesting inflationary pressures in the UK could remain elevated for longer than the Bank of England had anticipated.

And, further confirmation that the ending of the government's job support scheme did not result in a surge in unemployment will give further assurances that the UK economy can support higher interest rates in 2022.

The data does however come amidst fears of another rise in Covid infections, which means the December 16 meeting of the Bank's Monetary Policy Committee could yet result in rates being left unchanged at record-lows.

"Today’s labour market report probably would have been strong enough to convince the MPC to raise Bank Rate at this week’s meeting, if Omicron had not emerged," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Despite Omicron, the outlook remains constructive for the economy and the Pound given the ONS said its Average Earnings Index (+ bonuses) rose by 4.9% in October; this is lower than September's 5.8% but higher than the 4.6% forecast by markets.

The Pound to Euro exchange rate was seen higher on the day at 1.1718 in the wake of the data's release, the Pound to Dollar exchange rate was however less decisive and has hovered around the 1.3210 area.

- Reference rates at publication:

GBP to EUR: 1.1717 \ GBP to USD: 1.3209 - High street bank rates (indicative): 1.1488 \ 1.2939

- Payment specialist rates (indicative: 1.1657 \ 1.3143

- Find out more about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

Employment increases do however appear to be slowing with headline employment rising 149K in the three months to October, which is lower than the 247K growth recorded in the three months to September. The market was looking for gains of 228K.

Slowing employment gains and rising wages could indicate fierce competition for a limited pool of labour, which is inflationary for wages and provides a demand-side inflation driver that the Bank of England cannot ignore indefinitely.

Indeed, the job market looks set to remain robust with the number of job vacancies in September to November 2021 rising to a new record of 1,219,000, an increase of 434,500 from the pre-coronavirus January to March 2020 level.

This is why economists are of the view that should the Bank of England dodge a rate rise on December 16 they will almost certainly have to raise rates in February, an expectation that is supportive of Sterling valuations.

"Labour market conditions are tight, as evidenced by low unemployment, robust wage growth and the still elevated number of vacancies," says Fabrice Montagné, an economist at Barclays.

He adds though that the exact degree of labour market tightness "remains subject to interpretation as various bias and measurement issues still somewhat blur the picture".

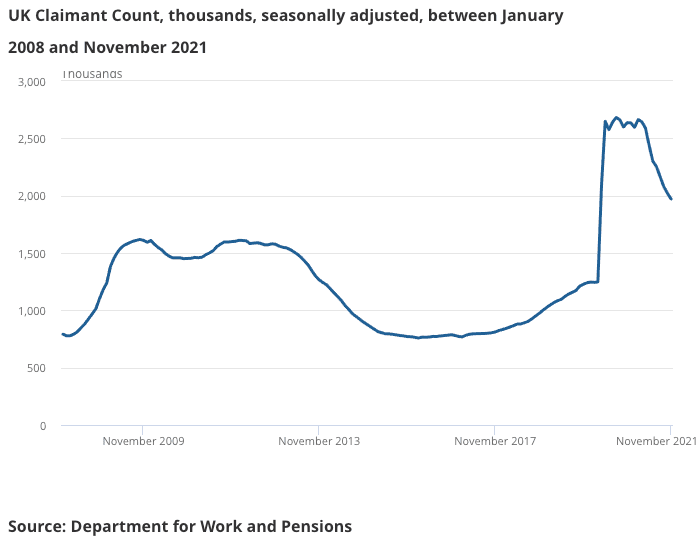

Bank policy setters had said over much of 2021 they would avoid raising interest rates in order to assess the impact the ending of the government's Covid jobs support scheme - known as furlough - would have on the labour market. There were fears that ending the scheme would result in a surge in unemployment.

But those seeking out-of-work benefits fell by 49.8K in November, which is a faster improvement than the -14.9K reported in October.

Above: "The Claimant Count has continued to decrease following the end of the Coronavirus Job Retention Scheme" - ONS.

A surge in job losses following the ending of furlough in September would have been consistent with a rise in the claimant count over the ensuing period.

Meanwhile, early estimates for November 2021 indicate that the number of payrolled employees rose by 4.8% compared with November 2020.

The ONS said there were 257K more people in payrolled employment in November 2021 when compared with October 2021.

But the estimate for October - the first month following the ending of furlough - showed a sharp revision lower from an increase of 160K reported in the previous month's statistics to an increase of 74K.

Nevertheless, "the continued decline in unemployment in the period that included the end of the government’s furlough scheme seems to confirm that most workers still on the scheme at its end have returned to their previous employers," says Rhys Herbert, an economist at Lloyds Bank.

Above: "The number of employees declined between February and November 2020, but is now above the pre-coronavirus level" - ONS.

The UK labour market looked to be in a strong position heading into December and the bad news the Omicron variant of Covid-19 would drive another wave of infections.

The government has acted by imposing fresh measures to contain the variant, but these measures will inevitably hit economic activity and pose headwinds to the recovery in employment.

"With Plan B coming in, the net effect is that demand in some sectors will be suppressed. Those sectors hardest hit must be closely monitored as further targeted support may yet be needed," says Matthew Percival, CBI Director of Employment. "Job creation remained strong this autumn, but continuing difficulty hiring, the emergence of omicron variant and new restrictions will mean a challenging winter for businesses."

Pantheon Macroeconomics says Omicron could hit employment in the consumer services sector, which already has suffered from declining demand.

"So far, the Treasury has not offered any additional assistance to Covid-hit businesses, though that might change if the government imposes restrictions on businesses, such as a return to the 2m+ social distancing rule, later this month." says Tombs.

Pantheon anticipate the unemployment rate to flatline over the coming months, before edging below 4% next summer.

They also estimate the labour market maintains "just enough slack" to prevent wage growth from keeping up with inflation; an observation that suggests wage hikes won't be an outright inflationary concern for the Bank of England.

"Most companies are managing well to control across-the-board pay rises; the median pay settlement remained at 2% in the three months to October, according to XpertHR," says Tombs. "A decline in job-to-job moves, which recently have surged because many job moves were postponed in 2020 due to the pandemic, also will help to contain wage growth next year."

Pantheon Macroeconomics anticipate average weekly wages to rise by about 3.5% next year, trailing the 4.0% average rate of CPI inflation and enabling the MPC to raise Bank Rate more slowly than investors currently expect.