Canadian Dollar Week Ahead Forecast: GBP/CAD, EUR/CAD and USD/CAD Analysis

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar forecast for the week ahead shows better prospects for advance against the U.S. Dollar but vulnerabilities against the Pound and Euro.

Inflation prints from Canada and the UK form the main calendar risks to watch, while Eurozone PMIs provide volatility for EUR/CAD on Thursday.

With no major U.S. releases due, we would expect recent downside trends in the Dollar-Canadian Dollar exchange rate to persist, provided Canada's Tuesday inflation print does not disappoint.

The figure to watch for is 2.8% year-on-year reading for April, which will firm expectations for a June rate cut at the Bank of Canada in June. Should the figure beat expectations then the odds of such a move will diminish, boosting the Canadian Dollar across the board.

"Absent an upside surprise, we think the soft conditions in the economy and labour markets should warrant a 25-bps interest rate cut from the BoC in June," says Nathan Janzen, Assistant Chief Economist at Royal Bank of Canada.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Pound to Canadian Dollar Week Ahead Forecast

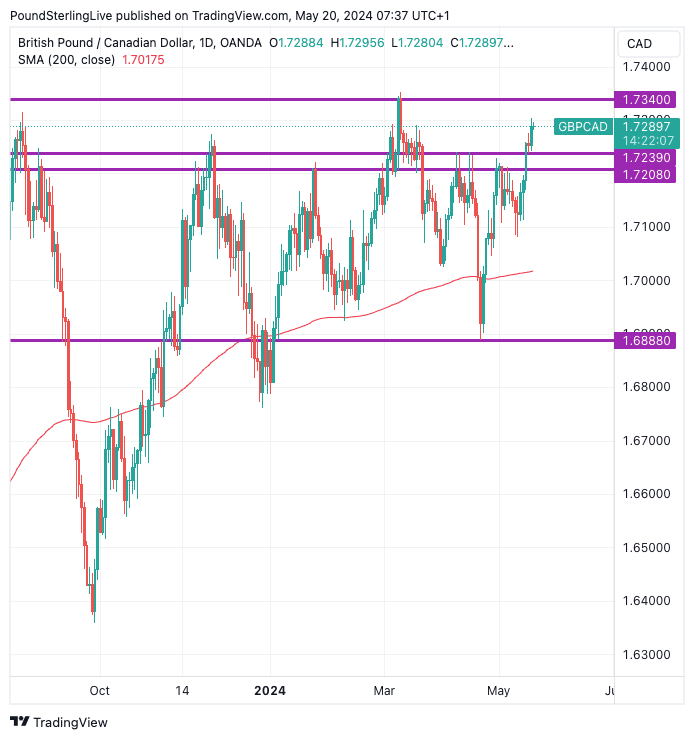

GBP/CAD saw an upward impulse last week that resolved some notable resistance areas and turned momentum more constructive on a near-term basis.

"The potential, inverse Head & Shoulders pattern noted previously remains in place as a potential bull trigger for the cross. Recall that a bullish breakout targets a rally to the low/mid-1.75 zone for the GBP," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Above: GBP/CAD at daily intervals. Track GBP/EUR with your own custom rate alerts. Set Up Here

An important UK inflation print is due on Wednesday, with the outcome likely to determine whether the Bank of England proceeds with an interest rate cut in June.

The market expects CPI inflation to fall to 2.1% year-on-year in April from 3.1% in March, and the core inflation rate to fall to 3.7% from 4.2%. Any deviation from these expectations can influence the currency, with the Pound gaining on upside surprises and falling on any undershoot.

But with the Bank of Canada and Bank of England increasingly likely to cut in the same month, we would expect the overall impact on GBP/CAD of incoming data to be relatively muted. In this regard, a gentle uptrend can persist, interspersed with periods of flat, low momentum periods.

U.S. Dollar to Canadian Dollar Week Ahead Forecast

According to Osborne, USD/CAD trading remains confined to the downward-sloping channel... "shorter-term trading patterns also lean USD-bearish".

"All in all, price action appears to be gearing up for a test of 1.3610/15 (where high/low support converges with potential trend support off the late December low)," he adds.

Should the exchange rate break below this important pivot, the Scotiabank analyst says to expect USD losses back to the mid/upper 1.35s (channel base, retracement support) pretty quickly.

He says such a move would put a drop to 1.3500/10 (50% retracement of the 2024 move up at 1.3512) firmly on the radar.

Euro to Canadian Dollar Week Ahead Forecast

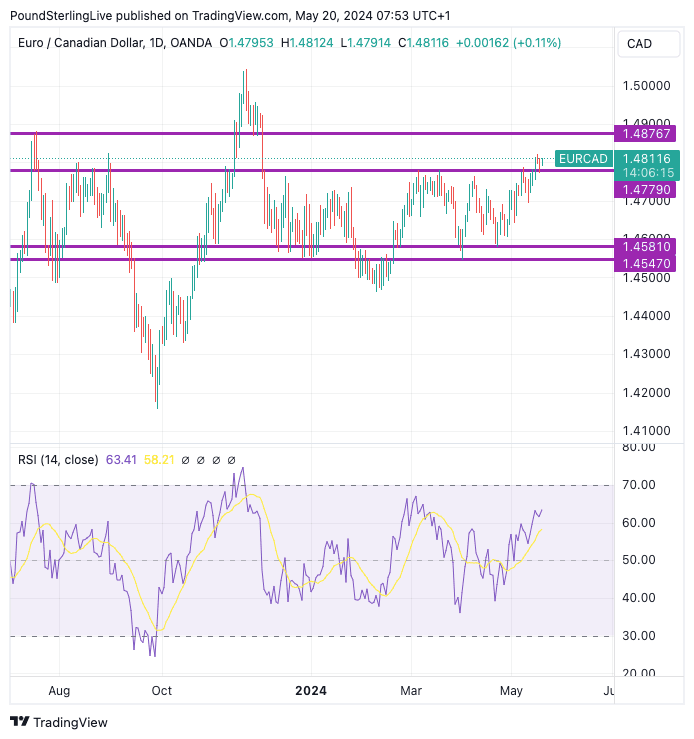

Like GBP/CAD, EUR/CAD saw a pickup in upside momentum last week, which also creates a more bullish near-term setup.

The break above the recent trading range in the upper 1.47 now opens the door to further advances, with momentum signals firming.

Momentum is firming as we note the RSI is pointed higher and the exchange rate resides above its key moving averages.

We note firm resistance at 1.4876, which forms the July 2023 peak and the late 2024 support area and we expect a test of this level in the coming days and 1-2 weeks.

The main event for the Euro this week is Thursday's preliminary PMI numbers for May, which should confirm the recovery continues. Markets look for Germany's composite PMI to print at 43.5, any improvement on this could underpin the Euro. The main number to watch with regard to the pan-Eurozone release is the composite PMI, which is expected to read at 52, up from 51.7 in April.