Canadian Dollar Forecast: Bank of Canada to Offer Some Support Says BofA

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar can strengthen in the short- and medium-term say foreign exchange analysts at Bank of America as they eye a 'hawkish' hold by the Bank of Canada midweek.

The Bank of Canada (BoC) is tipped to maintain its policy rate at 4.5% on April 12 (15:00 BST) as still-high inflation continues to edge lower.

But analysis from Bank of America finds the Canadian economy remains too robust, particularly the labour market, to warrant a rate cut later in the year, which could prompt the market to readjust its bearish perceptions of the CAD's outlook.

The decision by the Bank of Canada to pause its interest rate hiking cycle on March 08 resulted in a fall in the Canadian Dollar as analysts described the guidance issued alongside the decision as 'dovish'.

Specifically, the guidance gave little clues to suggest the BoC might restart its hiking cycle over the coming weeks; indeed, markets were emboldened to increase expectations for rate cuts to commence later in the year.

But Bank of America says Wednesday's policy event will be interpreted as a 'hawkish hold', therefore it could offer some Canadian Dollar upside.

"Inflation is falling but upside pressures abound, hence the message will be hawkish," says Carlos Capistran, Canada and Mexico Economist at Bank of America.

Such an outcome would be supportive of the Canadian Dollar near-term says Bank of America's currency strategists, which if correct would offer the Canadian currency some rare support.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

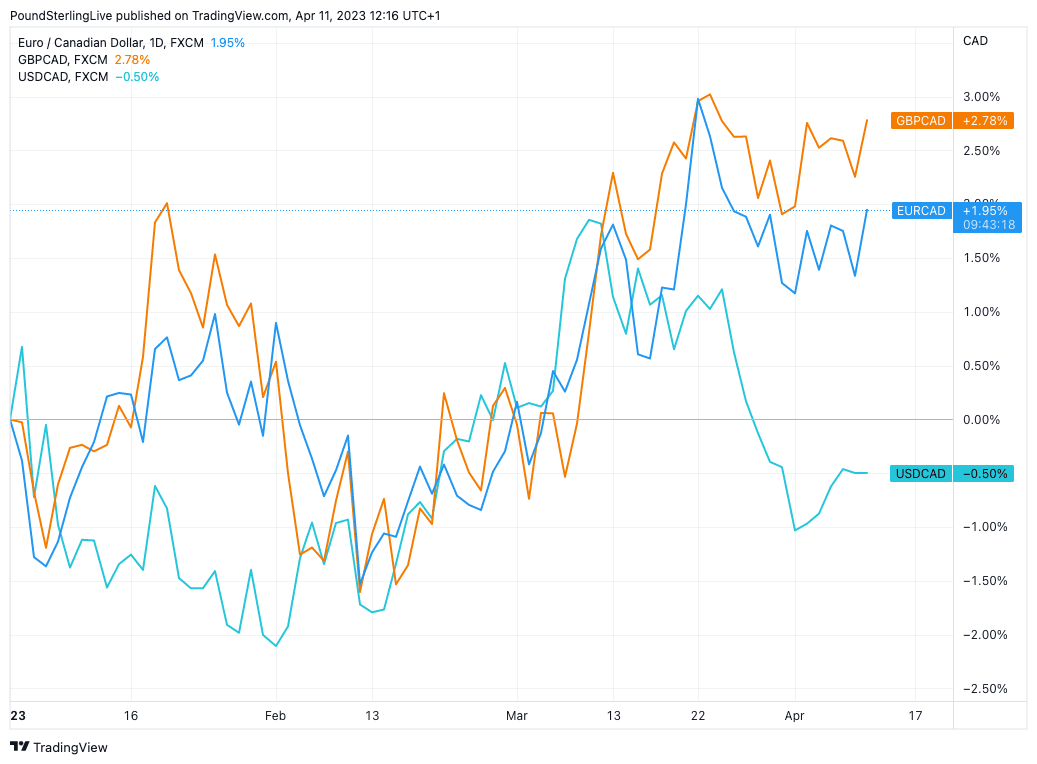

Although the Canadian Dollar gained a per cent against the U.S. Dollar in March it was a distinct underperformer elsewhere as investors factored in the prospect of no further BoC hikes.

The Pound to Canadian Dollar exchange rate gained 1.61% in value and is now on course for its eighth successive monthly gain as it tests 1.68.

The Euro to Canadian Dollar exchange rate meanwhile rallied 1.57% last month and extends its run higher to 1.4741.

Canadian Dollar underperformance against the majority of G10 currencies comes as investors have moved to price in up to 30 points of rate cuts from current levels at the BoC by year-end.

Only the Fed is priced for more, which explains USD/CAD's downside tilt over recent weeks.

Above: GBP/CAD and EUR/CAD are up amidst CAD underperformance in 2023. Only the USD has underperformed.

The Canadian Dollar would therefore likely find some upside support against the Dollar, Euro and Pound were these expectations to reverse in the wake of the BoC.

"The BoC is nowhere near cutting rates," says Capistran.

"The economy remained strong overall at the beginning of the year with the monthly GDP at 0.5% mom sa in January," he adds.

Another consideration for the BoC will be Canada's robust labour market that sees the unemployment rate remaining at 5.0%, near the lowest on record, as the economy keeps creating jobs.

In fact, the Canadian Dollar found some support ahead of the just-finished Easter weekend after Statistics Canada reported the economy created 35K jobs in March, which was ahead of expectations.

Granted, Bank of America says the economy will decelerate and the labour market deteriorate over the coming months, but the pace will be gradual.

Although analysts anticipate the Bank of Canada to keep interest rates unchanged through the remainder of the year, "a tight labour market, higher oil prices and a change in the fiscal outlook for the worse will likely keep the BoC hawkish and will maintain risks for the policy rate to switch to the upside," says Capistran.

"We think it is too early to think about cuts in Canada," he adds.

Howard Du, G10 FX Strategist at Bank of America, says any repricing of market expectation on the back of a hawkish BoC guidance should be bullish for the Canadian Dollar.

"We continue to expect CAD to strengthen against USD over the medium-term," he says.