GBP/CAD 5-Day Forecast: Correction Required

- Written by: Gary Howes

- GBPCAD selloff has been severe

- But charts screaming of oversold conditions

- Near-term consolidation likely

- But the trend advocates for further weakness

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate (GBPCAD) has entered a downtrend that can be expected to advance over the coming weeks, but the next five days could see some consolidation as the daily chart is screaming of oversold conditions.

Pound Sterling's recent selloff has left it oversold against a number of major currencies, including AUD and NZD, but it is against the Canadian Dollar where the selloff is looking particularly overbaked.

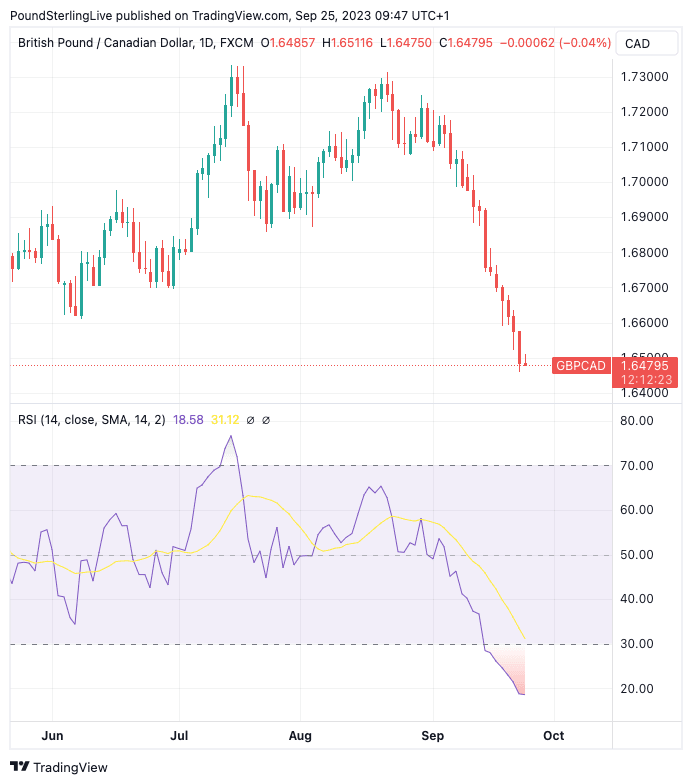

The below daily chart shows the GBPCAD rate with the RSI in the lower panel. Typically, when an RSI goes below 30 the asset in question is considered to be oversold and technical watchers are put on alert for a rebound or consolidation.

Above: GBPCAD at daily intervals with RSI in the lower panel.

An RSI of 18.57 is particularly rare in its severity and can be explained by the eleven successive losses in GBPCAD, a run that has not been seen since 1991.

Last week we noted GBPCAD had slipped below its 200-day moving average which we consider to be a technical sign that the uptrend of 2023 has been relinquished and the advantage had therefore fallen into the Canadian Dollar's camp.

The exchange rate is therefore likely to extend lower over the coming weeks, even if a countertrend rebalancing in favour of Sterling is increasingly likely near-term.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

At the heart of the GBPCAD's recent selloff is the shift in relative monetary policy expectations: the Bank of England has abandoned its interest rate hiking cycle and allowed the market to raise bets on the prospect of rate cuts in 2024.

On the other hand, markets are reckoning the Bank of Canada might have to hike rates again in the face of elevated inflation levels, creating a bond yield divergence that favours CAD over GBP.

The Canadian Dollar leapt higher last week on a surprisingly strong set of inflation figures that put the market on watch for another Bank of Canada rate hike, and perhaps more significantly, a global inflationary rebound.

Markets are already anticipating an uptick in global inflationary pressures due to rising oil prices, but Canada's reading suggests the matter might be more acute than previously anticipated. "First time in my nearly 40 years in the business that I’ve seen the Treasury market respond to a Canadian CPI report," observes David Rosenberg, President of Rosenberg Research & Associates Inc.

The Canadian Dollar is meanwhile also benefiting from the rebound in the U.S. Dollar, a reminder of the close linkages between the U.S. and Canadian economies; as long as the USD is on the front foot, so too will be the Loonie.

Turning to this week's domestic calendar, all eyes will be on wholesale sales due for release Tuesday. To be sure, this is second-tier data which means the impact on CAD would likely be limited, but it will nevertheless offer an insight into how broader consumer demand in the economy is holding out.

Should it reveal strong demand, markets will feel justified in raising the odds of another CAD-supportive interest rate hike at the Bank of Canada. (Previously, manufacturing sales read at 1.6% month-on-month and wholesale sales at 0.2% m/m).

Average weekly earnings are due Wednesday and markets will be looking for an improvement on the previous reading of 3.6. Earnings are important in that they signal the strength of wage pressures that are considered inflationary by the BoC. Again, this is second-tier data and any impact on CAD will likely be limited.

The big release in Canada is Friday's GDP for July, where a reading of 0.1% m/m is anticipated.

"Monthly Canada GDP figures for July will be crucial in tipping the balance for Bank of Canada pricing," says Simon Harvey, an analyst at Monex.

The relevance of the GDP release is heightened as Harvey reckons "the October decision is now live" owing to the strong inflation print.

The previous month's release of GDP for the second quarter revealed a contraction of 0.2% on an annualised basis, which prompted markets to slash bets for further BoC interest rate hikes, a development that has been overturned by the inflation numbers.

"Given the impact that growth conditions had on the outcome of the previous meeting, as well as officials’ declaration in the latest Summary of Deliberations that the supply-demand balance would become increasingly important for inflation conditions moving forward, this week’s GDP growth will likely cause a significant shift in interest rate expectations and the Canadian dollar," says Harvey.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes