Canadian Dollar Tests Fresh Highs in Wake of Bank of Canada Pushback against Rate Cut Expectations

- Written by: Gary Howes

Image © Bank of Canada, Reproduced Under CC Licensing

The Bank of Canada maintained interest rates at 4.5% for the second month running in April and indicated it was premature to expect rate cuts later in 2023.

For currency markets, the focus was always likely to fall on the issue of rate cuts given another decision to hold rates steady was widely anticipated.

"The implied expectation in the market that we're going to cut later in the year doesn't look like the most likely scenario to us," said BoC Governor Tiff Macklem in a post-decision appearance before journalists.

The Canadian Dollar was under pressure ahead of the BoC decision, as it tracked the U.S. Dollar lower in the wake of softer-than-expected U.S. inflation data, but it found support on Macklem's attempt to push back on expectations for rate cuts.

Indeed, the BoC guided that it was prepared to hike interest rates again owing to concerns that inflation in the services sector posed upside risks to its inflation forecasts.

The Canadian Dollar has risen by nearly half a per cent against the U.S. Dollar in the wake of what is deemed to be a 'hawkish' hold by the central bank with USD/CAD at 1.34 at the time of this article's update on April 13.

This is the strongest Canadian Dollar has been against its southern neighbour since February 16.

The Pound to Canadian Dollar exchange rate (GBP/CAD) is however proving more resilient, in keeping with the Pound's status as 2023's top-performing major currency. The pair is quoted at 1.3772 at the time of writing; to be sure, the BoC decision does appear to have capped the pair's advance for now.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The Canadian Dollar has underperformed most other G10 peers in 2023 as markets have raised expectations for the Bank of Canada to cut interest rates from the second half of 2023.

But the BoC looks eager to cool such expectations saying demand in the economy continued to exceed supply, thanks in part to a strong jobs market, which could potentially warrant more restrictive rates.

Canadian Dollar downside would be limited from here if the market's rate cut expectations are put on ice.

"Overall, still on hold, but not in synch with market expectations for outright rate cuts this year, since the Bank isn’t calling for a recession," says Avery Shenfeld, an economist at CIBC Capital Markets.

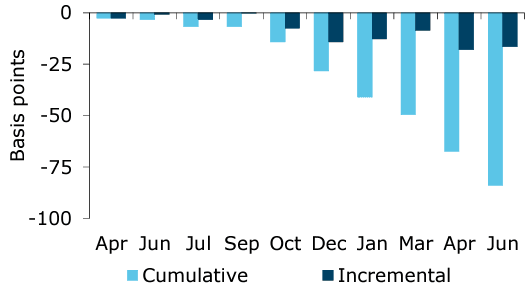

Above: Money market expectations for the trajectory of BoC rates. Image courtesy of ANZ.

But one major Canadian bank says the Bank of Canada is on track to cut rates by year-end, despite any protestations from Macklem.

"A lot has happened since the January MPR. But most importantly, inflation has come down faster than the Bank had previously anticipated and financial conditions have tightened on the back of banking sector turbulence outside of our borders," says Randall Bartlett, Senior Director of Canadian Economics at Desjardins Bank.

He says these factors look to have outweighed the sustained strength in the Canadian economy and labour market, "and should work to ensure the Bank’s next move is a rate cut as early as the end of the year".

The Canadian Dollar could resume its downward trend if Bartlett is correct and the market ultimately calls the BoC's bluff by adding to expectations for a rate cut later in the year.